🚨 Ethereum Hits New ATH: Perfect Storm or Top Signal? 🚨

-

Ethereum just smashed past $4,867, its highest level since 2021 — up 250% since April’s $1,385 lows.

So what’s fueling the move?

Powell turns dovish

→ The Fed hinted at a 25bps cut in September, loosening liquidity. Historically, that’s rocket fuel for risk assets like ETH.

→ The Fed hinted at a 25bps cut in September, loosening liquidity. Historically, that’s rocket fuel for risk assets like ETH.ETF inflows return

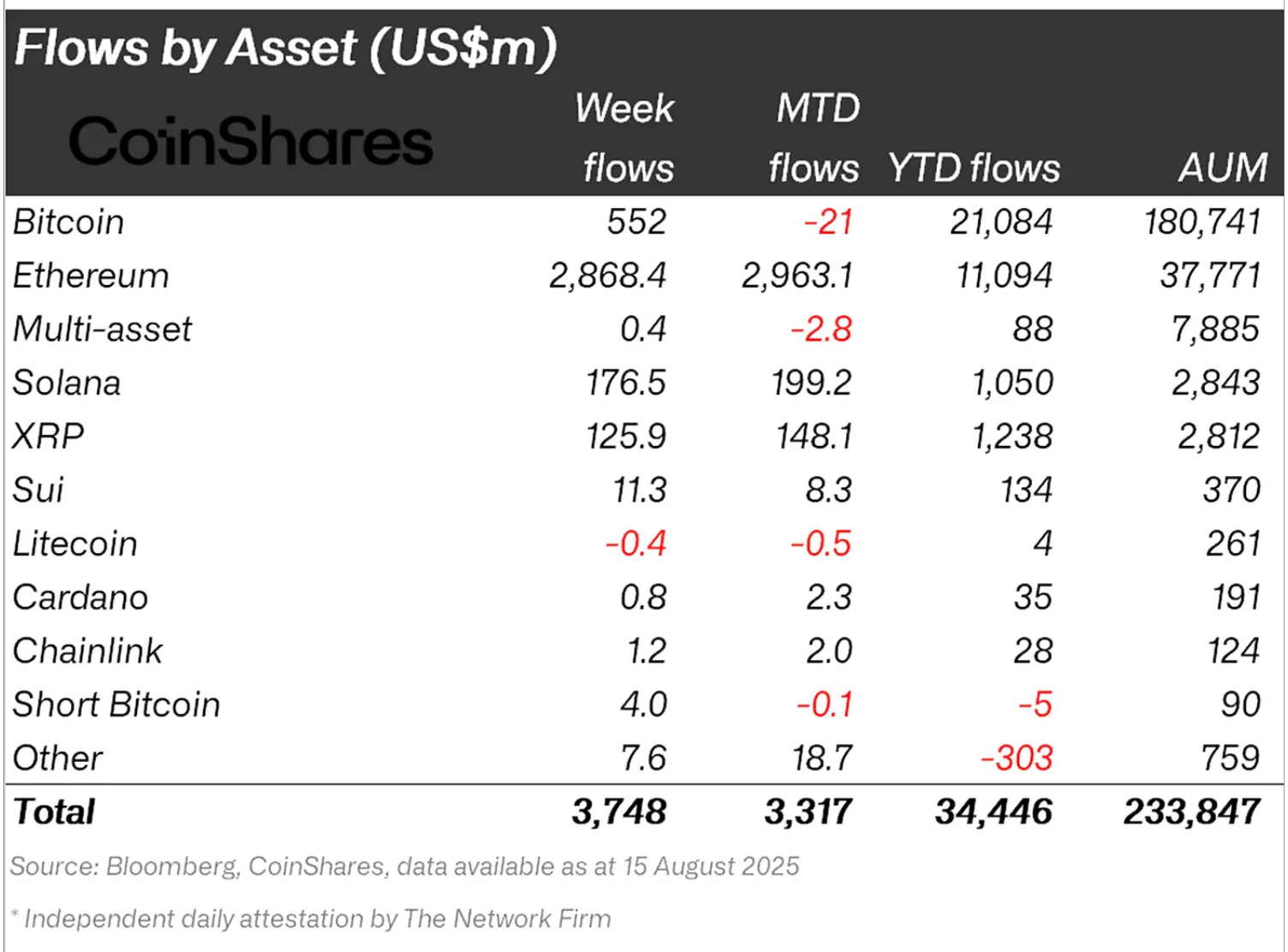

→ U.S.-listed ETH ETFs saw nearly $288M in a single day, lifting total AUM above $12B.

→ U.S.-listed ETH ETFs saw nearly $288M in a single day, lifting total AUM above $12B.Corporate treasuries stacking

→ Firms like BitMine, SharpLink, and BTCS have loaded up, pushing on-chain corporate holdings near $30B.

→ Firms like BitMine, SharpLink, and BTCS have loaded up, pushing on-chain corporate holdings near $30B.Institutional re-ratings

→ Standard Chartered raised its ETH target to $7,500 for 2025 and $25K by 2028.

→ Standard Chartered raised its ETH target to $7,500 for 2025 and $25K by 2028.Meanwhile, BTC dominance slipped under 60% — the lowest in 4 months. Capital is clearly rotating into alts, and ETH is leading the charge.

Analysts warn this isn’t a “weak hands” pump. Unlike previous tops, OG selling pressure is being met with real demand from ETFs, treasuries, and DeFi adoption.

Key Question: Are we entering an altseason supercycle led by Ethereum — or is this just the market overreacting to dovish Fed talk?

Key Question: Are we entering an altseason supercycle led by Ethereum — or is this just the market overreacting to dovish Fed talk? -

The $4.8K breakout feels very different from the 2021 hype cycle. Back then, leverage and retail FOMO drove price action. This time we’ve got $288M in ETF inflows in one day, corporate treasuries openly disclosing ETH positions, and institutions putting $7.5K–$25K price targets on the table. Add Powell’s dovish pivot = liquidity tailwinds. Feels like the foundation of an altseason led by ETH, not just another speculative spike.

-

ETH strength is undeniable, but calling an “altseason supercycle” might be premature. Powell is dovish today, but CPI is still 2.7% — a surprise inflation print could flip Fed tone back to hawkish overnight. Plus, BTC dominance dipping below 60% often marks short-term euphoria phases where alts overextend. Long term I’m bullish (treasuries + ETFs are real demand), but short term I’m watching $4.6K as the must-hold level before getting carried away.