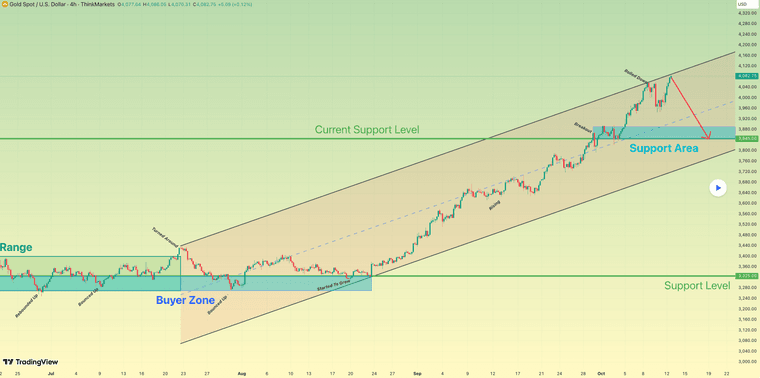

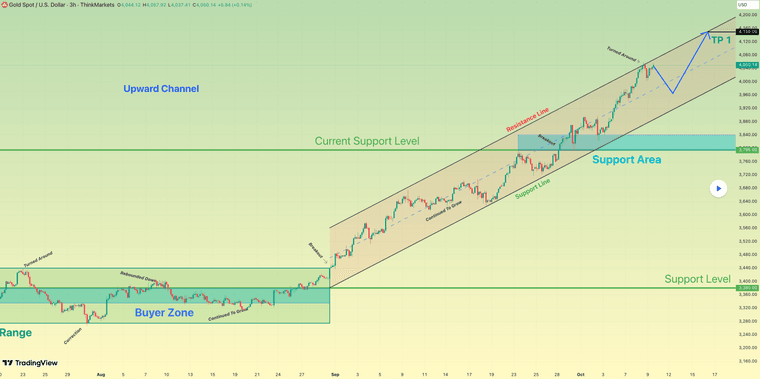

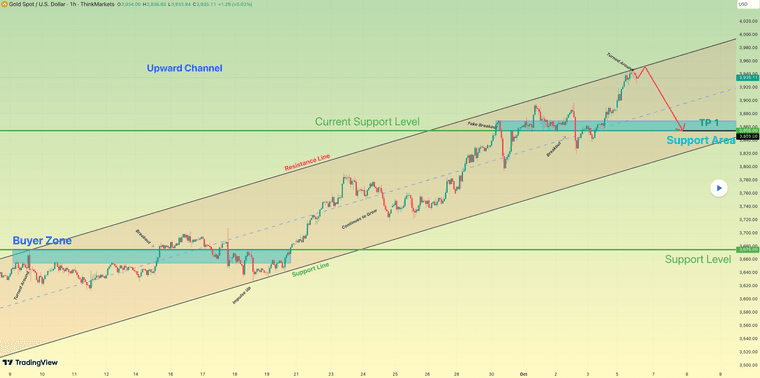

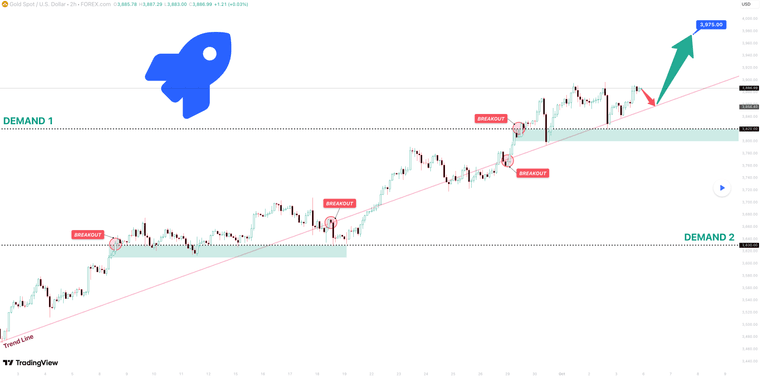

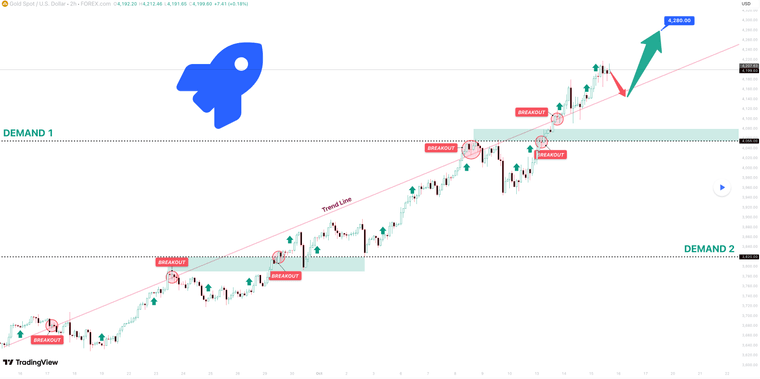

Hello, traders! The price auction for XAUUSD has been in a powerful and sustained bullish phase, with the market structure being clearly defined by a major ascending trend line. This uptrend has demonstrated significant strength, breaking through multiple key resistance levels such as 3820 and 4055, confirming that buyers are in full control of the market.

Currently, the auction has entered an acceleration phase. The price has broken out above its long-term ascending trend line, a significant event that suggests the bullish momentum is increasing. The market is now in a clear expansion phase, trading in new high territory after leaving the prior structure behind.

My scenario for the development of events is a classic breakout and retest of this major trend line. I believe the price will make a corrective pullback to test the broken trend line from above, confirming it as new support. In my opinion, a successful bounce from this line would validate the acceleration and trigger the next impulsive wave higher. The take-profit is therefore set at 4280. Manage your risk!