Bitcoin Cycle May Be Breaking as ETFs and Treasuries Take Over

Hero Portfolio

3

Posts

3

Posters

3

Views

-

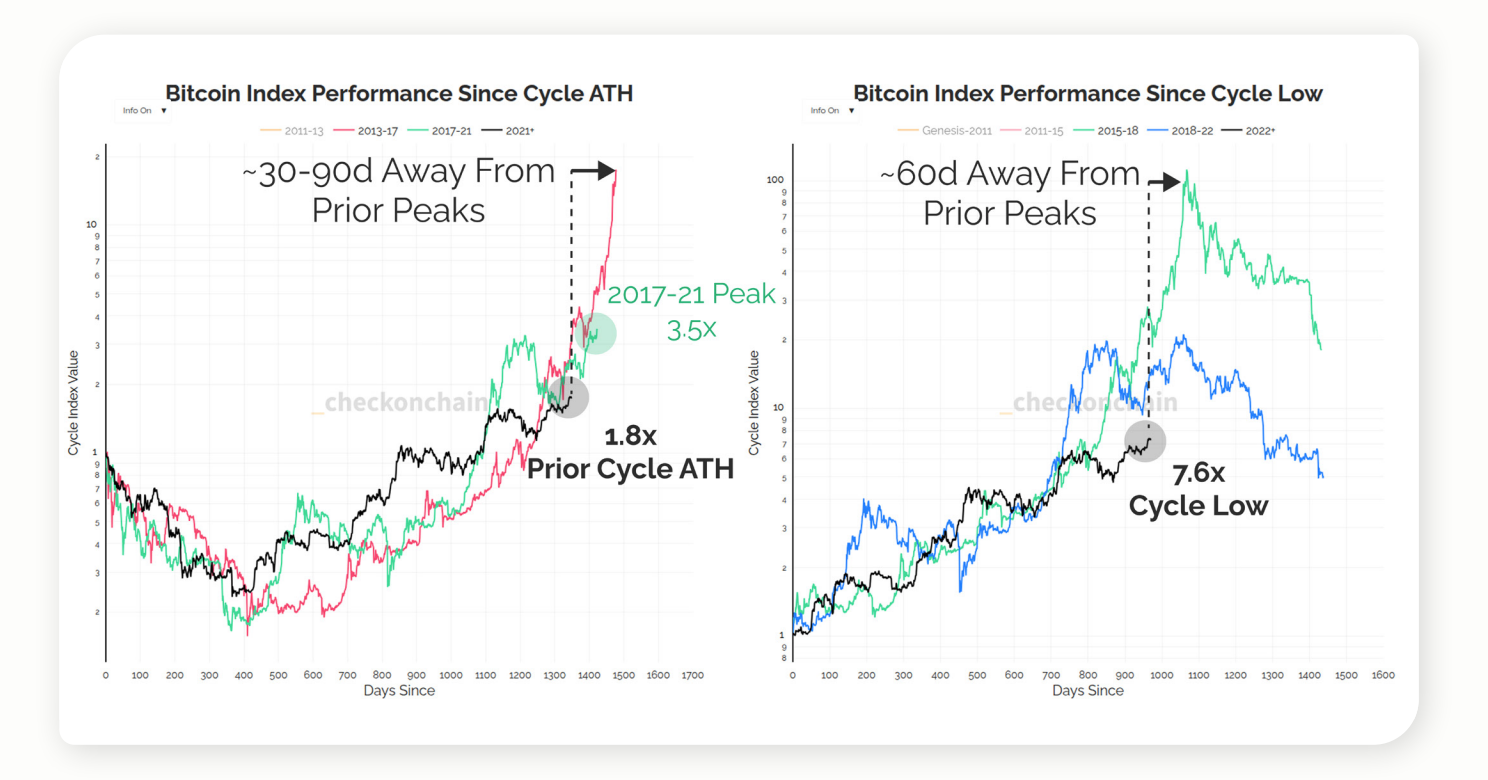

Bitcoin’s traditional four-year halving cycle may no longer dictate price action. Despite record ETF inflows and growing corporate treasuries, the market now responds more to liquidity shocks, sovereign allocations, and derivatives growth.

On-chain analyst James Check from Checkonchain notes that long-term holders and ETF demand are the main drivers, while miner supply—once key—has become negligible. The era of cycle-based trading could be ending as Bitcoin matures into a liquidity-driven asset.