Gold Hits $5,000 While Bitcoin Stalls — Analysts Say It’s Normal

-

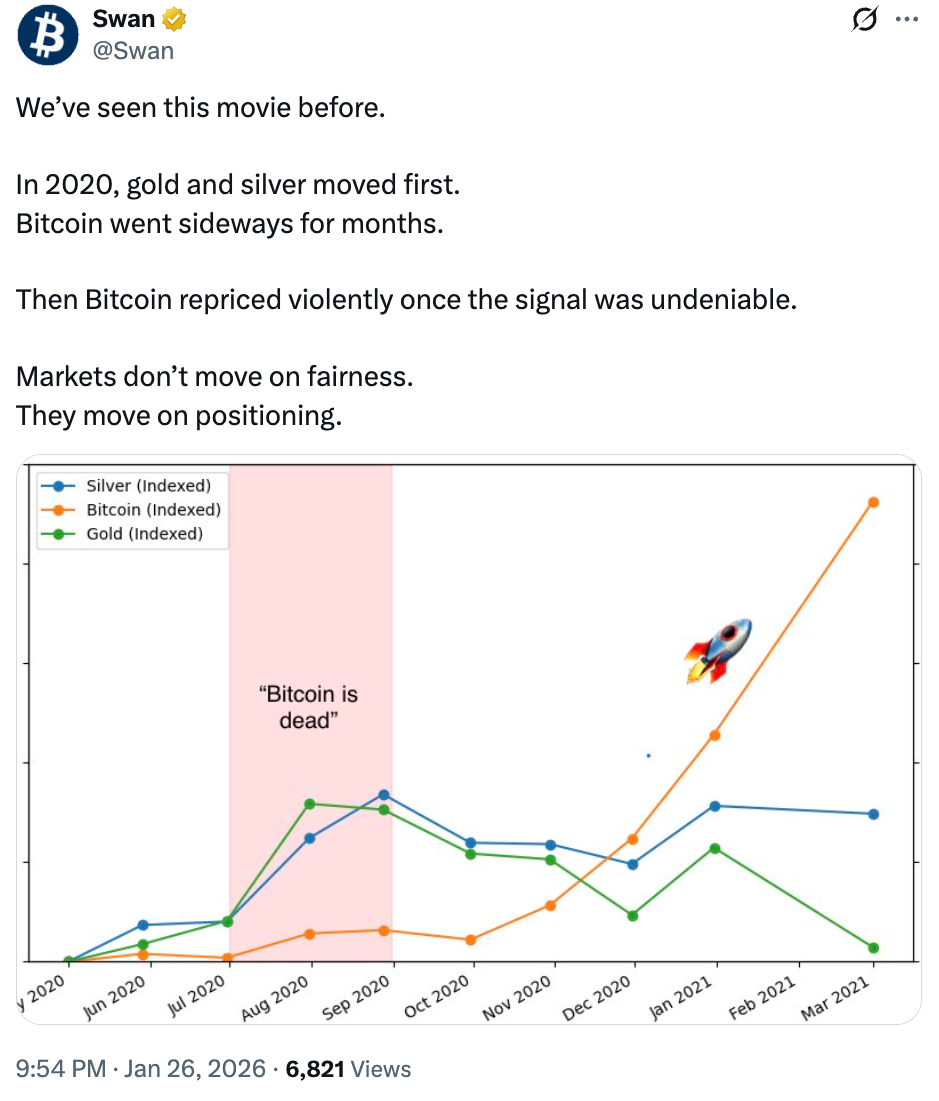

Gold surged to a new all-time high above $5,000, while Bitcoin continues to trade sideways, widening the divergence between the two assets. Some traders see this as a warning sign, but analysts at Swan argue the pattern is familiar.

Historically, gold tends to move first during macro shifts, while Bitcoin often consolidates for months before breaking out sharply. Similar divergences were seen ahead of previous Bitcoin bull runs, where extended range-bound trading eventually gave way to aggressive upside moves.

-

History doesn't always repeat, but it usually rhymes! Seeing Gold hit $5,000 in 2026 while Bitcoin trades sideways is exactly the kind of 'accumulation phase' we've seen before every major leg up. For those of us in the Undeads ecosystem, this sideways movement is actually a blessing—it gives us more time to stack UDS and level up our NFTs before the retail FOMO kicks in. If the Swan analysts are right and BTC follows Gold's lead with an aggressive breakout, do you think we'll see a massive rotation from 'safe haven' gold into high-growth GameFi assets? I’m betting the breakout happens just as our Steam launch hype peaks!

-

History doesn't always repeat, but it usually rhymes! Seeing Gold hit $5,000 in 2026 while Bitcoin trades sideways is exactly the kind of 'accumulation phase' we've seen before every major leg up. For those of us in the Undeads ecosystem, this sideways movement is actually a blessing—it gives us more time to stack UDS and level up our NFTs before the retail FOMO kicks in. If the Swan analysts are right and BTC follows Gold's lead with an aggressive breakout, do you think we'll see a massive rotation from 'safe haven' gold into high-growth GameFi assets? I’m betting the breakout happens just as our Steam launch hype peaks!

@MoTaw Spot on with the 'rhyming' analogy. Gold hitting $5,000 while the dollar weakens is the classic precursor to a capital rotation. We're seeing that 'safe haven' money overflow, and history shows it usually trickles down the risk curve—from Gold to BTC, and finally into high-growth sectors like GameFi.

If the Steam launch lines up with a Bitcoin breakout, the 'retail FOMO' you mentioned won't just be a ripple; it’ll be a tidal wave. Stacking $UDS while the market is quiet is basically front-running the inevitable shift from 'store of value' to 'digital utility.' Let's see if that Swan analysis holds water!