Miner Stress and the 100-Week EMA: A High-Stakes Line

-

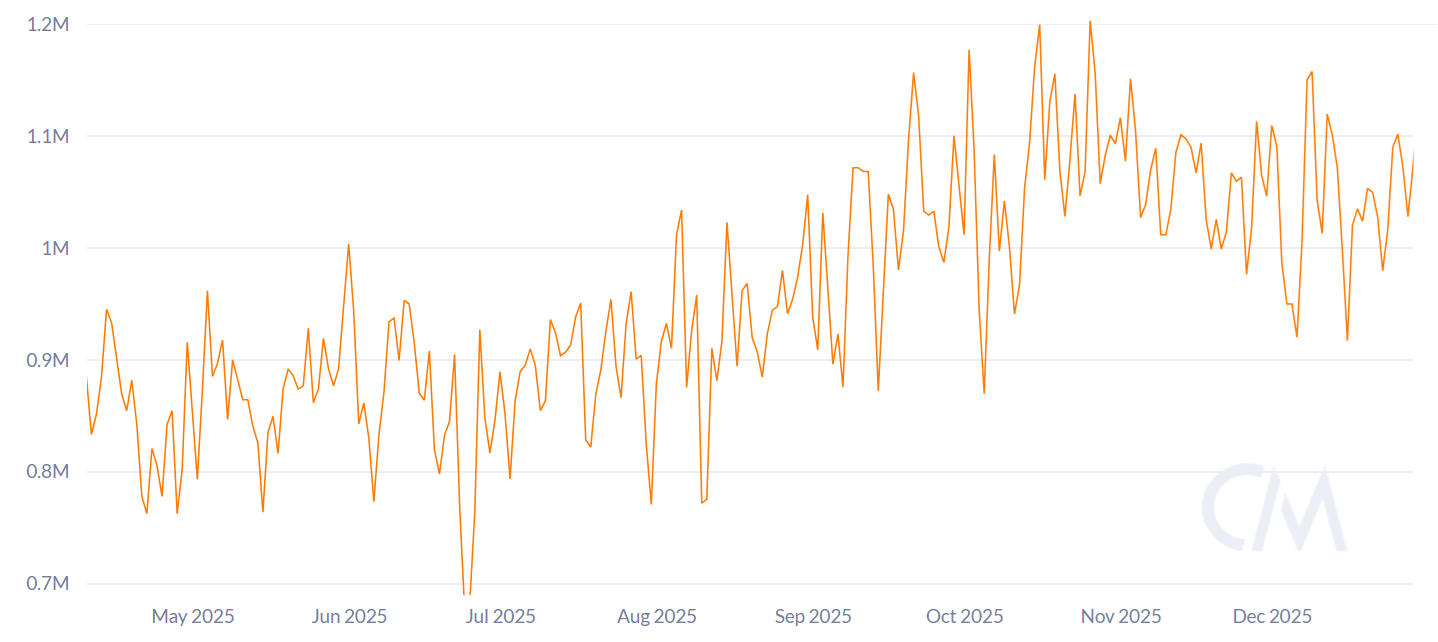

Rising energy costs and falling margins have pressured miners, and the network hash rate has pulled back from recent highs. While this often sparks fear, history shows that miner stress can act as a contrarian signal, with Bitcoin frequently posting strong gains months after sustained hash rate declines.

Technically, the 100-week EMA near the current range is the line that matters most. Holding above it keeps the broader uptrend intact and opens the door to rebounds toward higher levels. Losing it, however, shifts the strategy from buying dips to capital preservation — a reminder that making money also means knowing when not to trade.