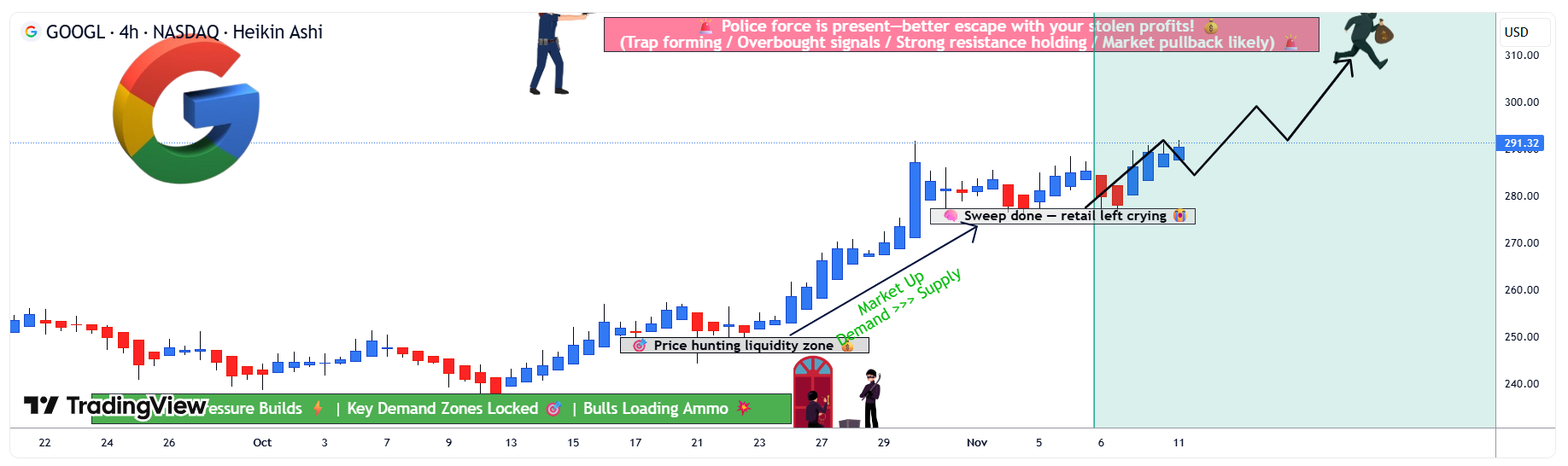

Can GOOGL Sustain Its Bullish Run Before 320 Resistance Hits?

-

GOOGL HEIST: Operation Alphabet Escape Plan

GOOGL HEIST: Operation Alphabet Escape Plan

Alphabet Inc. (NASDAQ) - Swing Trade | Multi-Layer Entry Strategy THE SETUP

THE SETUP

Sentiment: 🟢 BULLISH | Timeframe: Swing Trade | Risk Level: Medium ENTRY STRATEGY: "THIEF LAYERING"

ENTRY STRATEGY: "THIEF LAYERING"

Strategic multi-level buy accumulation using limit orders

Layer-by-Layer Approach:

Layer 1: $270.00 (Initial entry - 30% position)

Layer 1: $270.00 (Initial entry - 30% position)

Layer 2: $275.00 (Support zone - 35% position)

Layer 2: $275.00 (Support zone - 35% position)

Layer 3: $280.00 (Strength builder - 35% position)

Layer 3: $280.00 (Strength builder - 35% position)Why This Works? Multiple entries reduce average cost basis and allow maximum capital efficiency. If price rejects higher, you've got fills at lower zones. If it pumps, you're already in!

STOP LOSS PROTECTION

STOP LOSS PROTECTION

Hard Stop: $265.00 (Below support structure)

$265.00 (Below support structure)

This represents a 1.9% risk from Layer 1 entry — disciplined risk management at its finest.

️ Risk Acknowledgment: Your stop loss, your rules. We're traders, not financial advisors. Adjust based on YOUR risk tolerance and account size. This is educational strategy sharing, not personalized financial advice.

️ Risk Acknowledgment: Your stop loss, your rules. We're traders, not financial advisors. Adjust based on YOUR risk tolerance and account size. This is educational strategy sharing, not personalized financial advice. ️ PROFIT TARGETS & ESCAPE ROUTES

️ PROFIT TARGETS & ESCAPE ROUTES

Primary Target: $310.00

$310.00

Strong resistance zone forming

Overbought conditions developing

Action: Take 50-60% profits hereSecondary Target:

$320.00

$320.00

Police barricade zone (extreme resistance)

High trap probability at this level

Action: Scale out remaining 40-50% OR tighten stops to breakeven

Exit Philosophy: Greed kills traders. Take profits systematically. The best trade is one where you sleep well at night.

️ Profit Note: Your targets, your timing. Scale exits based on market conditions, volume confirmation, and YOUR comfort level.

️ Profit Note: Your targets, your timing. Scale exits based on market conditions, volume confirmation, and YOUR comfort level. RELATED PAIRS TO MONITOR (Correlation Watch)

RELATED PAIRS TO MONITOR (Correlation Watch)

MSFT

— High Correlation (Tech Sector) | If MSFT breaks down, GOOGL faces sector headwinds. Watch for divergence signals here first.

— High Correlation (Tech Sector) | If MSFT breaks down, GOOGL faces sector headwinds. Watch for divergence signals here first.

QQQ

— 0.85+ Correlation (Nasdaq-100) | QQQ weakness = potential GOOGL pullback signal. This is your sector health check before entry.

— 0.85+ Correlation (Nasdaq-100) | QQQ weakness = potential GOOGL pullback signal. This is your sector health check before entry.

IWM

— Inverse Correlation (Rotation Risk) | Russell 2000 strength = growth money leaving mega-caps. If small-caps pump, tech might cool off.

— Inverse Correlation (Rotation Risk) | Russell 2000 strength = growth money leaving mega-caps. If small-caps pump, tech might cool off.

TLT

— Interest Rate Proxy | Rising bonds = tech pressure; falling bonds = tech friendly. Fed policy flows directly through here.

— Interest Rate Proxy | Rising bonds = tech pressure; falling bonds = tech friendly. Fed policy flows directly through here.

VIX

— Volatility Index | VIX spike = risk-off, potential GOOGL liquidation. Above 20 = reduce position exposure.

— Volatility Index | VIX spike = risk-off, potential GOOGL liquidation. Above 20 = reduce position exposure.

Key Insight: Watch QQQ and MSFT first. They're your canary in the coal mine. If sector is weak, reconsider your entry conviction.

STRATEGY SUMMARY

STRATEGY SUMMARY

Bullish bias with disciplined multi-entry accumulation

Bullish bias with disciplined multi-entry accumulation

Defined risk with hard stop at $265

Defined risk with hard stop at $265

Staged profit-taking to lock gains systematically

Staged profit-taking to lock gains systematically

Correlation awareness prevents surprise sector rotations

Correlation awareness prevents surprise sector rotations FINAL THOUGHTS

FINAL THOUGHTS

Remember: This is the Thief Strategy — a fun, educational framework for swing trading, NOT financial advice. Trade at your own risk. Position sizing, stop losses, and profit targets should reflect YOUR unique situation, risk tolerance, and account size.

— a fun, educational framework for swing trading, NOT financial advice. Trade at your own risk. Position sizing, stop losses, and profit targets should reflect YOUR unique situation, risk tolerance, and account size.

The heist only works if you ESCAPE with profits. Don't get caught holding the bag!

-

320 is a key wall — if it breaks, next stop could be 335+.