Why is Ethereum staking hitting record highs in January 2026?

-

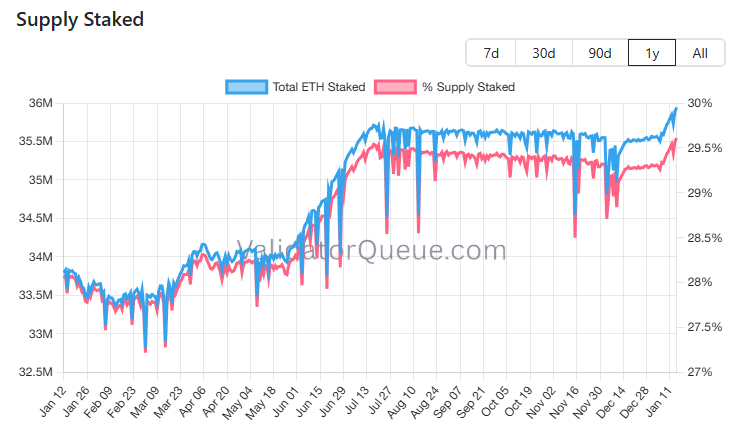

Ethereum staking has surged because long-term holders and institutions are showing strong conviction despite recent price weakness. Nearly 36 million ETH—about 30% of the total circulating supply—is now locked in staking, signaling confidence in Ethereum’s future rather than short-term trading. This rise comes even after ETH fell more than 30% from its August highs, suggesting investors are prioritizing yield, network security, and long-term appreciation.

Another key factor is institutional participation. Data shows large entities and digital asset treasuries are staking significant amounts of ETH, reducing the available liquid supply on the market. With the unstaking queue at zero and the staking queue at its highest level since 2023, the data points to a one-sided flow into staking, reinforcing Ethereum’s network stability and scarcity dynamics.

-

~30% of ETH locked = real supply squeeze.