Why Institutions Are Rushing to Put Real-World Assets Onchain

-

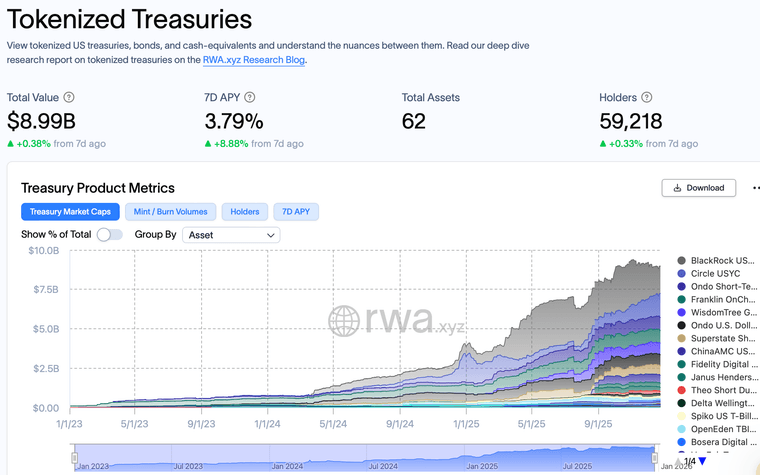

Financial institutions are accelerating efforts to tokenize traditional assets as blockchain infrastructure matures. Tokenization allows assets to settle faster, trade around the clock, reduce costs and expand global access to markets that were previously limited by geography and operating hours.

Hybrid networks like Canton, which blend permissioned and permissionless features, are increasingly seen as suitable for regulated use cases. Industry leaders say the shift could force legacy financial institutions to adapt more rapidly than previous digital transformations.

As MoonPay president Keith Grossman recently noted, putting real-world assets onchain may reshape finance faster than digital technology transformed media.

-

Treasuries on-chain feel inevitable.

-

Yield + instant settlement is powerful.