The Real Liquid Supply Under Pressure Is Small

-

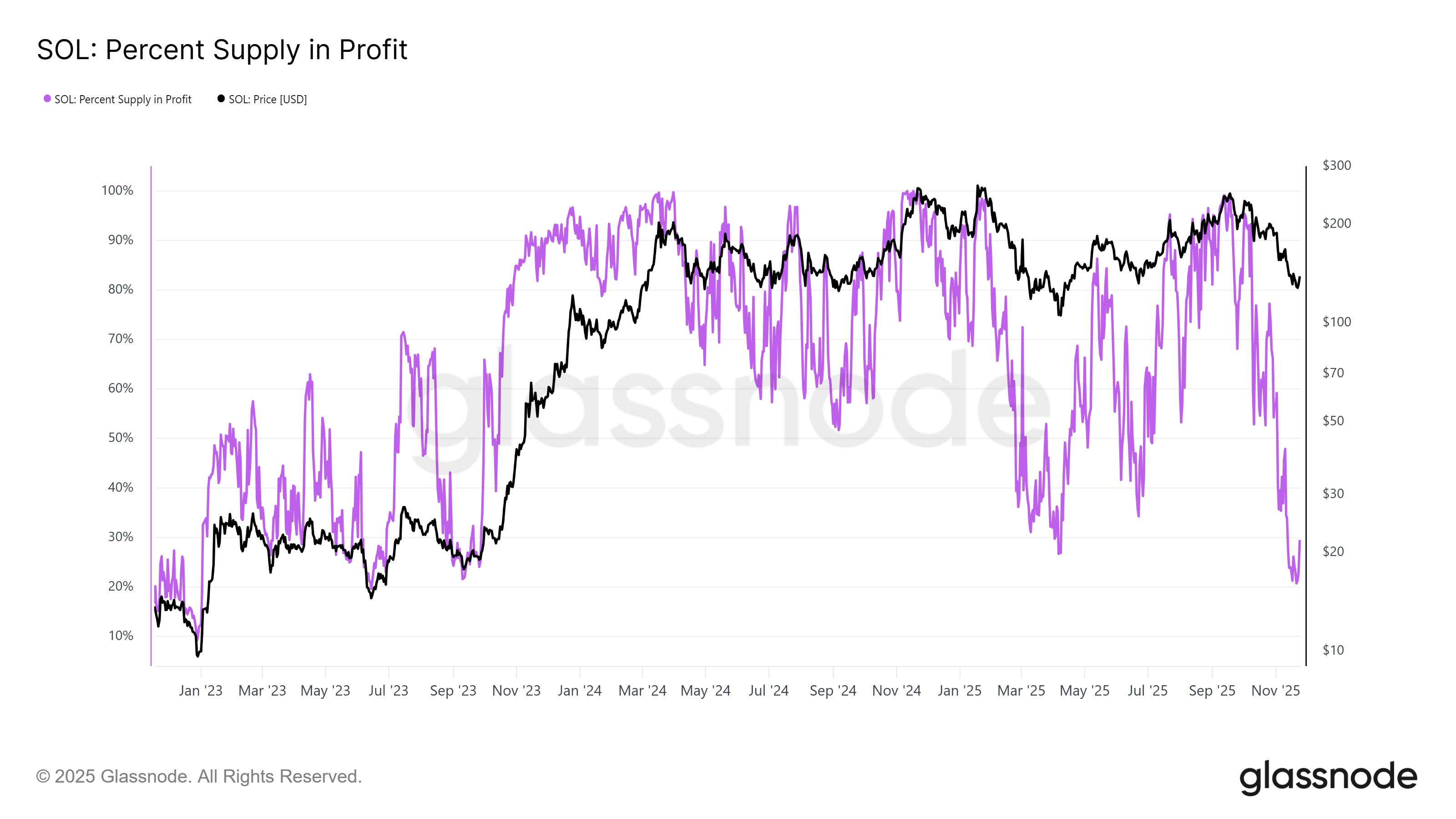

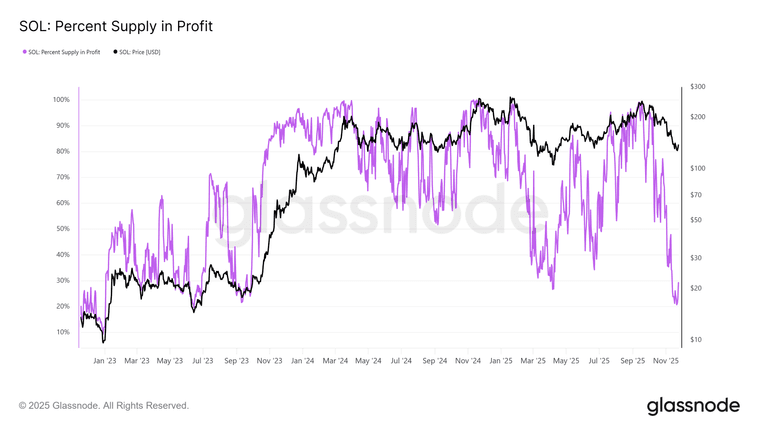

When adjusting for staking, institutional custody, ETFs, and long-term reserves, the supposed “record levels” of supply at a loss shrink dramatically.

• BTC’s liquid float is reduced by corporate holdings and millions of permanently lost coins

• ETH’s locked, non-reactive supply exceeds 40%

• SOL’s staking ratio keeps more than three-quarters of tokens off the market

The takeaway: price drawdowns don’t automatically translate to large sell pressure, because a huge portion of supply across these networks is structurally unavailable. -

Actual liquid supply is much smaller than most people realize.

-

Tight liquid supply often leads to sharp price movements.