🚨 The GENIUS Act Just Redefined Stablecoins — and Wall Street’s Coming In Hot

-

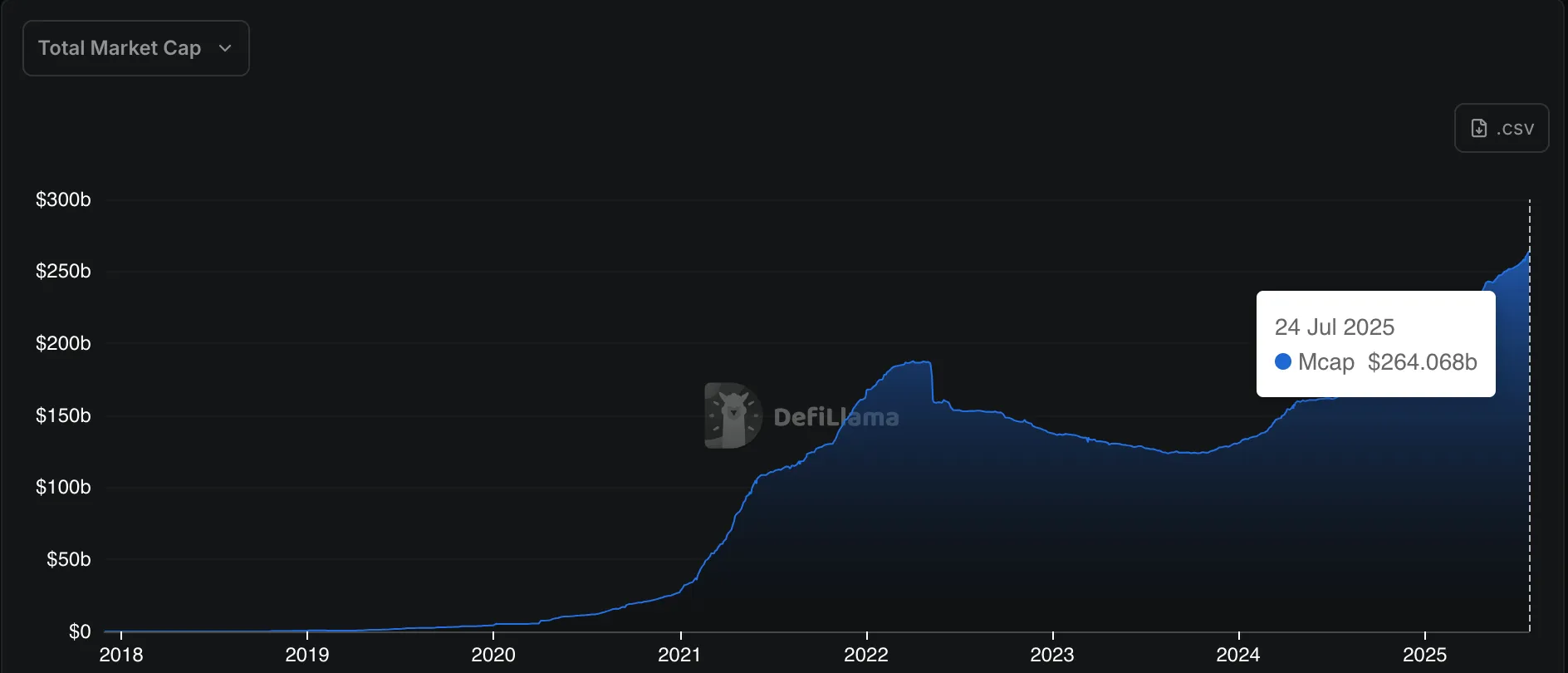

It’s official: the GENIUS Act has landed—and within one week, it’s already injected nearly $4 billion into the crypto sector, pushing stablecoin market cap to $264B+. Regulatory clarity? Check. Institutional FOMO? Also check.

This isn’t just another bill. The GENIUS Act gives U.S. banks, asset managers, and crypto-native companies a federal green light to issue fiat-backed stablecoins without fear of SEC whiplash. And the effects? Immediate.

TradFi Is Kicking In the Door

TradFi Is Kicking In the DoorCoinbase’s Brian Armstrong said it best:

“I think everybody should be able to create stablecoins.”Well, TradFi took that personally. Within days of the GENIUS Act passing:

🏛️ Anchorage Digital teamed up with Ethena Labs to launch a fully compliant USDtb 💼 WisdomTree dropped USDW, a stablecoin for tokenized dividend assets 🏦 Bank of America, JPMorgan, and Citigroup confirmed they’re exploring stablecoinsLooks like every major financial player wants their own flavor of digital dollars.

Not All Stablecoins Are Built the Same

Not All Stablecoins Are Built the SameLet’s break it down like a DeFi DJ:

Fiat-Backed (aka the SEC’s new favorite child) Pegged 1:1 to USD. Backed by Treasurys or cash. Think USDT, USDC. ~85% of the market. Crypto-Backed Overcollateralized with ETH, BTC, etc. The king here is DAI ($4.3B market cap). Algorithmic Auto-magic supply adjustments. Also, please see: Terra/LUNA implosion. Sidestepped by the GENIUS Act for now. Commodity-Backed Pegged to real-world stuff like gold (PAXG). Rare, but potential inflation hedges.The GENIUS Act is laser-focused on fiat-backed coins, requiring:

Full reserves

Full reserves

Audits

Audits

Licenses

Licenses

No algorithmic funny business

No algorithmic funny business

New Capital, New Rules, New Race

New Capital, New Rules, New RaceThis bill doesn’t just give legal clarity—it creates a whole regulated lane for stablecoin innovation. We’re already seeing:

Asset managers tokenizing dividends via stablecoins Crypto-native banks launching issuance platforms Speculation that 1 in 3 real estate purchases may use crypto within 5 yearsAnd now that U.S. banks don’t have to tiptoe around the SEC, expect a surge in stablecoin competition.

So What’s Next?

So What’s Next?The big questions:

Will USDt and USDC hold their lead, or will Wall Street create a new top dog? Can decentralized options like DAI stay relevant in a compliance-first era? Will commodity-backed stablecoins finally have their gold-pilled moment?Stablecoins just went from “DeFi rails” to front-page finance. And the real showdown? It’s not just about tech anymore—it’s about trust, regulation, and who controls the future of money.

What’s your take?

Are you riding with crypto-native issuers or switching teams to TradFi tokens?

Are you riding with crypto-native issuers or switching teams to TradFi tokens?Drop your thoughts below

#crypto #coin #USDT -

This is a watershed moment for stablecoin regulation in the U.S. The GENIUS Act—signed into law in mid‑July 2025—introduces for the first time a federal licensing framework for “payment stablecoins,” requiring 1:1 backing with high‑quality liquid assets (e.g. U.S. dollars and short-term Treasuries), mandatory monthly audited disclosures, and strict anti‑money laundering protocols

-

Wall Street and Big Retail are gearing up fast—but it's not all smooth sailing. With the GENIUS Act now allowing regulated banks and approved nonbank entities—including foreign issuers under certain conditions—to launch payment stablecoins, corporations like Amazon or Walmart could soon issue their own tokens, potentially cutting card fees by 2–3% per transaction and changing retail dynamics