Why Is US Labor Data Important for Crypto Markets?

-

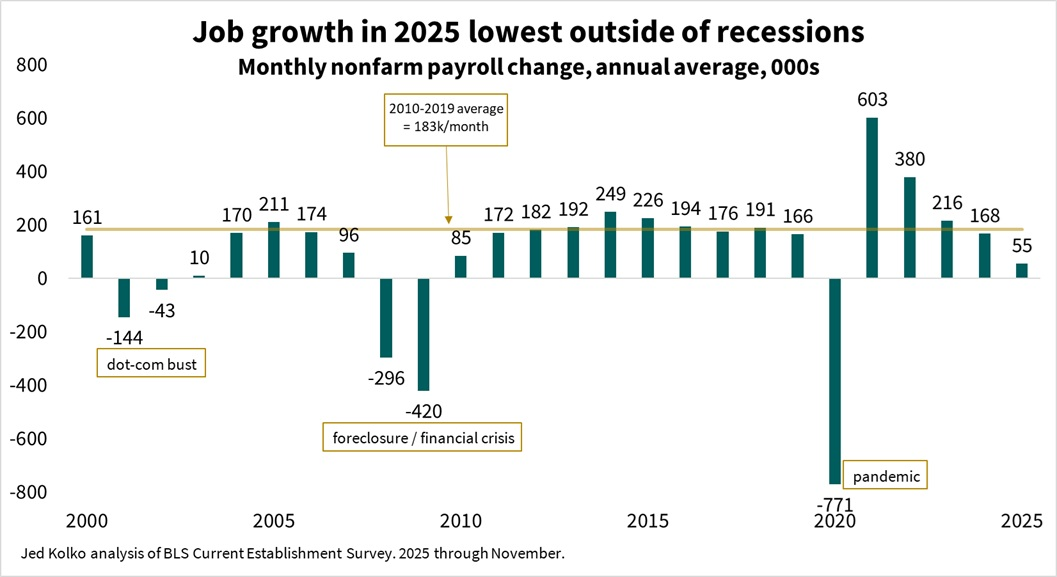

US Job Growth Over the Years. Source: X/Jed KolkoUS labor data signals how much disposable income households have. When job growth slows and wages weaken, people have less surplus cash to invest. Since retail investors often fund crypto purchases with discretionary income, softer labor data can reduce demand—especially for volatile assets.

-

Correlation doesn’t always mean causation in crypto markets.

-

Markets often price in slowdowns well before they show up in data.

-

Markets often price in slowdowns well before they show up in data.

-

Correlation doesn’t always mean causation in crypto markets.