🥪 MEV & Sandwich Attacks Explained (The Hidden Tax of DeFi)

-

If you’ve ever made a trade on a decentralized exchange (DEX) and thought, “Why did my slippage suddenly spike?” — you may have been hit by MEV or a sandwich attack.

What is MEV?

What is MEV?MEV (Maximal Extractable Value) = extra profit that blockchain validators (or bots) can make by reordering, inserting, or censoring transactions in a block.

In simple terms:

You submit a trade on Uniswap.

Before it confirms, bots see it in the mempool (pending transaction pool).

They jump in ahead of you, manipulate the price, and pocket the difference.

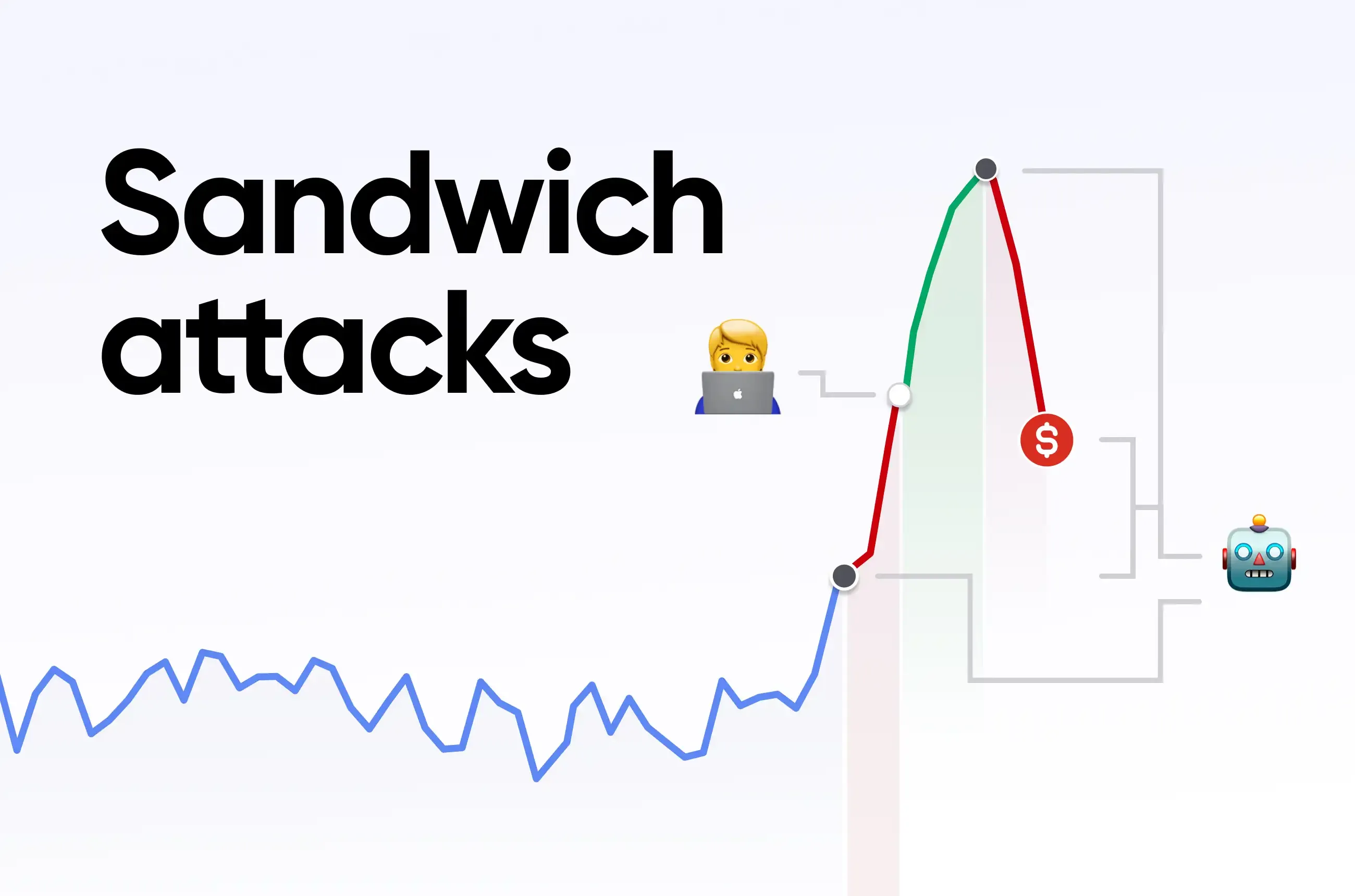

Sandwich Attacks 101

Sandwich Attacks 101A sandwich attack is the most notorious form of MEV:

Front-run: The attacker sees you’re buying Token X → they buy it before you.

Your trade goes through: You buy at a slightly worse price.

Back-run: The attacker immediately sells, profiting off the price bump you just created.

Result? You end up “sandwiched” between their buy and sell — losing value due to worse execution.

Why It Matters

Why It MattersIt’s basically an invisible tax on retail DeFi users.

Billions of dollars have been siphoned this way across Ethereum, BNB Chain, and others.

For whales, this can mean losses of hundreds of thousands per trade.

How to Protect Yourself

How to Protect YourselfUse MEV-protected RPCs like Flashbots Protect, MEV Blocker, or CoW Swap.

Set tight slippage limits — don’t leave it wide open.

Split large trades into smaller chunks.

Avoid peak congestion times when bots are especially active.

Takeaway: MEV and sandwich attacks aren’t bugs — they’re features of open mempools. Understanding them is crucial for anyone trading size in DeFi.

Takeaway: MEV and sandwich attacks aren’t bugs — they’re features of open mempools. Understanding them is crucial for anyone trading size in DeFi. Forum Question:

Forum Question:

Have you ever been front-run or sandwiched? What’s your go-to strategy for avoiding MEV traps when trading on-chain? -

MEV is such a double-edged sword. On one side, it feels like legalized front-running that punishes retail and undermines trust in DEXs. On the other, it’s a natural outcome of transparent blockchains — anyone can see pending transactions. Long term, I think the real solution will come from protocol-level changes like encrypted mempools or proposer-builder separation on Ethereum. Until then, most of us are stuck with workarounds: smaller trade sizes, protected RPCs, and watching gas times like hawks. Personally, I treat MEV as a “liquidity tax” — if you’re trading size, you better account for it.

-

This is one of those hidden costs of DeFi most new traders don’t realize until it bites them. I’ve definitely been sandwiched on Uniswap — the worst part is you don’t notice until you compare your expected fill with what you actually got. What’s crazy is how advanced the bot infrastructure has become: they’re literally running like high-frequency traders, scanning the mempool 24/7. My go-to now is using CoW Swap or MEV Blocker RPC, since at least you know your order won’t be sniped the same way. Setting tight slippage helps too, but it doesn’t fully stop bots with deep liquidity.