XAUUSD – Liquidity Zones in Focus Ahead of Key Mid-Week Flows

-

MARKET CONTEXT

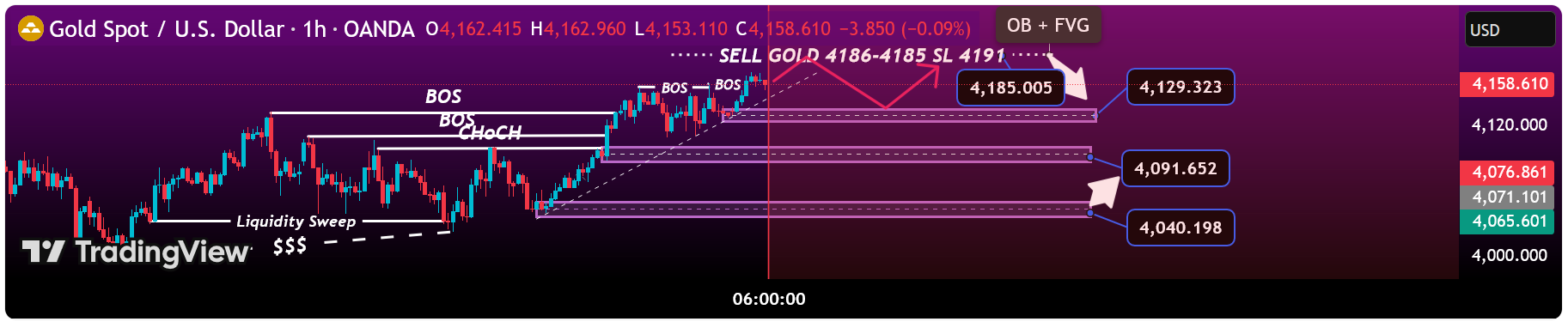

MARKET CONTEXTGold enters today’s market with a neutral-to-bearish structure on H1. After yesterday’s controlled movement and liquidity sweeps on both sides, price continues to trade inside a wide intraday range, waiting for a catalyst for expansion.

Recent Market Drivers:

USD remains steady as traders anticipate upcoming US economic data

Risk sentiment stays mixed → no dominant safe-haven inflows

Institutional orderflow shows accumulation at discount zones but controlled sell pressure at premium zones

Session Expectations:

London Session: Likely to engineer liquidity toward premium levels

New York Session: Higher probability of displacement and real directional movement

Bias: Bearish-to-neutral unless discount zones create a significant CHoCH

Price currently sits mid-range, meaning optimal trades are only at liquidity extremes.

TECHNICAL ANALYSIS (SMC + LIQUIDITY STRUCTURE)

TECHNICAL ANALYSIS (SMC + LIQUIDITY STRUCTURE)

Market StructureH1 trend: Lower Highs → Lower Lows

Current range: 4186 (premium) → 4038 (discount)

Liquidity layers building above recent highs and below structural lows

Liquidity Map

Buy-side liquidity (BSL): above 4186

Sell-side liquidity (SSL): below 4040 and especially below 4038

Engineered wicks indicate institutional stop hunts in both directions

Imbalance Zones

Premium imbalance: 4186–4185

Mid-range imbalance: 4130–4128

Reaction imbalance: 4092–4090

Deep discount imbalance: 4040–4038

KEY PRICE ZONES (With Clear, Attractive Explanations)

KEY PRICE ZONES (With Clear, Attractive Explanations)

4186–4185 ️ Premium Supply Trap – High-Probability Sell Zone

️ Premium Supply Trap – High-Probability Sell ZoneAn unmitigated bearish OB + BSL inducement.

Institutions use this region to trigger breakout buys before reversing strongly.4130–4128

️ Mid-Range Rejection Zone – Scalping Buy Opportunity

️ Mid-Range Rejection Zone – Scalping Buy OpportunityA small demand pocket sitting just below liquidity.

Ideal for quick intraday rebounds after a liquidity sweep.4092–4090

️ Discount Scalping Demand – Clean Reaction Area

️ Discount Scalping Demand – Clean Reaction AreaSSL lies just below + imbalance fill.

Favorable for low-drawdown buy setups during session transitions.4040–4038

️ Deep Discount Demand – Strong Reversal Zone

️ Deep Discount Demand – Strong Reversal ZoneMajor structural support + confluence with HTF discount.

If price reaches here, expect high-probability reversal and strong displacement. ️ TRADE SETUPS (Precision SMC Entries)

️ TRADE SETUPS (Precision SMC Entries)

SELL SETUP – PREMIUM REVERSAL

SELL SETUP – PREMIUM REVERSALEntry: 4186–4185

SL: 4191

TP1: 4170

TP2: 4140

TP3: 4100

Logic: BSL sweep → retest OB → bearish move expected. BUY SCALP SETUP 1 – MID-RANGE BOUNCE

BUY SCALP SETUP 1 – MID-RANGE BOUNCEEntry: 4130–4128

SL: 4122

TP1: 4140

TP2: 4160

Logic: Quick reaction zone following liquidity sweep near mid-range. BUY SCALP SETUP 2 – DISCOUNT REACTION

BUY SCALP SETUP 2 – DISCOUNT REACTIONEntry: 4092–4090

SL: 4084

TP1: 4105

TP2: 4125

Logic: SSL sweep + imbalance → bounce expected. BUY SETUP – DEEP DISCOUNT REVERSAL

BUY SETUP – DEEP DISCOUNT REVERSALEntry: 4040–4038

SL: 4032

TP1: 4060

TP2: 4090

TP3: 4120

Logic: High-value institutional demand, excellent for reversal plays.🧠 NOTES / SESSION PLAN

Avoid trading inside the mid-range → only execute at extremes

Expect false breaks during London opening

NY session likely determines real direction of the day

Confirm entries on M5/M15 (BOS + CHoCH)

Don’t buy near premium zones → avoid liquidity traps

CONCLUSION

CONCLUSIONXAUUSD maintains a bearish-to-neutral structure on H1.

Premium zone 4186–4185 remains the top-quality sell area, while discount zones 4128, 4090, and 4038 provide high-probability buy setups.Patience is key — wait for liquidity sweeps before striking.

-

Gold is moving toward major liquidity areas—mid-week action will be crucial.

-

Traders should watch volume closely as liquidity gets tapped.