BTC Losses Surge as Long-Term Holders Cash Out Billions

-

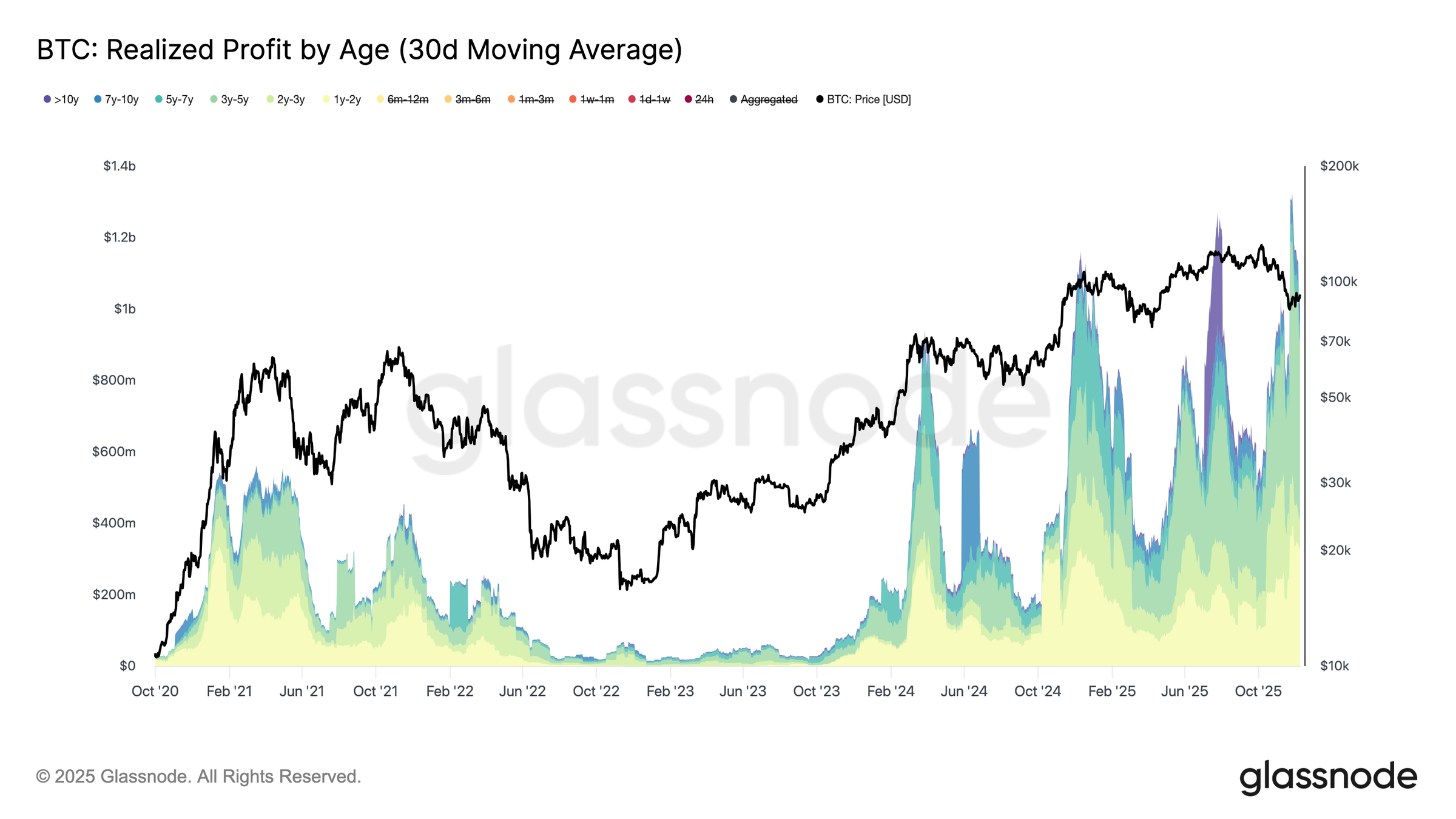

Realized profit by age. Source: GlassnodeBitcoin’s inability to reclaim the $95K–$102K resistance zone is fueling structural stress across the market. Glassnode reports realized losses hitting $555M/day, the highest level since the 2022 FTX collapse. At the same time, long-term holders have been locking in over $1B/day in profits, peaking at a record $1.3B.

This combination—capitulation from top buyers and large-scale distribution from older wallets—is keeping BTC pinned below $100K. With unrealized losses rising to 4.4% (the highest in two years), analysts warn that the longer Bitcoin remains range-bound, the higher the risk of forced selling. -

Long-term holders taking profit suggests uncertainty, but it also resets the market for stronger hands to enter.

-

Billions in selling pressure from long-term wallets can shake the market, but historically these phases create new opportunities.

-

the same time, long-term holders have been locking in over $1B/day in profits, peaking at a record $1.3B.