How Conflicting Whale Signals Can Shape Smarter Crypto Trades

-

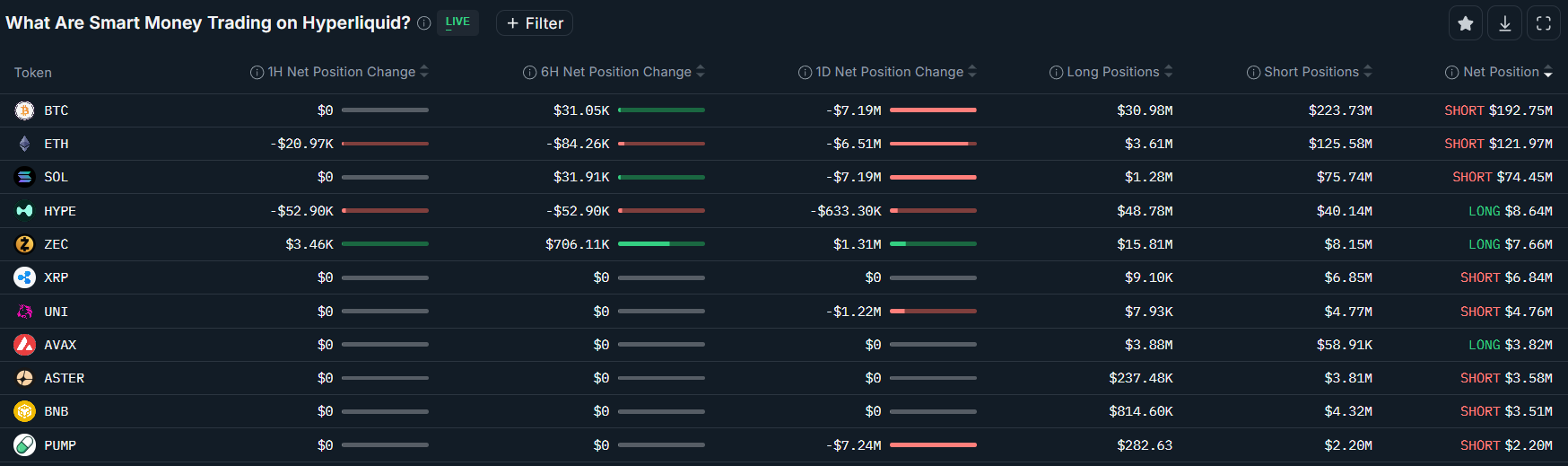

Smart money traders top perpetual futures positions on Hyperliquid. Source: NansenWhile some whales are aggressively buying Ether, another profitable approach is watching who disagrees. Data shows “smart money” traders are still net short ETH, BTC, and SOL despite rising whale accumulation. This split signals uncertainty rather than a guaranteed rally.

For traders, this environment favors flexibility: short-term trades, faster profit-taking, and avoiding overexposure. When large players are divided, markets often move sharply in both directions—creating opportunities for disciplined traders who manage risk instead of betting on a single outcome.