USDT Deposits on Binance Reach Annual Highs as Traders Brace for Volatility

-

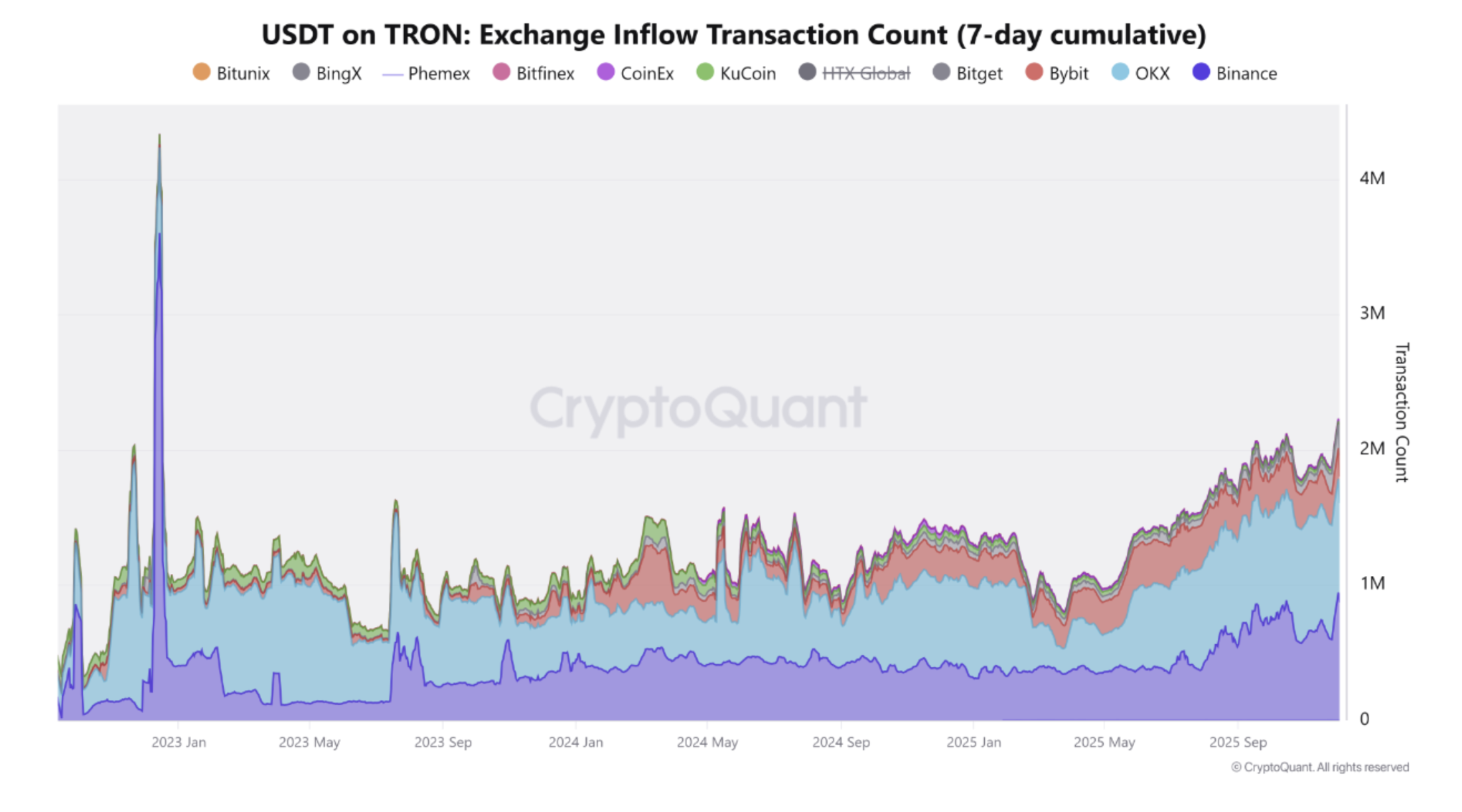

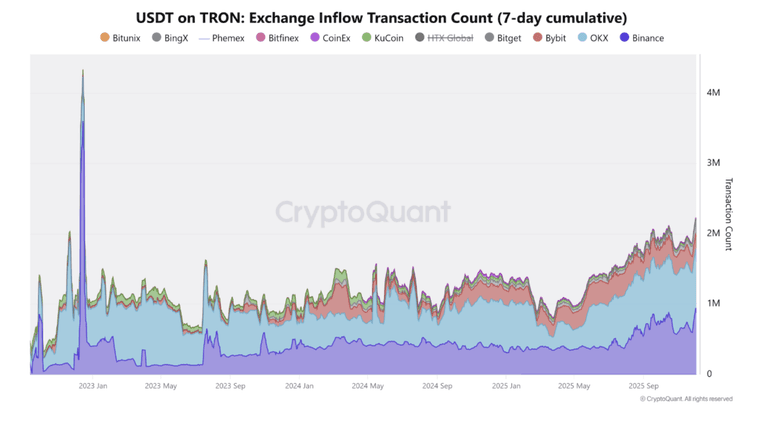

Binance logged 946,000 USDT deposit transactions within seven days, outpacing OKX (841,000) and Bybit (225,000). Rising stablecoin inflows usually signal traders are gearing up for movement — not waiting passively.

Amid whale selling pressure and elevated BTC inflows, the data suggests traders are preparing for reactive, high-volatility conditions.

If Bitcoin loses its $90,000 support, the influx of stablecoin liquidity could accelerate a sharper downside move. But if support holds, this capital could quickly flip into fuel for a strong counter-trend bounce. -

Large BTC inflows to exchanges rarely come without price implications.

-

High stablecoin deposits often signal caution—and upcoming volatility.