💧 How Do Liquid Staking Tokens (LSTs) Actually Work?

-

If you’ve staked ETH or SOL before, you know the pain: your tokens are locked up and can’t be used until the staking period ends. That’s where Liquid Staking Tokens (LSTs) come in — they give you the best of both worlds: staking rewards and liquidity.

The Problem with Traditional Staking

The Problem with Traditional StakingYou stake ETH on Ethereum → it’s locked to a validator.

You earn rewards, but your ETH is illiquid — you can’t trade, lend, or use it elsewhere.

Unstaking often comes with long cooldowns (Ethereum withdrawals were only enabled after the Shanghai upgrade).

Enter Liquid Staking

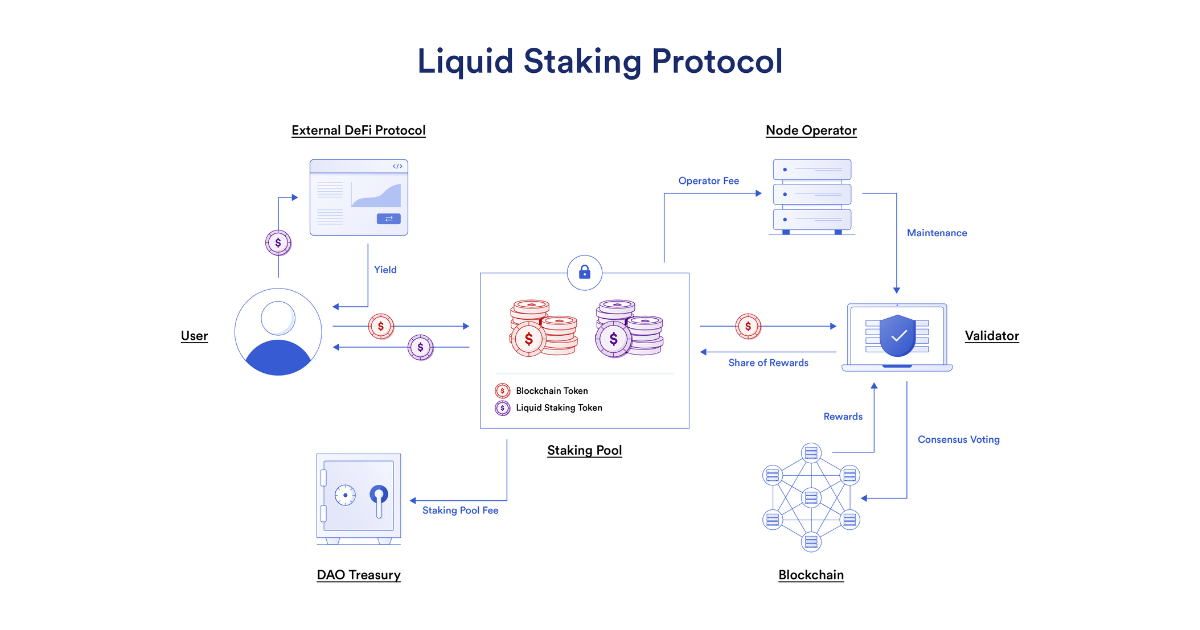

Enter Liquid StakingWhen you stake through a liquid staking provider (like Lido, Rocket Pool, Coinbase, Frax):

You deposit ETH into their protocol.

The protocol stakes it across validators.

In return, you get a receipt token — e.g., stETH, rETH, cbETH, sfrxETH.

This LST represents your staked ETH + earned rewards.

Why LSTs Are Powerful

Why LSTs Are PowerfulEarning yield: You keep accruing staking rewards automatically.

Staying liquid: You can trade, swap, or lend your LST on DeFi platforms.

Composability: LSTs can be used as collateral on Aave, Curve, MakerDAO, etc.

Compounding: You can loop them for even higher yields (though this cranks up risk).

Example:

Stake 10 ETH → get 10 stETH.

stETH slowly grows in value vs. ETH as rewards accumulate.

You can then use stETH to borrow stablecoins on Aave → farm with those.

Risks to Keep in Mind

Risks to Keep in MindDepeg risk: In stress events, LSTs can temporarily trade below ETH.

Smart contract risk: Bugs in the staking protocol or validators.

Centralization: Some providers (like Lido) control large portions of ETH staking.

Slashing: Validators misbehaving could cut into rewards.

Why They Matter (Big Picture)

Why They Matter (Big Picture)LSTs turn staking into a liquid financial primitive, powering “LSTFi” (Liquid Staking Finance).

They’re one of the biggest drivers of ETH adoption in DeFi, since staked assets don’t sit idle.

Think of them as the bridge between security (staking) and capital efficiency (DeFi).

Takeaway:

Takeaway:

Liquid Staking Tokens are like getting your cake and eating it too — stake for security + yield, but keep your assets usable across DeFi. Just don’t forget that with more rewards come more risks. -

Great breakdown

— LSTs really are the sweet spot between passive staking rewards and active DeFi use. The big unlock is capital efficiency: instead of locking ETH away, you can loop it into lending, trading, or liquidity pools while still earning validator rewards. It’s why tokens like stETH, rETH, and cbETH are so central to the ecosystem now. That said, people often forget about risks — depeg events, smart contract bugs, or validator slashing. The yield looks great, but it’s not “free money.”

— LSTs really are the sweet spot between passive staking rewards and active DeFi use. The big unlock is capital efficiency: instead of locking ETH away, you can loop it into lending, trading, or liquidity pools while still earning validator rewards. It’s why tokens like stETH, rETH, and cbETH are so central to the ecosystem now. That said, people often forget about risks — depeg events, smart contract bugs, or validator slashing. The yield looks great, but it’s not “free money.” -

I’d add that liquid staking is one of the main reasons ETH’s DeFi flywheel keeps spinning. The more ETH staked → the more secure the network → the more trust in DeFi → the more demand for LSTs. But it does concentrate risk too: a handful of protocols (like Lido) now control a huge chunk of staked ETH. That’s amazing for growth but scary for decentralization. Long-term, I think we’ll see more diversification of providers and maybe even new L2-native LSTs. Either way, liquid staking is shaping up to be one of Ethereum’s defining features.