AAPL – Decision Point Ahead? Nov. 21 Trade Plan

-

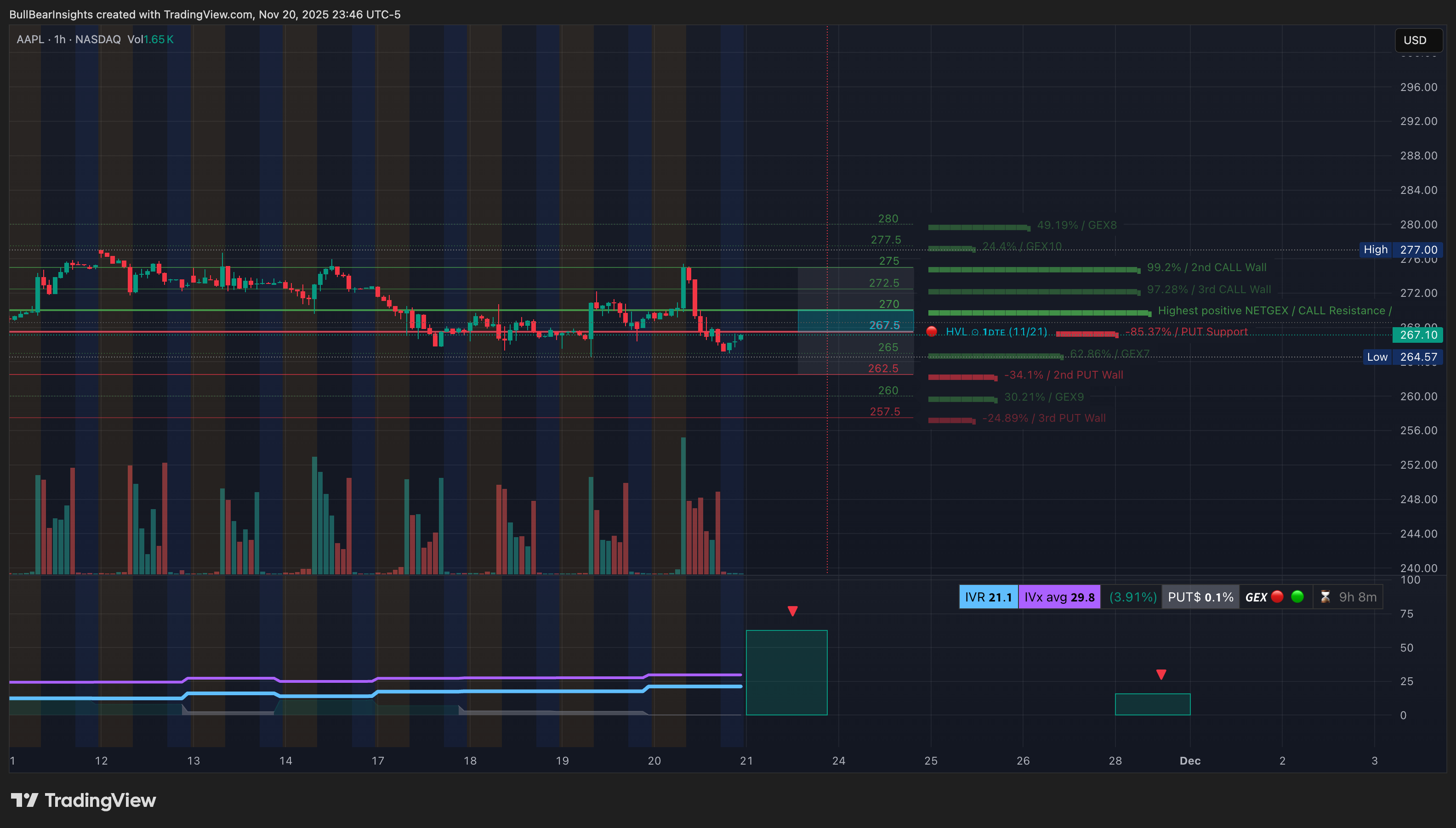

1-Hour Outlook (Main Bias)

1-Hour Outlook (Main Bias)

AAPL sold off sharply from the 275–277 zone and is now sitting at the lower trendline of a falling wedge structure. Price is stabilizing near 266–267, where the first signs of a short-term base are forming.

1H Structure- Clear downtrend but entering wedge support.

- Recent BOS to the downside confirms bearish pressure earlier today.

- Price is trying to form a higher low at the wedge bottom.

- MACD is flattening — early signs of slowing bearish momentum.

- Stochastic deeply oversold, beginning to curl up.

1H Key Levels

Upside levels - 270.00

- 272.50

- 275.40–277.00 (major resistance)

Support - 264.50 (1H demand)

- 262.00 (lower wedge support)

Bulls gain advantage above: 270.50 Bears gain control below: 264.50

1H Trading Idea

Bullish scenario: If AAPL holds 266–267 and pushes above 270, buyers can attempt to reclaim 272.50 then 275.40.

Bearish scenario: If 270 rejects or price breaks back below 266, look for continuation into 264.50 → 262.

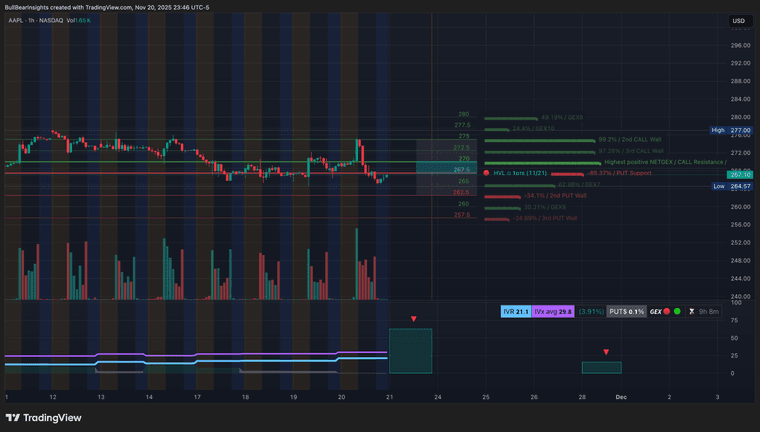

15-Minute Outlook (Execution Timeframe)

AAPL is consolidating inside a narrow 266–268 range after the heavy drop earlier. Structure is mixed but trying to form a micro base.

15M Structure- CHoCH → small BOS → micro consolidation.

- EMAs are still stacked bearish but flattening.

- Price is sitting inside a discounted zone of the wedge.

15M Trading Setups

Bullish entry: - Ideal retracement entry: 266.20–266.80

- Look for a bullish engulfing or strong rejection wick.

- Targets: 270 → 272.50

- Stop: below 265.20

Breakout entry: - Enter if AAPL clears 270.50 cleanly.

- Stop below last 15M swing low.

- Targets: 272.50 → 275

Bearish scalp: - Only valid if price rejects 270–272 zone repeatedly.

- Target: 264.50

GEX Confirmation

From the GEX chart:

Bearish Pressure- Strong negative NETGEX near 267 → 264 (PUT support).

- Highest negative NETGEX aligns near 264–262, a natural downside magnet.

Bullish Signals - Large CALL walls 275 → 277 → 280, a major resistance cluster.

- Positive GEX blocks appear only if price gets above 272.50.

Interpretation - GEX favors sideways to slight downside unless AAPL can reclaim 270.50.

- Above 272.50, gamma can flip bullish and price can drift toward 275–277.

Options Trading Plan (GEX-Based)

Bullish Plan (requires reclaim of 270.50)

Contracts:- 270C

- 272.5C

Targets: - 272.50 → 275

Reason: Reclaiming 270.50 shifts structure bullish and forces hedging upward into CALL resistance.

Bearish Plan (base case unless reclaimed 270.50)

Contracts:- 265P

- 262.5P

Targets: - 264.50 → 262

Reason: Strong negative NETGEX below 267 guides price toward the 262–264 zone.

Final Bias for Nov. 21

AAPL sits at wedge support.- Bullish only above 270.50 with upside toward 272.50–275.

- Base case: Continued chop/downward drift into 264–262 unless buyers step up aggressively.

Disclaimer

This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk appropriately. -

Apple is sitting at a crucial level — the next move could set the monthly trend.

-

Breakout or breakdown, this zone won’t last long. Big move coming soon.