Corporate Crypto Treasuries Are Booming — But Is It a Gold Rush or a Minefield?

-

Big news this week: traditional companies are going full degen (well, sort of).

In just the past few days, we’ve seen firms from agriculture, manufacturing, and even a 78-year-old Japanese textile company start stacking digital assets like XRP, SOL, and BTC as part of their corporate treasury strategies.

That’s right — crypto isn’t just for hedge funds and HODLers anymore. Now it’s part of the balance sheet.

🧾 Who's Buying What?🌾 Nature’s Miracle (AgriTech) – Allocating up to $20M in XRP for its treasury 🏭 Upexi (Consumer Goods) – Just bought 83,000 SOL (~$16.7M) 👘 Kitabo (Textile & Recycling) – Buying ¥800M (~$5.6M) in BTCFrom tractors to t-shirts, companies are diversifying into tokens. And they’re not just chasing Bitcoin — they’re going after altcoins too.

What This Means for Investors

What This Means for InvestorsIf this trend holds, we could see:

More corporate demand = upward pressure on prices

More corporate demand = upward pressure on prices

Institutional validation of altcoins like SOL and XRP

Institutional validation of altcoins like SOL and XRP

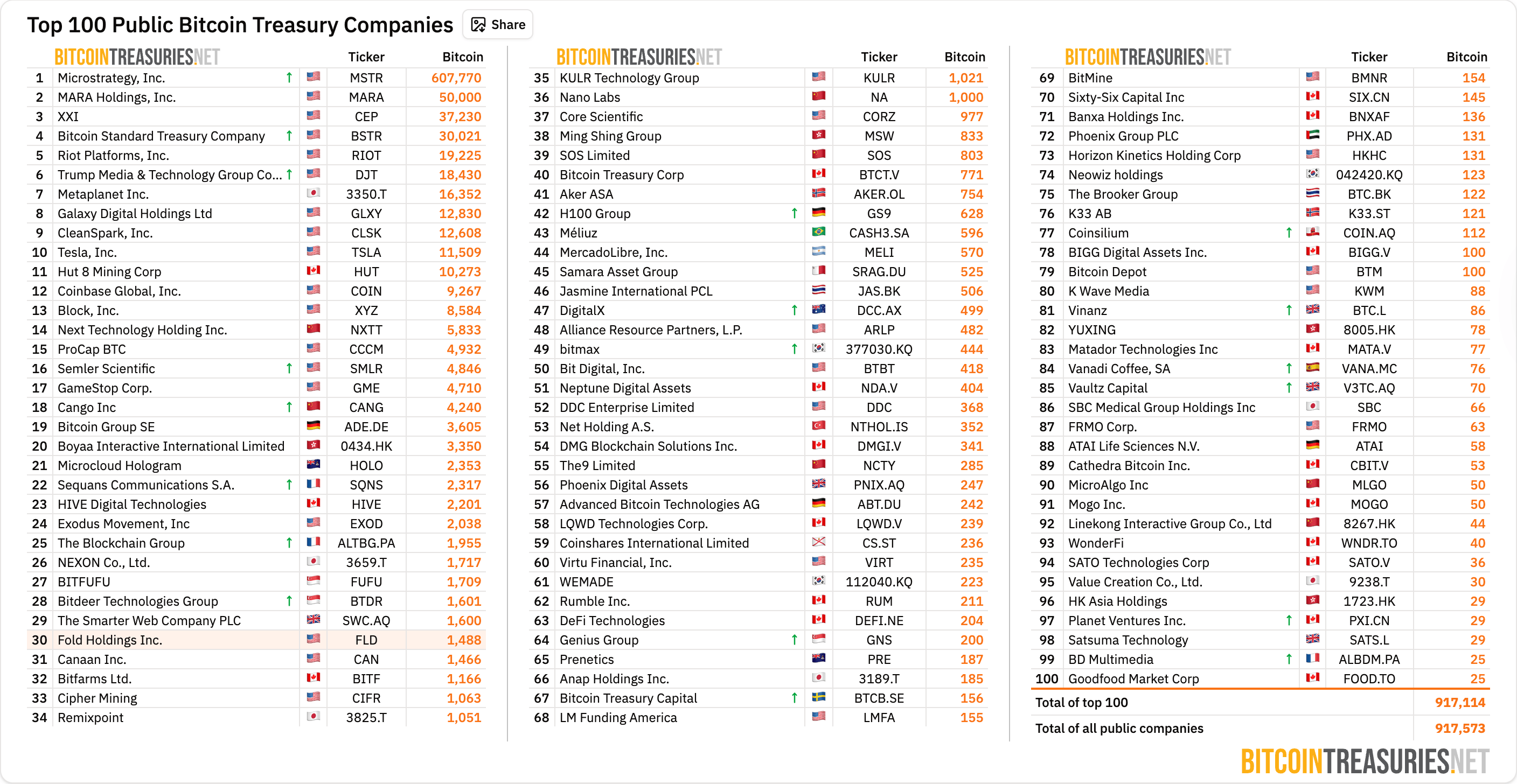

A new market segment of “crypto treasury stocks” — companies whose valuation is tied to their token holdings

A new market segment of “crypto treasury stocks” — companies whose valuation is tied to their token holdingsSound familiar? It’s like MicroStrategy 2.0 — but now in multiple sectors.

If you're looking for exposure to crypto without directly holding coins, these treasury-loaded stocks could be your entry point.

️ BUT — Let’s Talk Risks

️ BUT — Let’s Talk RisksAnalysts are warning this could get messy if:

BTC drops sharply → companies overleveraged on Bitcoin may be forced to sell to cover debt Altcoins nosedive → assets with no floor could collapse by 90%+ in bear markets Shareholder lawsuits → public firms could face blowback if token strategies underperformBreed VC even coined the phrase: "Bitcoin treasury death spiral" — when falling BTC forces corporate panic selling, dragging the market lower in a vicious loop.

As one community member put it:

“Altcoins have no floor… they’re cooked once the music stops. BTC at least has a rising long-term floor.” TL;DR – Is There Money to Be Made?

TL;DR – Is There Money to Be Made?👀 Crypto is going corporate — XRP, SOL, BTC are entering boardrooms 📈 Public companies may pump based on token holdings (just like MicroStrategy) 🧨 But this strategy is risky AF, especially for firms betting big on volatile altcoins 🎯 Play it right, and there’s real upside — but don’t sleep on the crash potentialAnyone here buying into these companies? Watching which token treasuries? Or avoiding it all and stacking spot?

Let’s talk plays, risks, and the next MSTR below

-

Insightful post — it really captures the tension between opportunity and risk in corporate crypto treasuries. On one hand, firms can optimize idle capital, hedge foreign-exchange exposure, and even tap into staking yields. But on the flip side, this is uncharted territory: market volatility, regulatory shifts, and custody vulnerabilities are serious concerns. I’d love to see more discussion around internal governance—especially how boards are evaluating risk thresholds, setting position limits, and managing auditors or custodians. Bold yet methodical risk management is absolutely essential here.

-

Fantastic breakdown! The ROI potential is tempting, but treasury teams need to act with institutional-grade diligence. Exposure to bitcoin or stablecoins can offer real returns, but that depends on factors like custody safeguards, counterparty counterchecks, insurance coverages, and contingency plans for sharp price moves. What matters most is integration: treasury policies should define clear entry/exit criteria, stress testing scenarios, and audit trails. This isn’t a speculative play—it’s a financial management evolution that must be executed with precision.