🚨 ETH BREAKOUT MODE 🚨

-

$ETH up +250% since April lows ($1.3K → $4.8K).

Powell went dovish @ Jackson Hole, hinting at rate cuts → liquidity flood incoming.

ETH ETFs just saw $287M inflows in one day → total AUM now $12.1B+.

Corporates stacking ETH treasuries → $29.7B holdings locked.

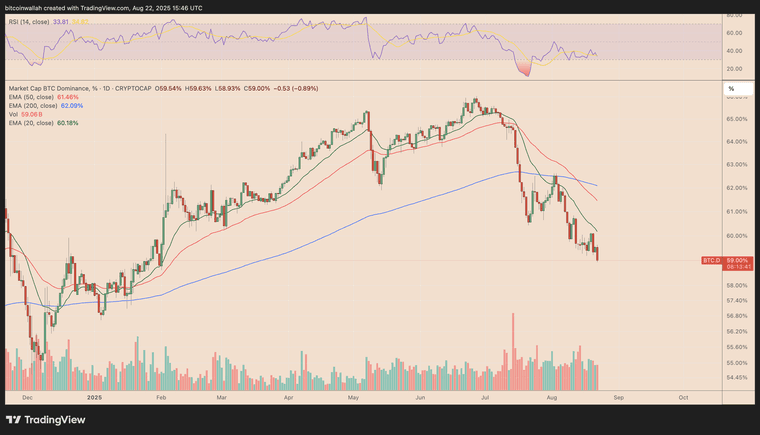

Smart money rotation → BTC dominance <60%, altseason brewing.

Big banks turning bullish:

Standard Chartered target → $7.5K by EOY, $25K by 2028.

Analysts eye $13K ETH in coming months.

ETH no longer “just a token” → it’s becoming a reserve-grade asset.

Perfect storm = ETFs + treasuries + liquidity + altseason. While BTC chills at $114K, $ETH is quietly leading the next leg up.

While BTC chills at $114K, $ETH is quietly leading the next leg up. The market’s telling you: this isn’t 2021 déjà vu… it’s ETH 2.0 narrative season.

The market’s telling you: this isn’t 2021 déjà vu… it’s ETH 2.0 narrative season. -

What’s happening with Ethereum right now feels like the institutional re-rating moment Bitcoin had in 2020. The combination of ETF inflows, corporate treasuries, and dovish macro policy isn’t just speculative noise — it’s ETH moving into reserve-grade territory. When $287M flows in a single day and total AUM crosses $12B+, that’s sticky capital, not retail chasing green candles. Add $29B in corporate holdings and you’re looking at Ethereum being treated as an actual balance-sheet asset. The irony? BTC dominance falling under 60% while ETH quietly leads. If this trend continues, ETH could redefine what the “digital reserve asset” narrative even means.

-

The most bullish signal isn’t just the price pump — it’s the quality of the flows. Standard Chartered openly talking about $7.5K near-term and $25K longer-term shows how the market is reframing ETH as infrastructure, not just a speculative alt. ETFs are sucking in capital, corporate treasuries are stacking, and liquidity from potential Fed cuts is fuel on the fire. Meanwhile, BTC feels like it’s in consolidation mode while ETH is front-running the next cycle. This doesn’t look like 2021 hype — it looks like the start of an ETH-driven altseason supercycle. For anyone still fading ETH, the window is closing fast.