XAUUSD – Gold at a Turning Point Near 4,000$

-

Gold is under pressure again as strong USD recovery and rising US Treasury yields push XAUUSD closer to the 4,000$ psychological level. At the same time, fading expectations of a December Fed rate cut continue to weigh on bullish sentiment — leaving buyers hesitant despite the broader uptrend still intact.

Gold is under pressure again as strong USD recovery and rising US Treasury yields push XAUUSD closer to the 4,000$ psychological level. At the same time, fading expectations of a December Fed rate cut continue to weigh on bullish sentiment — leaving buyers hesitant despite the broader uptrend still intact. Macro Snapshot

Macro SnapshotUSD rebounds as markets reassess Fed rate-cut probabilities.

US yields climb across the curve → bearish pressure on gold.

Lack of clarity on economic data releases increases volatility.

Gold investors remain split as macro uncertainty collides with recent bullish momentum.

Despite this pullback, gold has not broken its bullish structure completely. Technical levels continue to show where buyers may re-enter with conviction.

Technical Outlook (FiboMatrix)

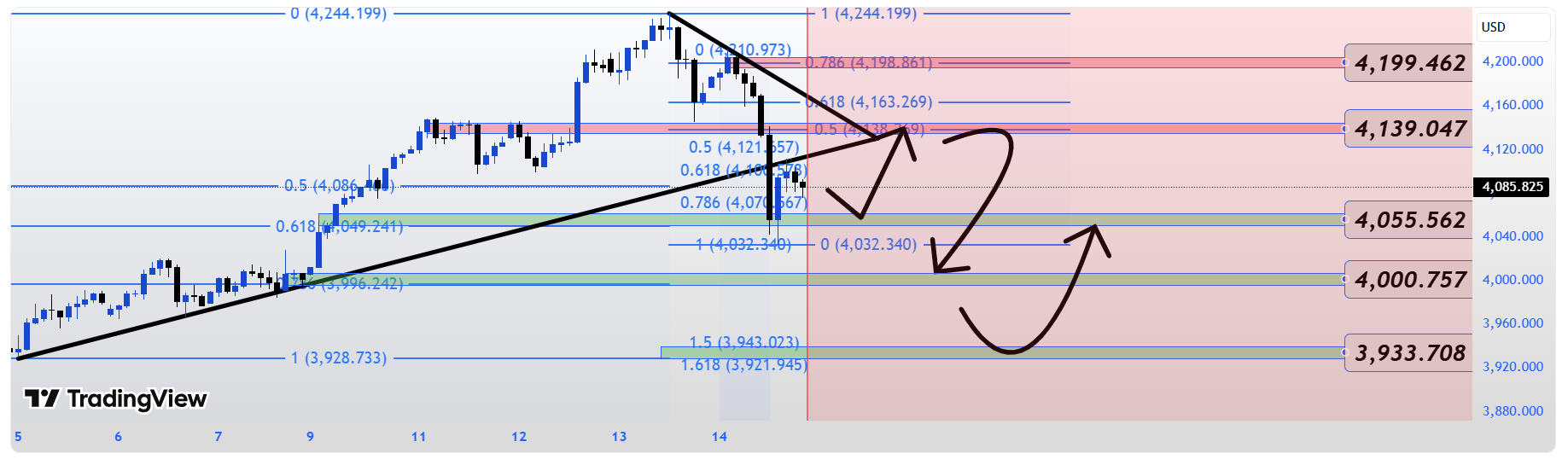

Technical Outlook (FiboMatrix)The chart is currently respecting key structure zones:

SELL Side Levels

SELL Side Levels4,139$ – Reaction Zone 0.5

First intraday rejection area. If price retests this zone, expect short-term selling pressure.4,199$ – Key Sell-Side Level

Major resistance. Bulls must reclaim this zone to unlock 4,245$+.🟩 BUY Side Levels

4,055$ – KeyLevel for Bulls

Primary defense zone. If held, bullish continuation remains valid.4,000$ – 0.786 Reaction Buy Zone

A strong Fibo confluence for buyers to step back in.3,933–3,921$ – Deep Liquidity / 1.5–1.618 Extension Buy Zone

Only targeted on deeper flush; high-value area for long-term bulls. Scenarios I’m Watching

Scenarios I’m Watching

Bullish Scenario (Preferred if 4,055$ Holds)Price pulls back into 4,055–4,070$, bases, then pushes back toward:

️ 4,139$ reaction zone

️ 4,139$ reaction zone

️ 4,199$ key level

️ 4,199$ key level

A clean break above 4,199$ opens the door to:

4,245$

4,245$

4,300$ major target

4,300$ major targetBearish Scenario (If 4,055$ Breaks)

Losing this level increases momentum toward:

️ 4,025$ minor support

️ 4,025$ minor support

️ 4,000$ psychological magnet

️ 4,000$ psychological magnet

A breakdown below 4,000$ flips the short-term trend bearish and exposes:

3,940–3,920$ liquidity zone

3,940–3,920$ liquidity zone Market Outlook

Market OutlookDespite sharp intraday drops, gold’s higher-timeframe structure remains bullish as long as 4,055$ doesn’t break. The market is simply recalibrating after an extended rally toward 4,200–4,245$.

Macro uncertainty will likely continue to drive volatility, but dips into strong Fibo zones remain an opportunity for informed traders.

If you found this breakdown helpful, drop your view below —

Are you buying dips or waiting for deeper liquidity?

-

4K is a psychological monster level — a breakout here could reshape the macro trend. 🟡

-

Gold reacting near such a major level always signals big moves coming.