Wall Street Treats Hyperliquid Like Real Trading Infrastructure

Hero Portfolio

4

Posts

3

Posters

22

Views

-

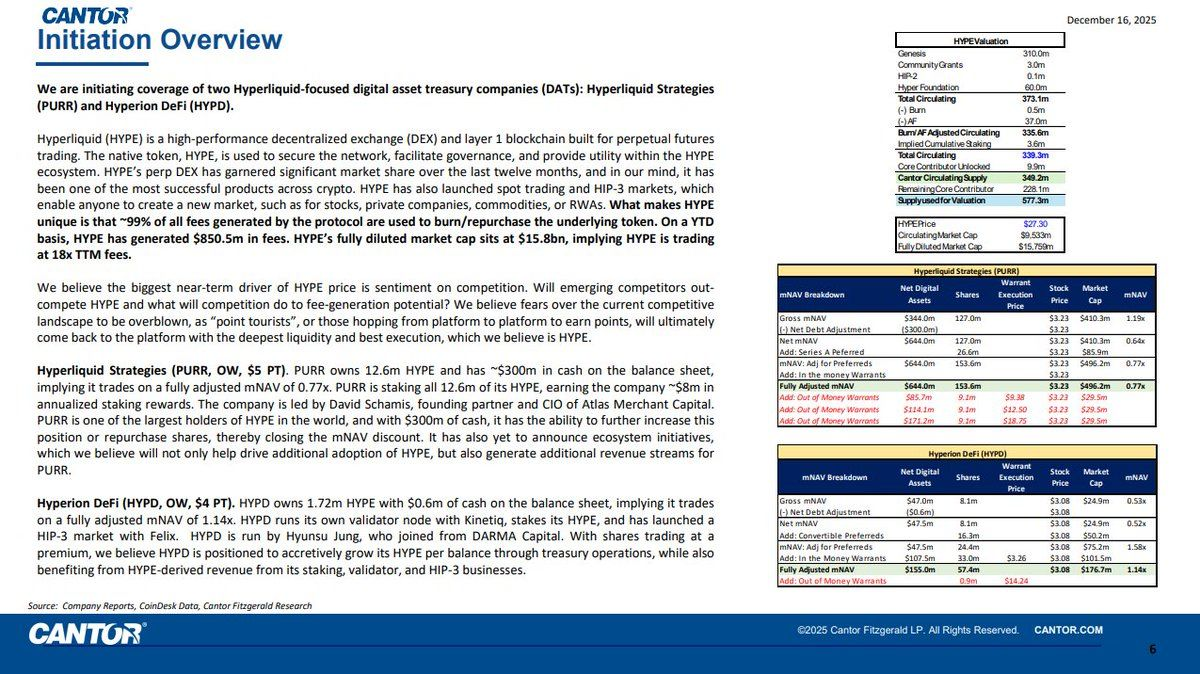

Unlike speculative crypto forecasts, Cantor frames Hyperliquid as core market infrastructure, comparable to global exchanges. The protocol has already processed nearly $3 trillion in volume in 2025, generating $874 million in fees—most of which are returned to token holders through buybacks and burns.

-

When Wall Street pays attention, it usually means real volume is coming.

-

This shows crypto infra is starting to meet institutional standards.

-

When Wall Street pays attention, it usually means real volume is coming.