Institutions Are Reshaping Bitcoin Cycles

-

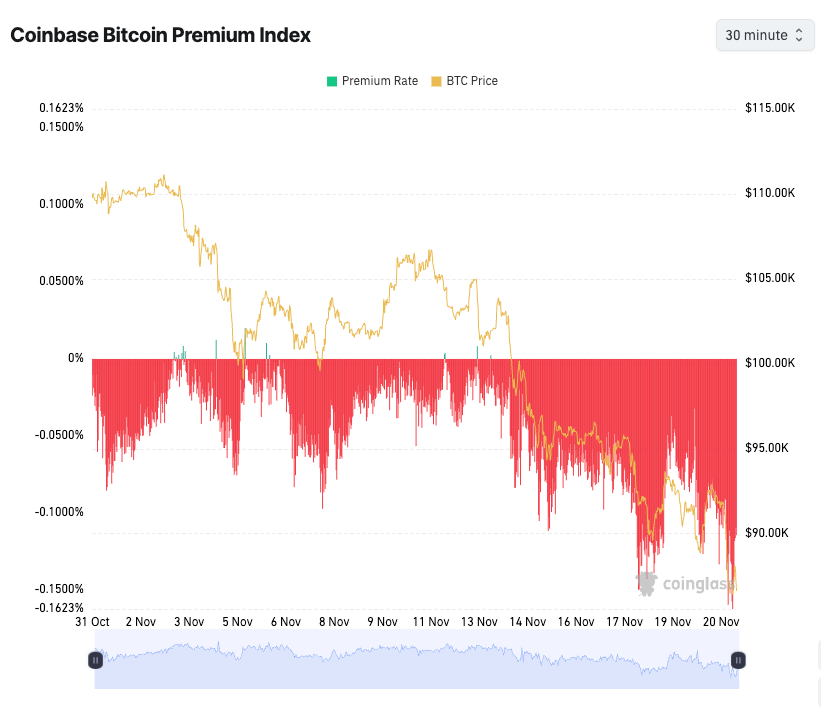

While short-term volatility has traders divided, on-chain analysts argue the bigger story is institutional influence.

According to Ki Young Ju, Bitcoin’s bull cycle technically peaked above $100K earlier in 2024 — but unlike past cycles, institutional holders now form a price floor. Corporate treasuries and long-term allocators are absorbing supply instead of capitulating.This stabilizes drawdowns but also introduces new risks: if institutional strategies shift, the impact could be sudden and severe. Still, current signals show whales remain bullish, retail is fearful, and U.S. institutions remain cautious.

Bitcoin’s correction may look dramatic, but structurally, liquidity and ownership are changing in ways we’ve never seen in previous cycles.

-

Institutional flows are rewriting the old BTC playbook. Big shift underway.

-

Traditional cycles don’t hold when deep-pocket players step in.