The Hidden Opportunity Behind “Fake” Bitcoin Whale Signals

-

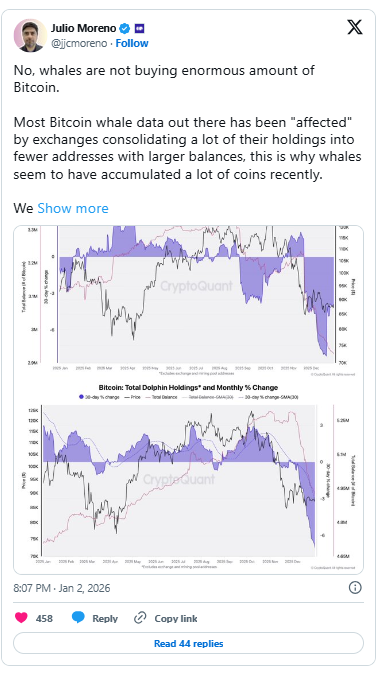

Recent data that looked like aggressive Bitcoin whale accumulation turned out to be mostly internal exchange activity, not real buying pressure. According to CryptoQuant research head Julio Moreno, exchanges were simply consolidating funds into cold wallets—movements that often get misread as large investors entering the market.

For opportunistic traders, this matters because false accumulation signals can inflate short-term optimism. When the crowd believes whales are buying—but they’re not—prices often move ahead of fundamentals. Spotting these misinterpretations early can help traders fade hype-driven rallies or wait patiently for cleaner, confirmation-based entries.