⚠️ When a Bitcoin Gift Becomes Taxable

-

Most Bitcoin gifts are simple — until they’re not. A few mistakes can trigger IRS headaches.

Don’t sell or swap first. That’s a taxable sale, not a gift.

Don’t sell or swap first. That’s a taxable sale, not a gift.

Don’t skip valuation. Record the market price at the time of transfer.

Don’t skip valuation. Record the market price at the time of transfer.

Don’t “gift” for work or services. That’s income, not generosity.

Don’t “gift” for work or services. That’s income, not generosity.

Foreign gifts? Rules get stricter — especially for non-US recipients.

Foreign gifts? Rules get stricter — especially for non-US recipients.Keep it clean: transfer directly, document everything, and stay under $19K per recipient to avoid filing.

-

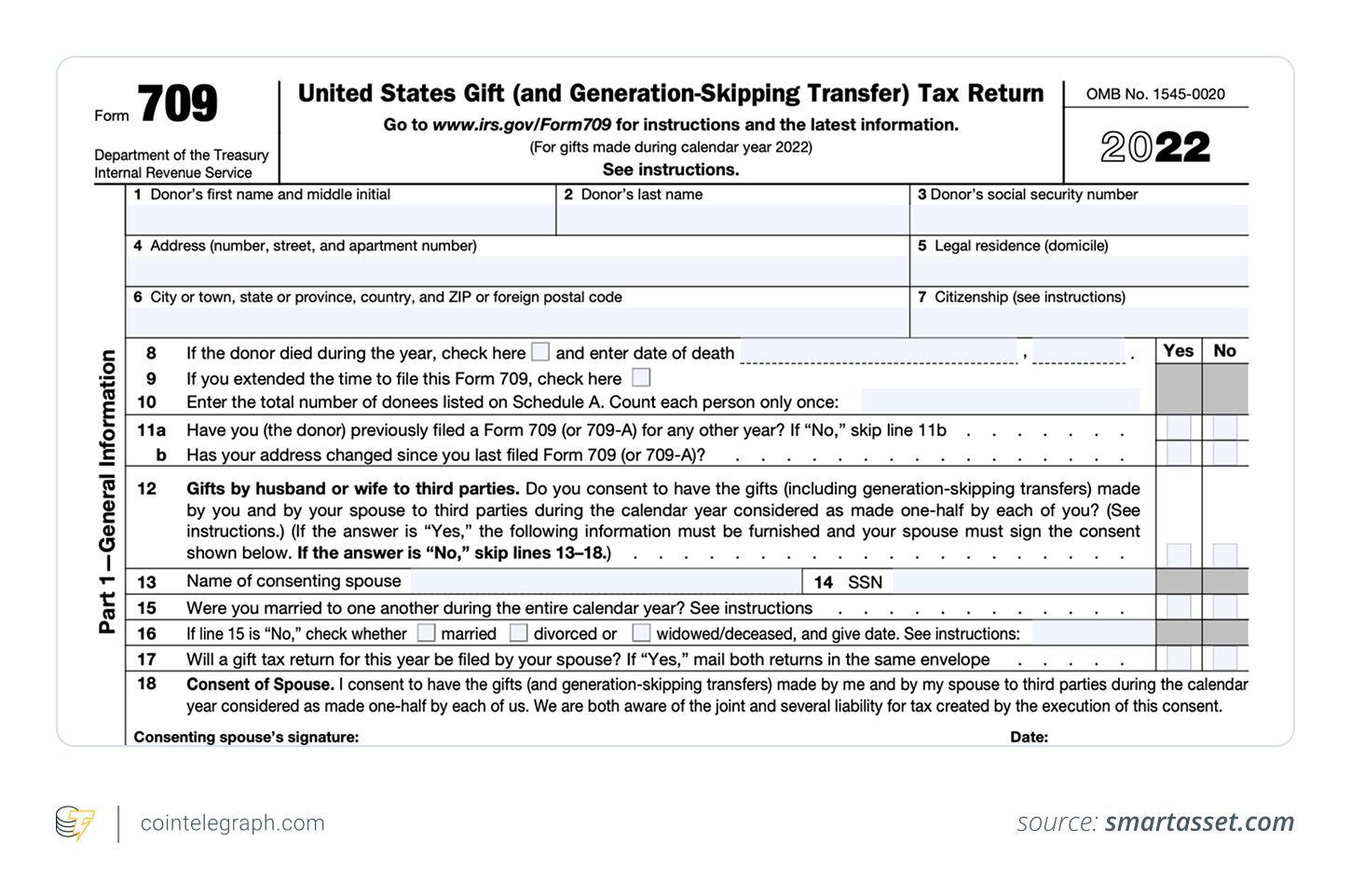

Tax thresholds matter — one small mistake can trigger major reporting. 🧾

-

There should be no tax on BTC. Just a currency.

️

️