Why USDC Is Becoming a Backbone of Onchain Finance

-

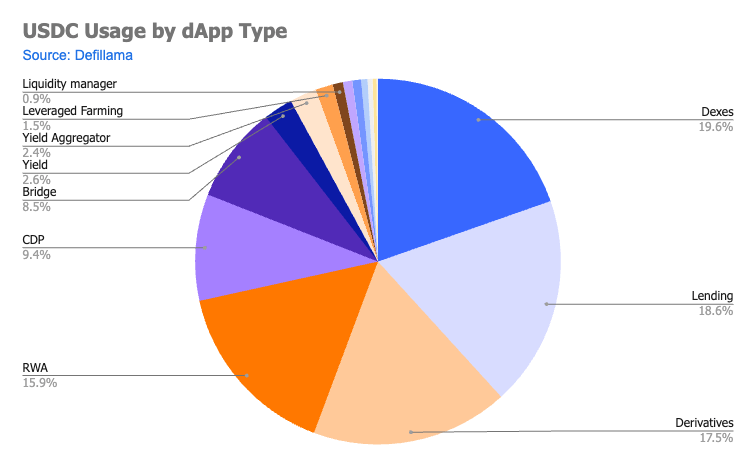

USDC plays a central role in decentralized finance, acting as a settlement asset across lending, trading, payments, and tokenized real-world assets. On networks like Ethereum, USDC is widely used for liquidity pools, derivatives margining, and DAO treasuries because of its perceived stability and lower counterparty risk.

As onchain activity grows beyond speculation into payments and tokenized finance, USDC’s reliability matters more than speed or hype. Many developers choose USDC as their default dollar because it integrates cleanly with compliance workflows while still remaining fully programmable on public blockchains.