ETH & SOL Loss Metrics Ignore Massive Staking Locks

-

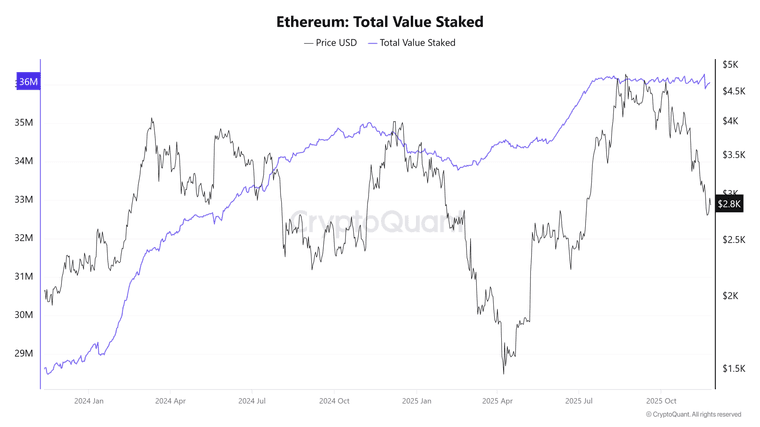

ETH shows 37% of supply at a loss, but over 40% of the supply is locked in staking, ETFs, or strategic reserves.

SOL looks even more dramatic at 70% supply in loss, yet 73.6% of all SOL is staked — one of the highest staking ratios in the industry.

Both assets’ supply-at-loss metrics spike during fast pullbacks, but these moves mostly reflect price velocity, not capitulation. Heavy staking reduces the share of tokens that can actually be sold, making raw loss data misleading. -

Loss metrics look scary, but staking locks change the full picture.

-

Large staked amounts reduce real circulating supply significantly.