Using Macro Signals to Position for a Bigger BTC Move

-

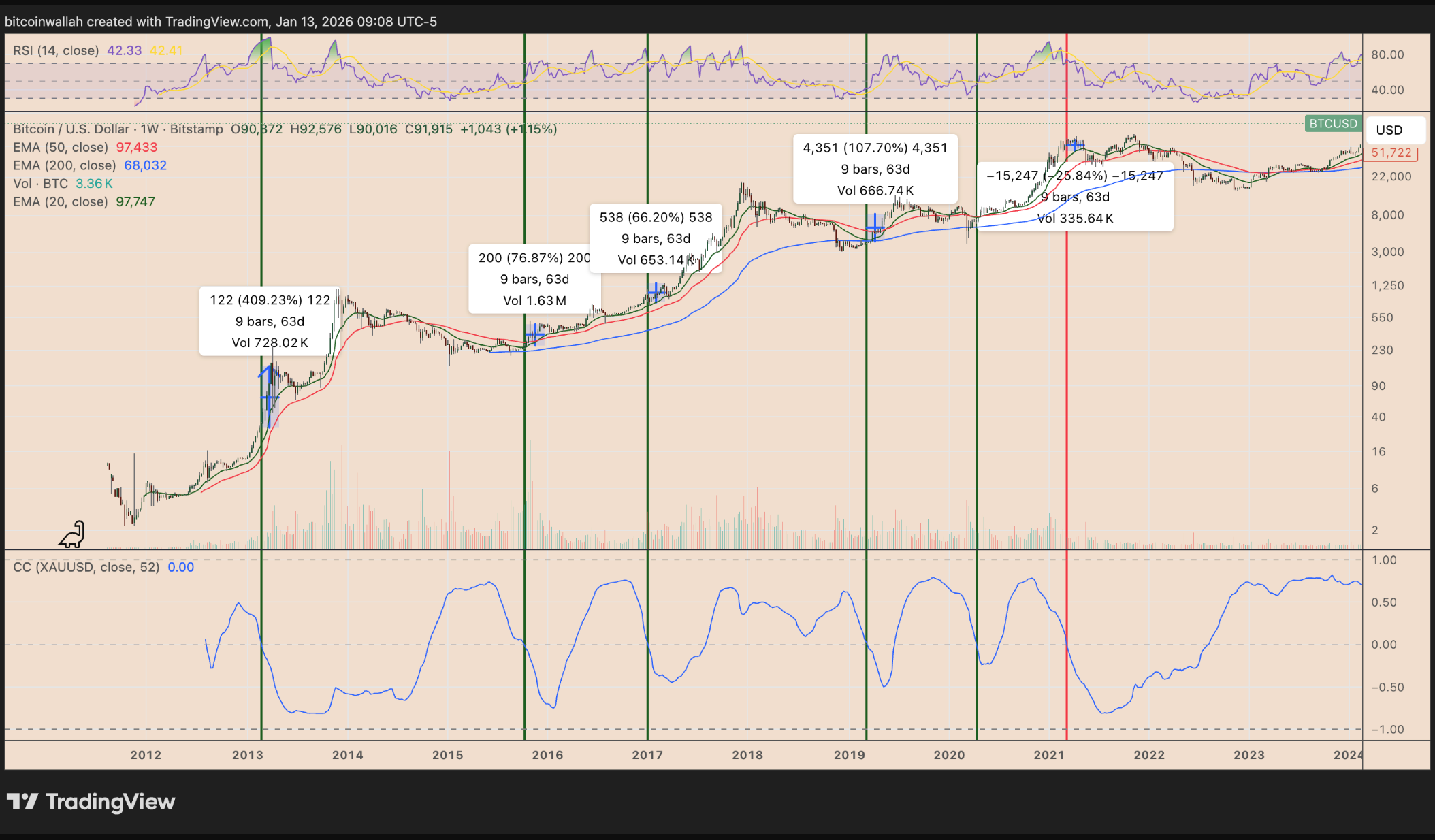

Beyond charts, macro conditions are increasingly supportive. Bitcoin’s correlation with gold has turned negative—a setup that historically preceded strong BTC rallies. Combined with rising global liquidity and the end of quantitative tightening by the Federal Reserve, this backdrop strengthens the case for higher prices.

Longer-term investors often position for these moves by accumulating during consolidations or rotating capital from defensive assets into Bitcoin. Analysts like Matt Hougan of Bitwise note that Bitcoin bull markets tend to align with expanding global money supply—making the current setup attractive for those aiming to profit from a sustained 2026 uptrend rather than short-term trades alone.

-

negative btc/gold correlation always sounds fake until it suddenly isn’t