How do Bitcoin halving cycles interact with global liquidity cycles and Fed rate policies?

-

The Bitcoin halving is a supply shock — block rewards get cut in half roughly every 4 years, reducing the rate of new BTC entering circulation. Historically, halvings have aligned with major bull runs… but here’s the twist: it’s not just about supply, it’s also about macro liquidity.

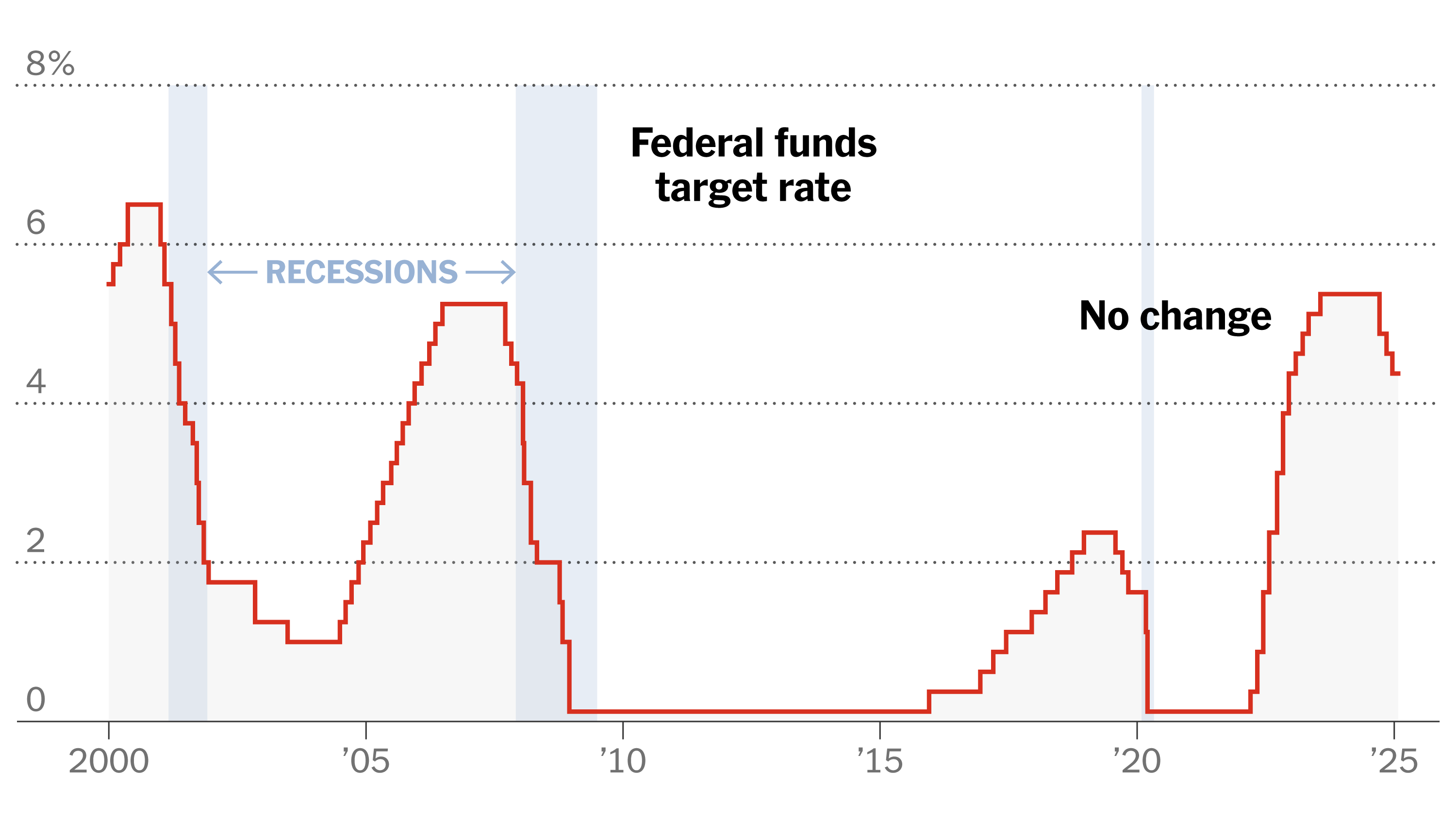

Fed Tightening (high rates, QT) → Even if halving cuts supply, capital is scarce, risk assets underperform, and BTC can stall.

Fed Tightening (high rates, QT) → Even if halving cuts supply, capital is scarce, risk assets underperform, and BTC can stall. Fed Easing (low rates, QE) → Fresh liquidity plus Bitcoin’s new supply squeeze = rocket fuel.

Fed Easing (low rates, QE) → Fresh liquidity plus Bitcoin’s new supply squeeze = rocket fuel. Think of it this way:

Think of it this way:Halving = potential energy (supply cut).

Global liquidity cycle = catalyst (demand trigger).

That’s why some halvings led to immediate parabolic runs (2012, 2016), while others took time (2020 halving + COVID QE = perfect storm).

Takeaway: Smart traders don’t just mark halving dates. They overlay them with Fed liquidity cycles, DXY trends, and bond yields to gauge whether the macro backdrop is risk-on or risk-off. The biggest gains often come when Bitcoin scarcity meets cheap money.

Takeaway: Smart traders don’t just mark halving dates. They overlay them with Fed liquidity cycles, DXY trends, and bond yields to gauge whether the macro backdrop is risk-on or risk-off. The biggest gains often come when Bitcoin scarcity meets cheap money. -

This is such an underrated point. Everyone loves to circle the halving date on their calendar, but without looking at the liquidity cycle you’re basically missing half the picture. The 2020 run is the perfect example — the halving cut supply, but it was the unprecedented wave of QE and near-zero rates after COVID that poured gasoline on it. Scarcity alone doesn’t create parabolic price action; it has to collide with easy money and risk-on sentiment.

I also like how you framed it as “potential energy vs. catalyst.” Halving loads the spring, but it’s Fed easing (plus dollar weakness) that releases it. Traders who only focus on Bitcoin charts without checking DXY or bond yields are flying blind.

-

I get the argument, but it’s also worth remembering that markets front-run both halvings and Fed policy shifts. Everyone knows the supply cut is coming, and institutions are very aware of liquidity cycles. That means some of the “rocket fuel” may already get priced in before retail even reacts.

Plus, the Fed isn’t the only variable anymore. Geopolitics, sovereign adoption, ETF flows, and even miner economics play a role. It’s possible this cycle won’t look like past ones at all. Bitcoin might grind higher without the same kind of euphoric blow-off top if liquidity stays tighter for longer.

So yes, halving + macro alignment can be powerful, but I’d caution against assuming history will repeat in the same pattern.