EURUSD - Waiting on the direction!

-

Introduction

Introduction

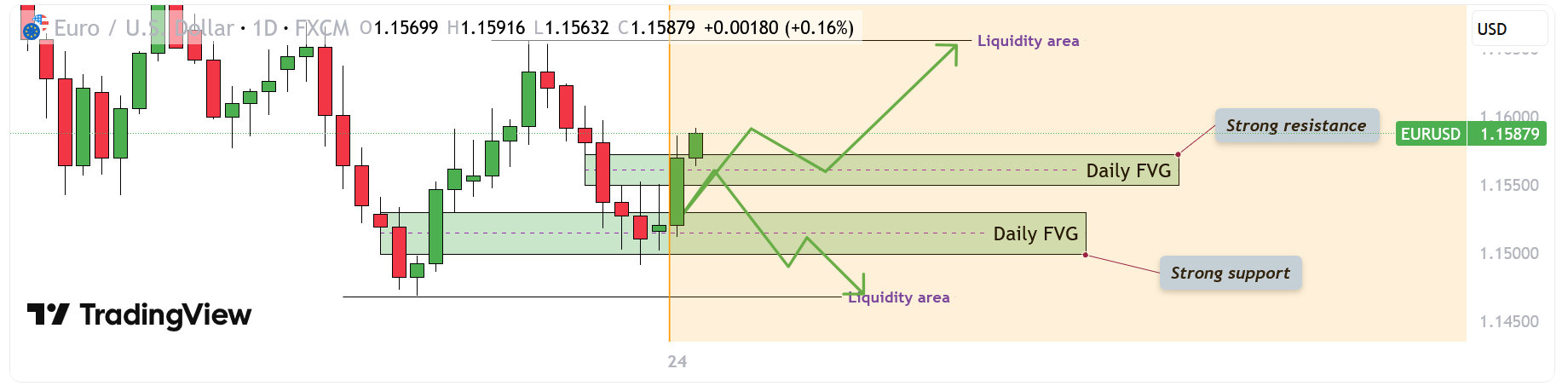

EURUSD is currently trading in a very technical zone where price is positioned between two significant daily fair value gaps. These opposing imbalances—one bearish and one bullish—are acting as major directional barriers. As long as price remains contained between them, the pair is effectively trapped in a compression phase, awaiting a decisive breakout. The next clear move will likely arise when either the upper or lower FVG gives way, allowing the market to target the liquidity zones that lie beyond these imbalances.Daily Bearish FVG

Above current price sits the daily bearish fair value gap, which is acting as a strong resistance area. If EURUSD manages to break through this upper FVG with conviction, it would indicate that buyers have reclaimed control. A clean break above this zone would open the path toward the liquidity area located at the top of the chart. This region is where a large cluster of stop orders and resting buy-side liquidity is likely positioned. A move into this area would be a natural target as price seeks to rebalance inefficiencies and tap into the liquidity pool above previous highs.Daily Bullish FVG

Below the current range lies the daily bullish fair value gap, functioning as a major support zone. If EURUSD breaks below this lower FVG, it would signal a shift in momentum back to the downside. Such a move would send price toward the liquidity zone at the bottom, where sell-side liquidity rests beneath prior lows. This would align with typical market behavior in a bearish continuation—first taking out inefficiencies, then reaching into the liquidity pools that form below structural lows.Conclusion

EURUSD is currently confined between two major daily FVG levels, creating a tightly compressed structure where the next breakout will dictate direction. Until price decisively breaks either the bearish FVG above or the bullish FVG below, the pair remains in a waiting phase. The eventual breach of one of these imbalances will determine whether EURUSD hunts liquidity at the top or at the bottom, making this a critical moment for directional clarity in the market. -

EURUSD is stuck in indecision—breakout would define the next trend.

-

Direction will be clearer once liquidity on either side gets taken.