Brazil’s Crypto Surge Defies Traditional Macro Logic

-

Brazil is challenging one of crypto’s oldest assumptions: that digital assets only thrive when traditional finance fails.

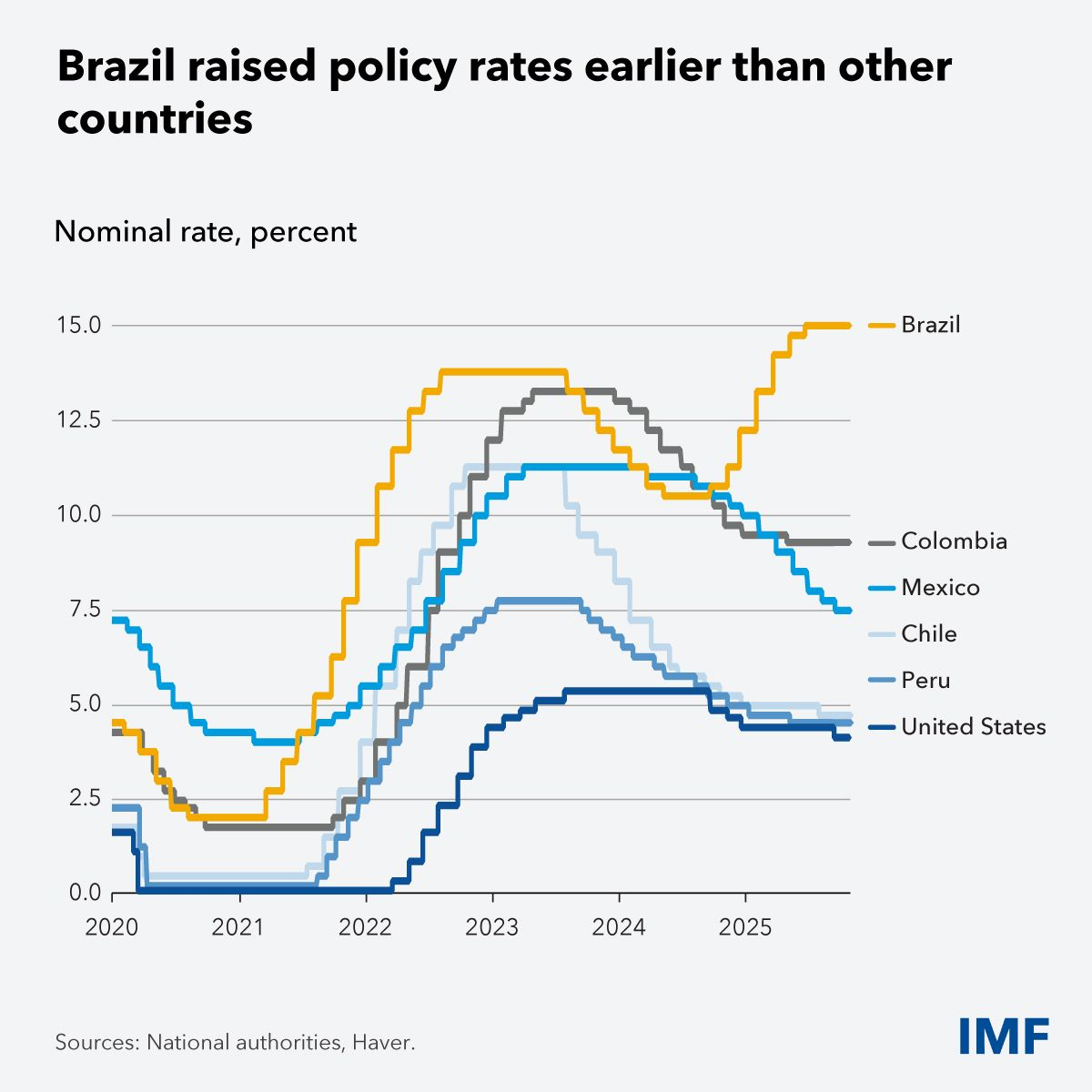

Despite a record-high Selic rate of 15%, the country’s financial system remains resilient. Bank lending rose 11.5% in 2024, corporate bond issuance jumped 30%, and credit markets show no signs of strain.

Yet crypto adoption is booming. In 2025, digital asset activity surged 43% year-over-year, with average investment per user topping $1,000. Investors are moving from speculative bets to diversified crypto portfolios, signaling a new phase in adoption that doesn’t rely on macroeconomic stress.