Stablecoins, RWAs, and the Case for Ethereum as the Global Ledger

-

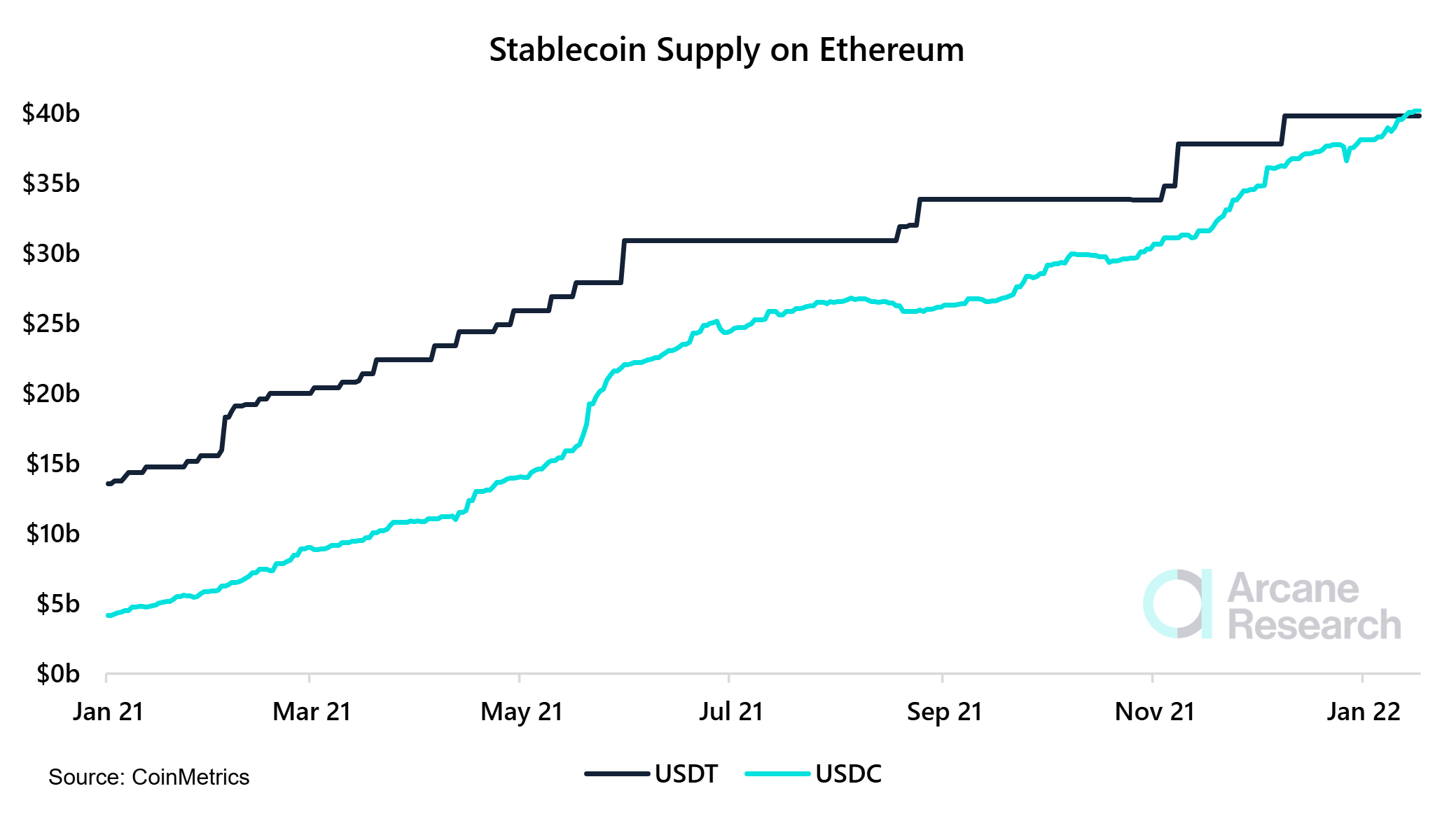

Ethereum’s dominance is most visible in stablecoins and real-world asset (RWA) tokenization. More than half of the world’s $300+ billion stablecoin supply lives on Ethereum, led by Tether USDt and USD Coin, making it the backbone of onchain dollar settlement.

At the same time, Ethereum hosts the largest share of tokenized real-world assets, from bonds to funds, reinforcing its role as the institutional standard. While price volatility can obscure this progress in the short term, the data suggests Ethereum is steadily becoming what many blockchains aspire to be: the global settlement layer beneath the crypto economy.

-

Vitalik is a hero.