Revenue-Based Model Paints a Bearish Picture

-

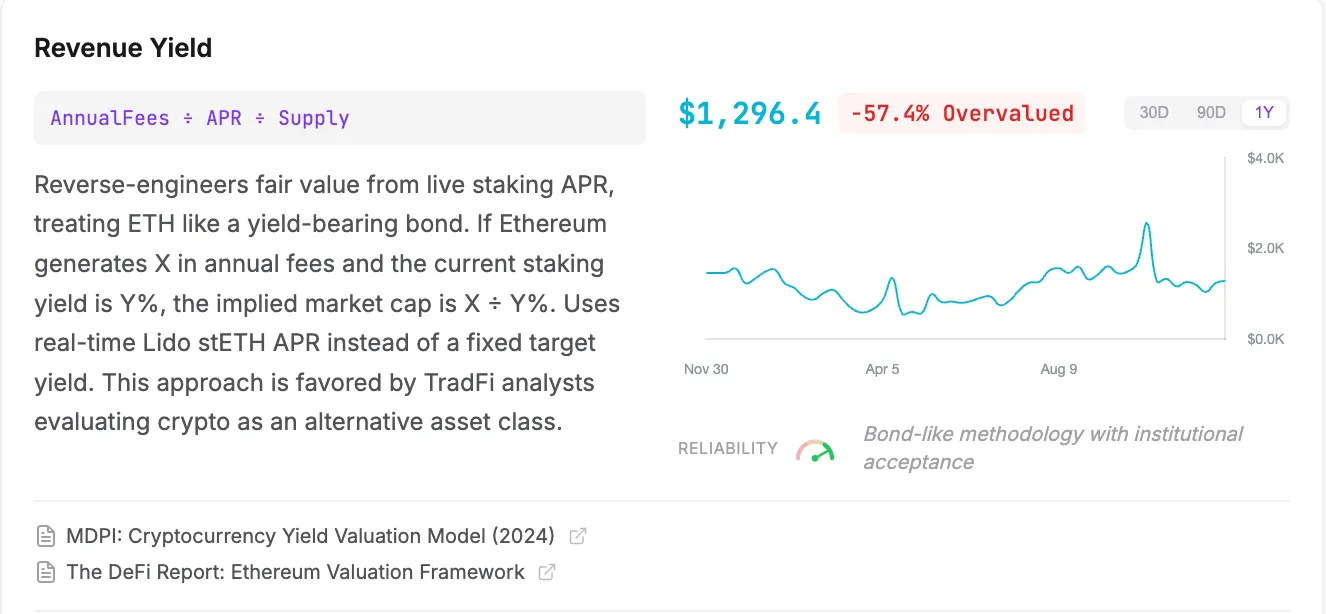

Despite broad bullish signals, one model stands firmly against the trend: the Revenue Yield model, which ETHval ranks as the most reliable of all 12.

According to this approach — which values ETH based on network revenue relative to staking yield — ETH should be worth $1,296, meaning the asset is overvalued by more than 57% at current prices.

The bearish estimate reflects Ethereum’s declining fee revenue as gas prices hit record lows and activity shifts to competing networks. -

Revenue-driven models highlight potential downside risks.

-

This bearish outlook raises questions about current market valuations.