How Ethereum’s “Liquidity Lag” Could Be Your Next Big Opportunity

-

While Bitcoin’s up 130% since 2022, Ethereum’s only gained 15% — but that may be about to change.

Here’s what’s bullish:

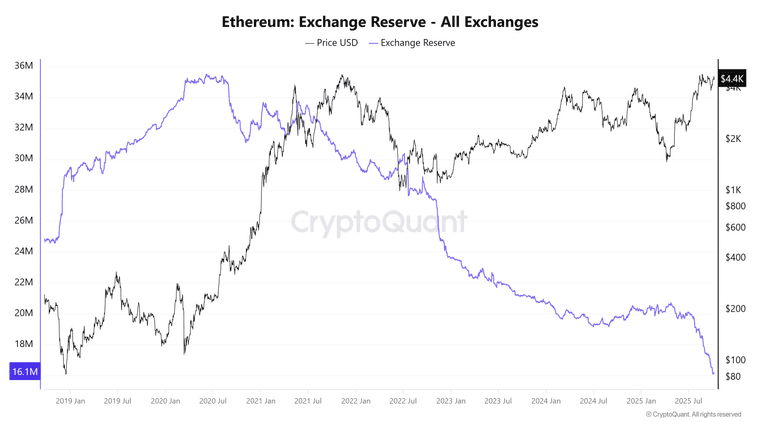

Here’s what’s bullish:Exchange reserves dropped 25% since 2022 → less ETH available to sell.

More ETH staked or self-custodied → reduced supply.

Liquidity is increasing across the economy, which historically boosts ETH prices with a lag.

How to make money: Accumulate during dips ($4.1K–$4.4K zone) and stake ETH for passive yield while waiting for the next breakout above $4,800.

How to make money: Accumulate during dips ($4.1K–$4.4K zone) and stake ETH for passive yield while waiting for the next breakout above $4,800.Patience + positioning = profit.

-

Smart investors always move when liquidity gaps appear — ETH could surprise soon.