How could rising staking activity impact ETH’s price?

-

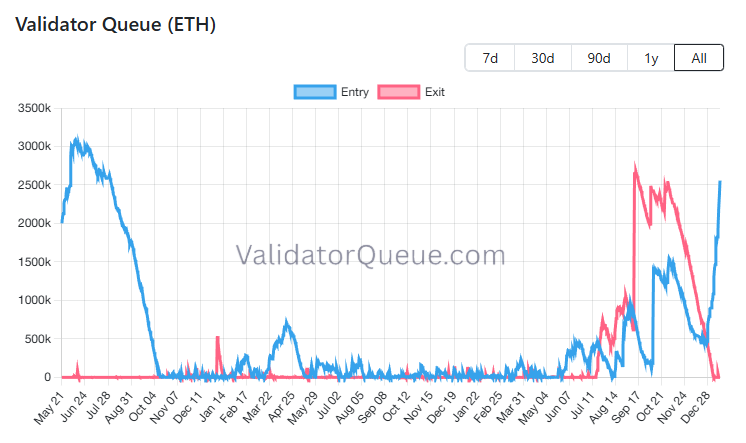

Higher staking levels reduce the amount of ETH available for trading, which can create supply-side pressure if demand increases. As more ETH is locked up, even modest inflows can have a stronger price impact. Analysts believe this dynamic could help ETH break above key resistance levels around $3,450 and potentially move toward $4,000 if bullish momentum continues.

Institutional actions further strengthen this outlook. Onchain intelligence from Arkham shows that investors like Tom Lee have staked over 1% of Ethereum’s total supply through large-scale treasury strategies. Combined with rising user activity in DeFi and stablecoins, these signals suggest Ethereum’s fundamentals are strengthening—often a precursor to a broader price breakout.

-

Retail panic vs validator conviction — same movie, different actors.