🚨 Bitcoin Eyes $122K — But Is the Bull Run Losing Steam?

-

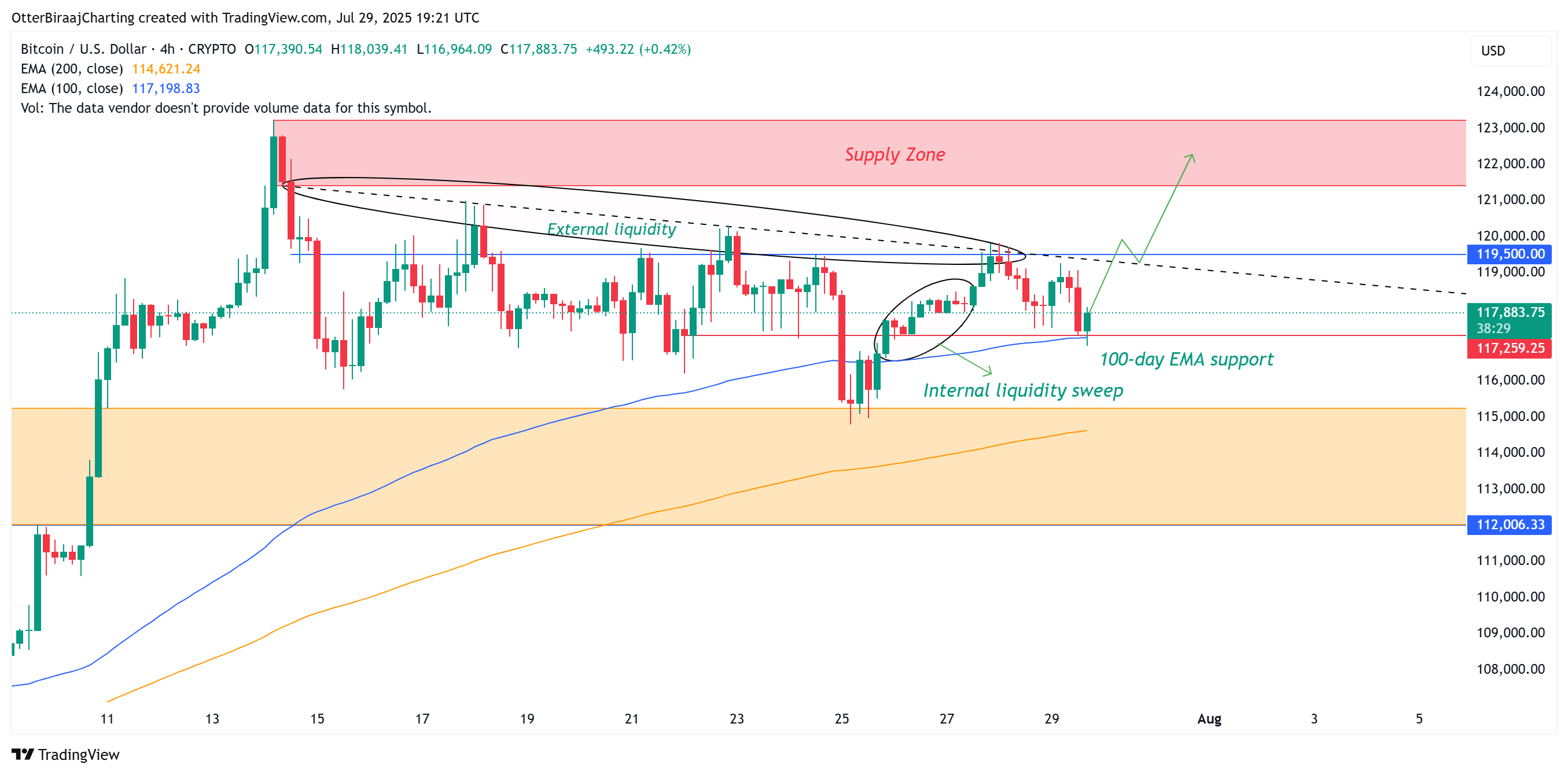

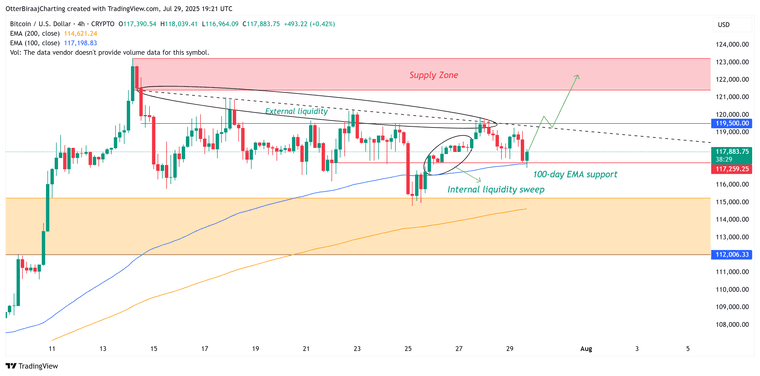

Bitcoin just dipped below $117K and swept weekend liquidity — but that might not be the bad news it sounds like.

Here’s what’s going on

Key Observations

Key ObservationsBTC is targeting the $120K–$122K zone, where $2 billion in shorts could get liquidated 💥 100-day EMA still providing support — bulls aren’t out of the game yet But RSI is dropping fast, and ETF inflows have fallen 80%. Institutional interest is cooling Trading volume is shrinking, and on-chain activity is starting to fade 96.9% of BTC supply is in profit — is a sell-off brewing? Why $122K Matters

Why $122K MattersThat price level is loaded with short liquidations. If Bitcoin can sweep through, we might see a rapid move higher — maybe even a break past resistance at $123.2K.

But here’s the catch: we could also be forming a double top, signaling potential buyer fatigue at these highs.

🧠 Context: Seasonality + Sentiment Historically, August is red 60% of the time with only 2.5% avg gains

Historically, August is red 60% of the time with only 2.5% avg gains

Spot ETF flows dropped from $2.5B to $496M last week

Spot ETF flows dropped from $2.5B to $496M last week

Daily RSI has dropped from 74 → 51.7

Daily RSI has dropped from 74 → 51.7

Daily volumes: $8.6B and falling

Daily volumes: $8.6B and fallingTranslation? Market participation is fading just as we approach a key resistance zone.

What Could Flip the Script?

What Could Flip the Script?Two big events this week:

White House crypto policy announcement: A Bitcoin Reserve Framework could reignite ETF flows 🔥 FOMC meeting: No rate cut expected, but a dovish Powell might spark optimismBoth could bring bulls back just in time to blow through $123K. But without those catalysts, we may see a retrace.

Discussion Time

Discussion TimeWill Bitcoin break above $123K this week or are we headed for a correction? Is the $2B short squeeze setup enough to push the market higher? Are you reducing exposure or holding through Q3 volatility?Let’s hear your takes