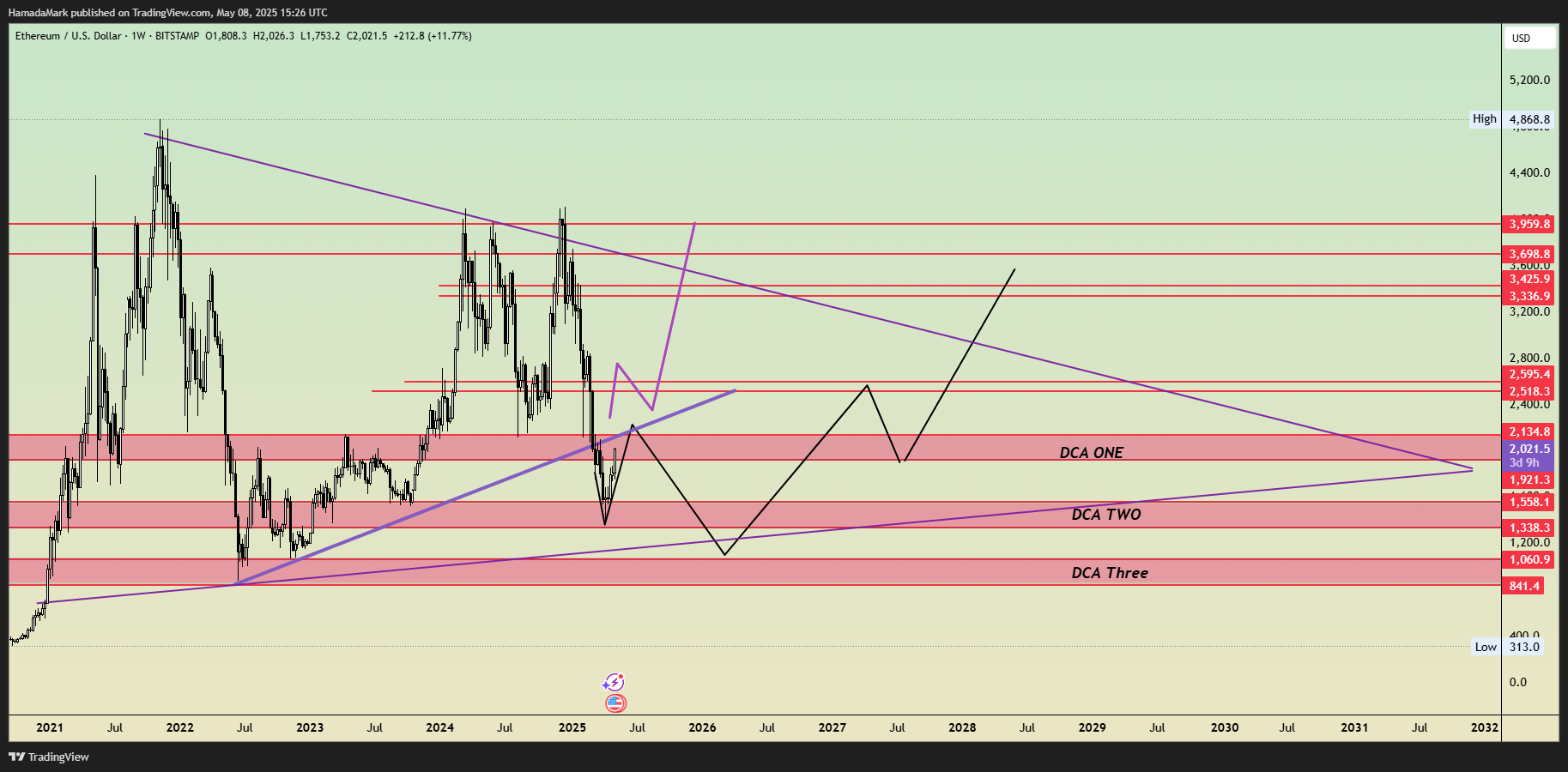

#ETHUSDT 2025–2028 Outlook

-

FIB/GANN/classic Method Analysis

FIB/GANN/classic Method Analysis Gann Key Timing

Gann Key Timing

According to Gann cycles,

25 November marks the start point of a new bullish attempt for ETH.The $2,500 level is the critical line

if ETH closes a monthly candle below $2,500, it signals a significant change in the long-term roadmap.Trend Setup

As long as ETH holds $2,500 and stays above the Blue Trend Line (A),

The bullish roadmap remains valid. Roadmap Targets

Roadmap TargetsBreakout Key:

$5,100 → Main breakout confirmationTarget 1:

$5,900 – $6,700 → First bullish leg (until Feb 2026)Target 2:

$8,200 – $8,900 → Full bullish year if 2026 confirmsTarget 3:

$10,150 → Extended top projection (2027–2028) All levels remain valid as long as ETH holds $2,500 on the monthly close.

All levels remain valid as long as ETH holds $2,500 on the monthly close. Trade Plan

Trade Plan

We have active entries: from $3, XXX, with remaining buy levels between $1,500–$1,850–$2,150.

Set up invalidation: Monthly close below $2,500.

Max investment: 15 % of wallet.

Risk-Reward (R: R): ≈ 1: 2 or higher.

Example: If you hold 10 ETH, you risk about $10K vs. the potential upside of $35–70K. ️ Summary

️ Summary

Support to hold: $2,500

Breakout confirmation: $5,100

Main targets: $5,900 → $6,700 → $8,900 → $10,150

Cycle: 2025 → 2028

Exposure: 15 % maxAlways trade with a clear plan and controlled risk.

Renzo Tip

Renzo Tip

“The chart tells its truth to the patient — not the loudest trader, but the calm observer of time.”🤲 Prayer

May Allah guide us to trade with clarity, protect our effort from greed and confusion,

and reward our discipline with lasting growth and wisdom. -

ETH’s long-term trajectory still leans bullish thanks to fundamental burn mechanics.

-

2025–2028 could be ETH’s strongest cycle yet if L2 adoption accelerates.