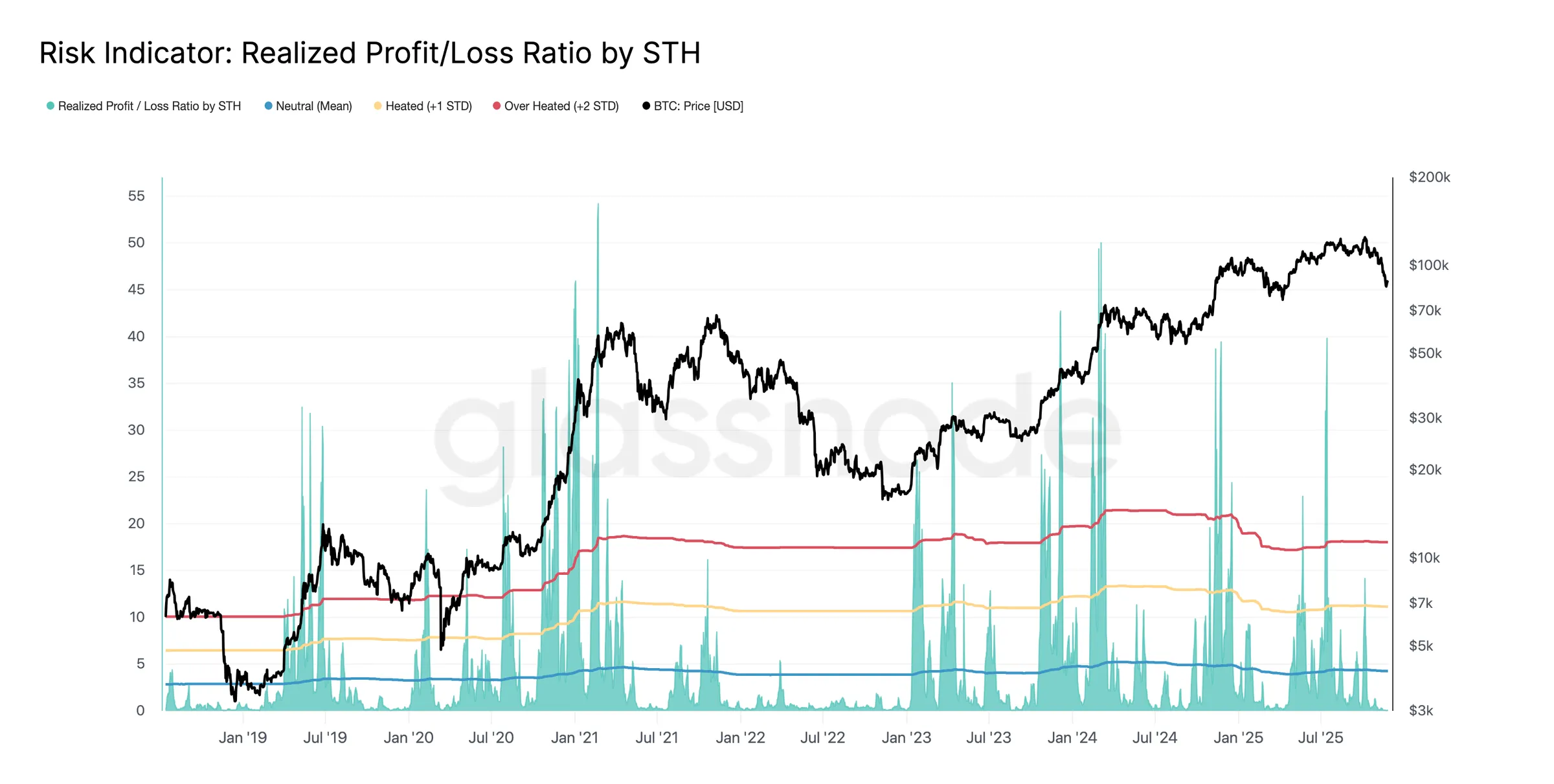

Liquidity Signals Flash Caution as Short-Term Holders Realize Heavy Losses

-

Bitcoin’s liquidity profile is beginning to resemble the weakness seen in early 2022. The asset continues trading below the short-term holder cost basis at $104,600, pushing the market into a fragile, low-liquidity zone. Realized losses have ballooned to $403 million per day, and the STH Profit/Loss Ratio has collapsed to 0.07x, indicating confidence has evaporated. Analysts say BTC may drift back toward the “True Market Mean” near $81,000 unless liquidity stabilizes and short-term holder profitability recovers.

-

Short-term loss taking usually signals stress—market may stay volatile.

-

Liquidity thinning is a warning sign for anyone expecting quick upside.