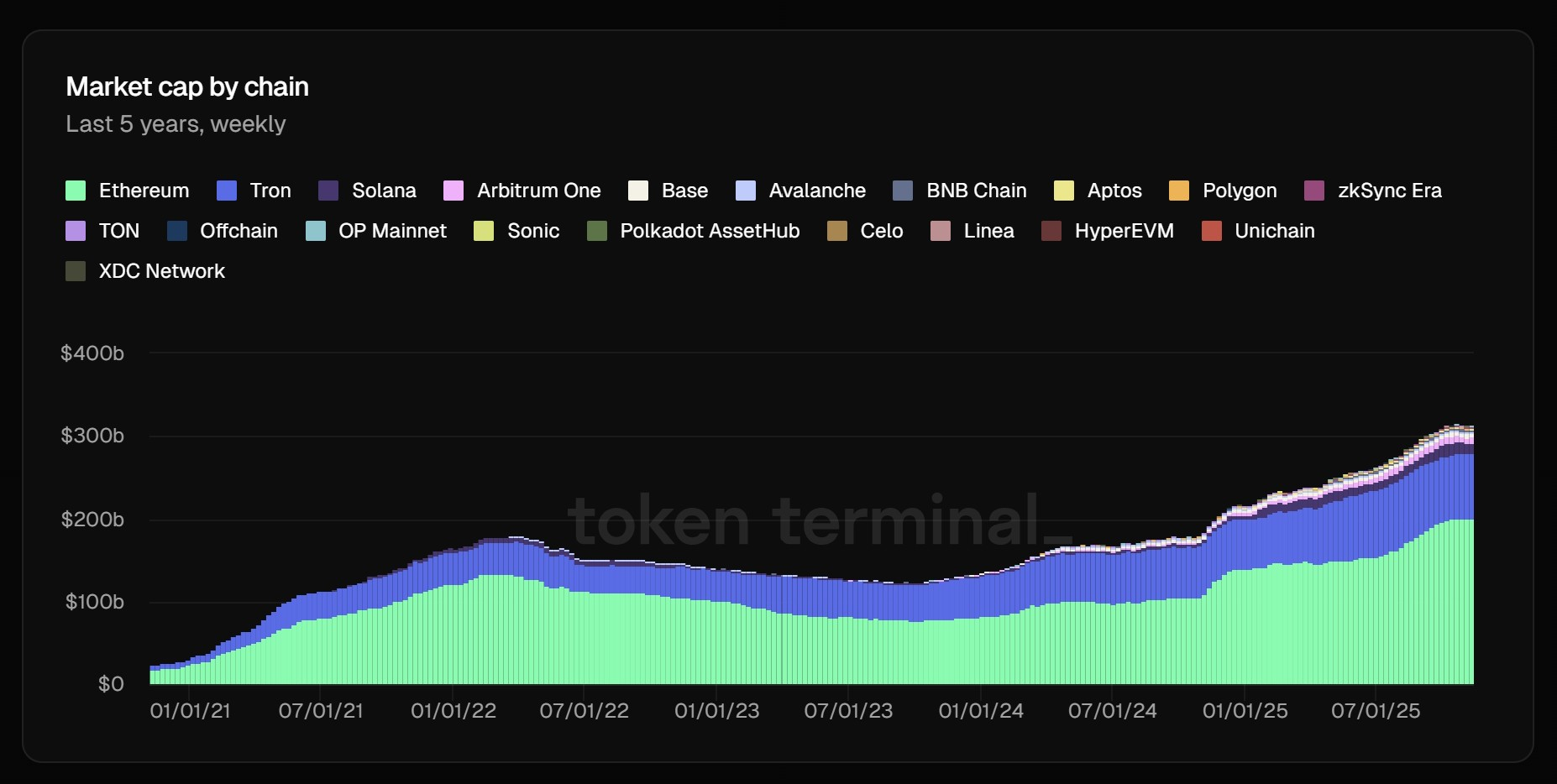

Ethereum Dominates the $314B Tokenization Market 🏦

Pulse of the market

3

Posts

3

Posters

18

Views

-

Ethereum now hosts $201 billion in tokenized assets — nearly two-thirds of the global total. That makes it the #1 blockchain for real-world asset tokenization (RWAs).

Institutional players like BlackRock and Fidelity have driven a 2,000% surge in onchain fund AUM since 2024, bringing traditional finance directly onto Ethereum.

Why it matters: Ethereum’s growing role as a settlement layer for tokenized funds and stablecoins could strengthen ETH’s long-term valuation floor.

Why it matters: Ethereum’s growing role as a settlement layer for tokenized funds and stablecoins could strengthen ETH’s long-term valuation floor.

️

️