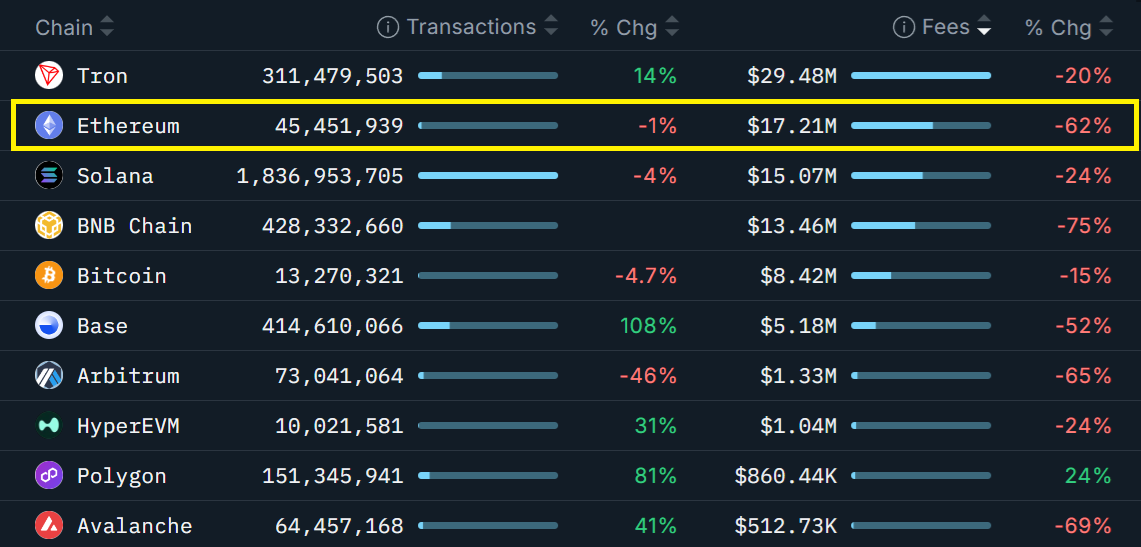

Ethereum Fees Fall 62% as Base Layer Activity Softens Despite Price Rally

-

Ethereum’s base layer is showing clear signs of cooling even as ETH climbed to a three-week high near $3,400 on Tuesday. According to Nansen, Ethereum’s 30-day network fees fell 62%, a much deeper drop than Tron, Solana, or HyperEVM. Total value locked on major Ethereum DApps has also pulled back sharply, slipping from $100B to $76B in two months.

Still, some of the slowdown may be structural: the Fusaka upgrade went live on December 3, improving rollup efficiency — and with it, lowering fees. Despite this, traders remain cautious that weaker base layer demand could cap Ethereum’s short-term upside even with the recent 11% weekly surge. -

Low fees during a rally signal shifting user behavior toward L2s.

-

Activity softening while price rises usually hints at speculative movement.