How is Zcash (ZEC) different from ETH and SOL?

FAQ

2

Posts

2

Posters

8

Views

-

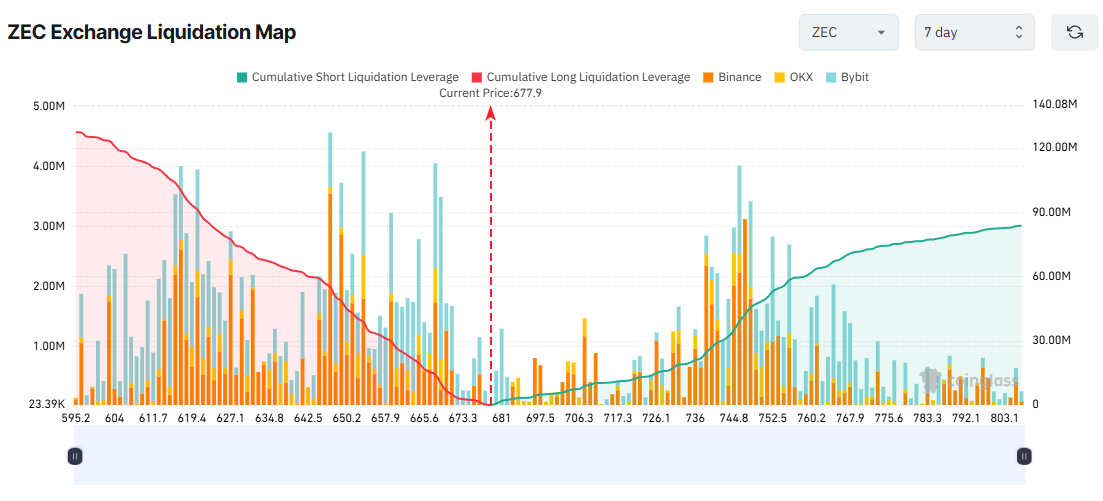

ZEC faces Long-side liquidation risk, unlike ETH and SOL:

Short-term traders are bullish, expecting higher highs.

But repeated rejections near $700 raise the risk of a correction.

If ZEC falls below $600, Long liquidations could exceed $123M.

ZEC’s all-time high open interest of $1.38B shows significant leveraged exposure, increasing volatility risk.

-

But repeated rejections near $700 raise the risk of a correction.