Why Central Banks Matter for Bitcoin’s Long-Term Price

-

A key assumption in VanEck’s forecast is that central banks could eventually allocate 2.5% of their reserves to Bitcoin. At a $2.9 million price, that would place Bitcoin at roughly 1.66% of total global financial assets, a level comparable to major reserve instruments today.

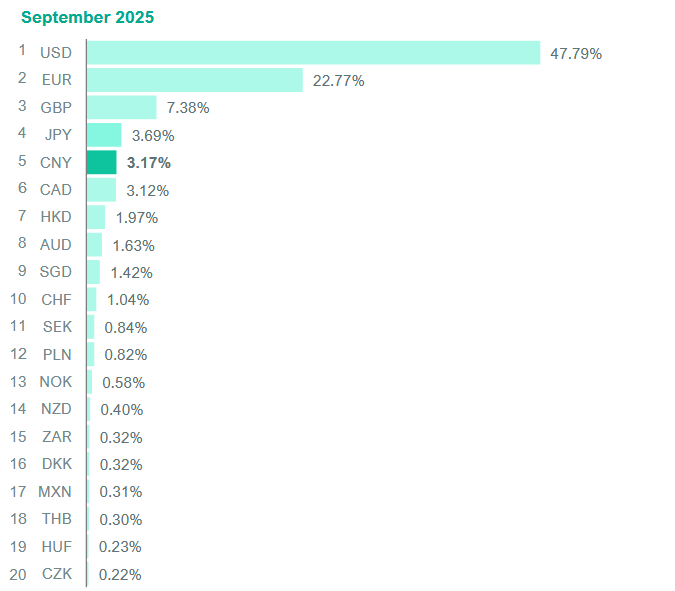

Bitcoin is already used in cross-border trade in certain sanctioned economies, but large-scale adoption among advanced economies remains limited. If Bitcoin were to capture a meaningful share of global settlement flows, its usage could rival established currencies like the British pound, fundamentally changing its role in international finance.