Spot Demand Lifts Bitcoin, but Futures Market Sends a Warning

-

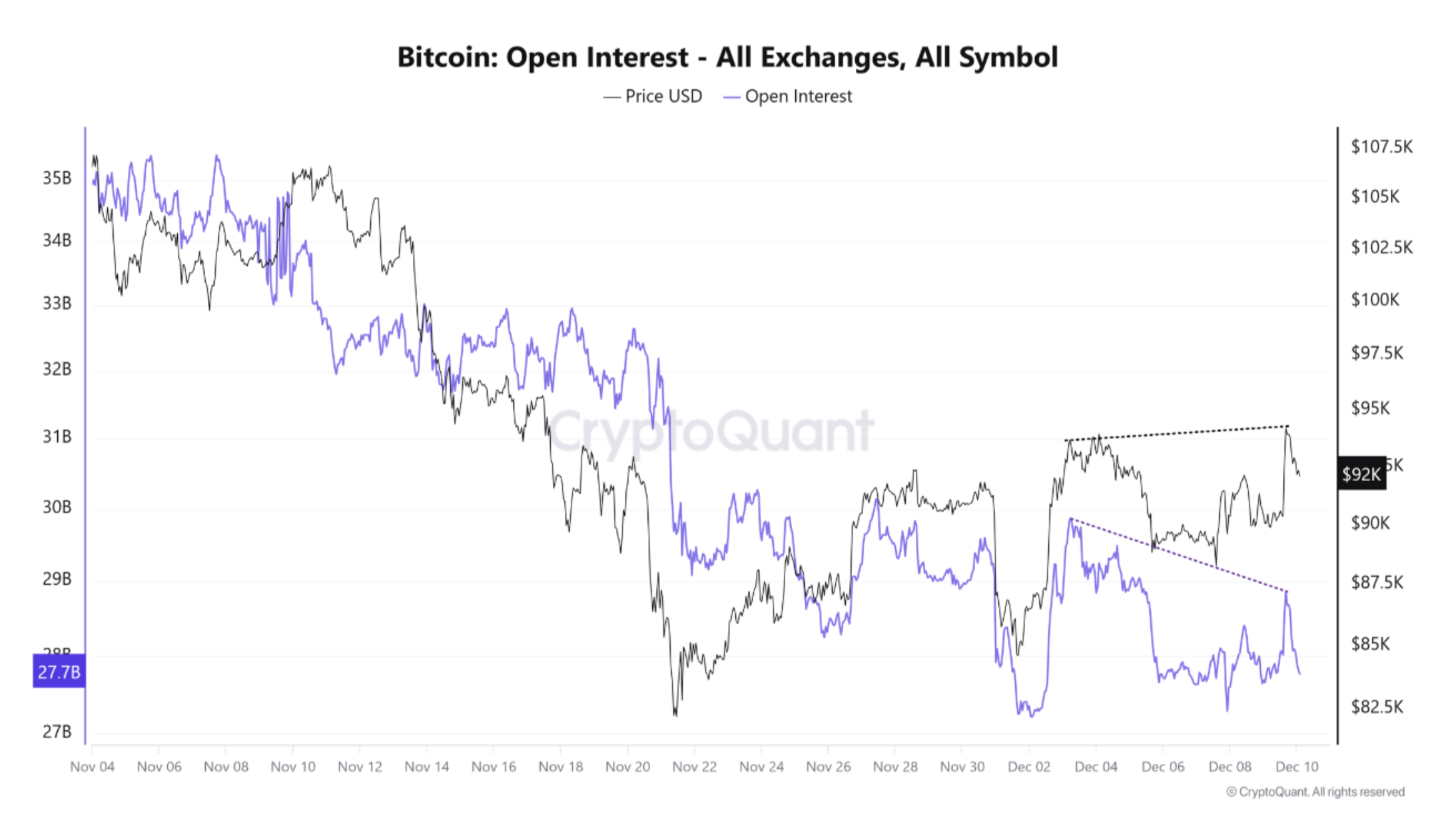

Bitcoin price versus open interest divergence. Source: CryptoQuantAhead of the Fed meeting, Bitcoin’s latest rally has been spot-driven, not leverage-driven—an unusual divergence highlighted by CryptoQuant. While BTC climbed off its late-November lows, open interest continued to fall, signaling dwindling appetite from futures traders.

Healthy spot momentum is encouraging, but history shows that sustained BTC uptrends require rising leveraged participation. With derivatives volumes still dominating the market and expectations for future rate cuts weakening, analysts caution that Bitcoin's upward trajectory may stall unless futures demand returns. -

Spot demand rising is positive, but the futures warning shouldn’t be ignored. Mixed signals often lead to volatility.

-

This kind of divergence usually means a sharp move is coming. Direction will depend on how spot demand holds up.