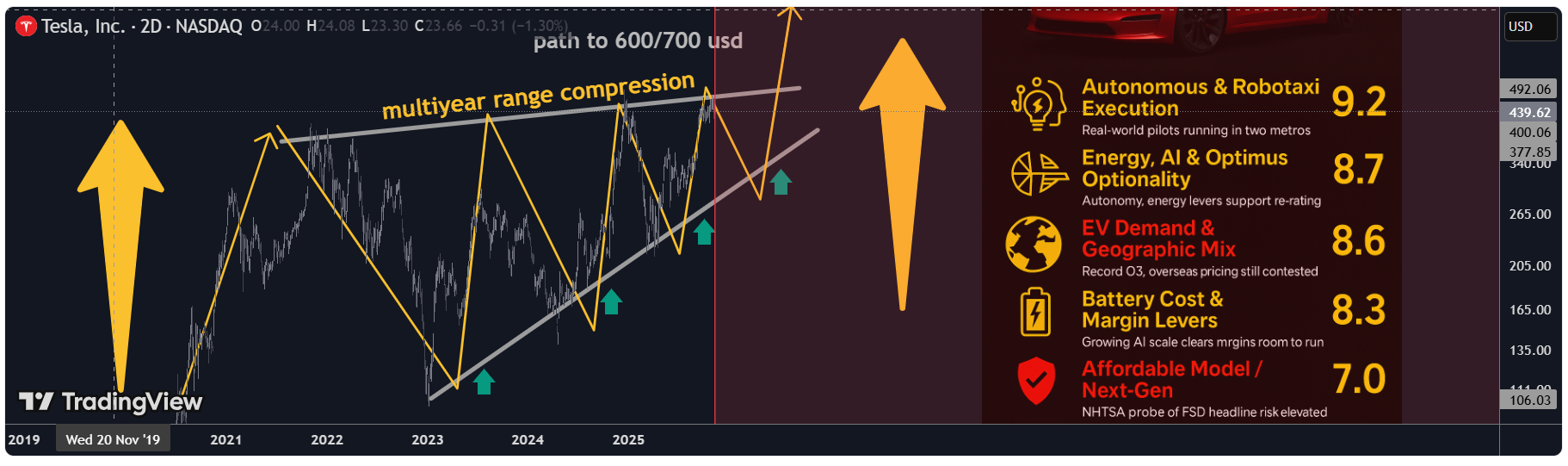

TSLA Catalysts Ranking: Q1 2026 Outlook PT 600 USD

-

TSLA: Updated Outlook (Nov-2025)

TSLA: Updated Outlook (Nov-2025)Here's an updated/revised outlook for TSLA including all the primary

catalyst ranking and analyst ratings and overview of latest developments

this was updated for Q1 2026 with all the viable market data.

1) Autonomous & Robotaxi Execution — 9.2/10 (↑)

1) Autonomous & Robotaxi Execution — 9.2/10 (↑)

• What changed: Tesla’s invite-only Austin robotaxi pilot kept running through the summer; Tesla also says it launched a Bay Area ride-hailing service using Robotaxi tech (Q3 deck). FSD v14 (Supervised) began rolling out in Oct with broader model upgrades; Tesla claims billions of supervised miles and AI training capacity lifted to ~81k H100-equivalents.

• Offsetting risk: NHTSA opened a fresh probe (Oct-2025) into ~2.9M Teslas over traffic-safety violations when using FSD; investigation cites 58 reports incl. crashes/injuries.

• Why the bump: Real pilots in two metros + visible AI scale-up keep autonomy the center of the bull case—even with elevated regulatory risk.

2) EV Demand & Geographic Mix — 8.6/10 (

2) EV Demand & Geographic Mix — 8.6/10 ( )

)

• What changed: Q3-25 delivered record vehicles and record energy storage deployments, with record revenue and near-record free cash flow. Still, we’re past the U.S. tax-credit pull-forward and China/Europe pricing remains competitive.

• Read-through: Momentum into Q4 looks better than 1H-25, but regional price discipline and mix will matter.

3) U.S. EV Tax Credits & Incentives — 6.0/10 (

3) U.S. EV Tax Credits & Incentives — 6.0/10 ( )

)

• What changed: Federal new/used EV credits ended for vehicles acquired after Sept 30, 2025 under OBBB. Buyers can still qualify if a binding contract + payment was made by 9/30 and the car is placed in service later (“time-of-sale” reporting). This creates a limited after-deadline tail into late ’25/early ’26 but the program has sunset for new acquisitions.

• Implication: Pull-forward demand helped Q3; near-term becomes tougher without the credit.

4) Rates & Credit Conditions — 6.5/10 (

4) Rates & Credit Conditions — 6.5/10 ( )

)

• Rate-cut expectations have eased financing costs M/M, but absolute affordability still binds EV uptake. (Macro-sensitive; no single decisive print.)

5) Affordable Model / Next-Gen Platform — 8.0/10 (

5) Affordable Model / Next-Gen Platform — 8.0/10 ( )

)

• Q3 deck emphasized Model 3/Y “Standard” variants to expand entry price points; true next-gen remains staged, with execution risk.

6) Battery Cost & Margin Levers — 8.3/10 (↑)

6) Battery Cost & Margin Levers — 8.3/10 (↑)

• What changed: Q3 total GAAP GM improved vs 1H; energy revenue +44% YoY; free cash flow ~$4.0B. Scale/learning and supply-chain localization called out.

7) Energy, AI & Optimus Optionality — 8.7/10 (↑)

7) Energy, AI & Optimus Optionality — 8.7/10 (↑)

• Record storage deployments, Megapack 3 / Megablock unveiled; expanding AI inference/training and a U.S. semi-conductor deal noted. This is the clearest re-rating vector beyond autos.

️

️  Safety, Regulatory & Governance Risk — 7.5/10 (risk) (↑ risk)

Safety, Regulatory & Governance Risk — 7.5/10 (risk) (↑ risk)

• New NHTSA probe into FSD reporting/behavior escalates headline risk; audit scrutiny persists. Interpret higher score here as more material risk to multiple.

9) Competition & Global Share — 6.2/10 (

9) Competition & Global Share — 6.2/10 ( )

)

• Competitive intensity in China/EU remains high; Q3 execution improved but pricing power still contested.

10) Macro & Trade/Policy — 6.5/10 (↑)

10) Macro & Trade/Policy — 6.5/10 (↑)

• Policy shifts (e.g., OBBB tax-credit sunset; tariff/trade uncertainty) remain a swing factor for cost & demand corridors.

11) Commodities/Inputs — 5.5/10 (

11) Commodities/Inputs — 5.5/10 ( )

)

• Mixed moves across lithium/nickel; no single driver eclipses execution/AI narrative near term.

Updated Catalyst Scorecard (ranked by impact)

- Autonomous & Robotaxi Execution — 9.2

- Energy, AI & Optimus Optionality — 8.7

- EV Demand & Geographic Mix — 8.6

- Battery Cost & Margin Levers — 8.3

- Affordable Model / Next-Gen — 8.0

- U.S. EV Incentives — 6.0

- Rates & Credit — 6.5

- Macro/Trade — 6.5

- Competition/Share — 6.2

- Safety/Reg/Gov Risk — 7.5 (risk flag)

- Commodities — 5.5

(Key Q3 facts from Tesla’s deck; probe/tax-credit items from NHTSA/IRS reporting.)

Analyst Rankings & Price Targets

Analyst Rankings & Price Targets

• Street consensus (near-term 12-mo): ~$391 average target; consensus rating: Hold across ~46 firms.

• Bull camp: Wedbush (Dan Ives) $600 PT (reiterated Nov-5; Street-high; thesis = embodied-AI/robotics optionality + robotaxi). Benchmark $475 Buy (post-Q3).

• Cautious/negative: UBS $247 Sell (raised from $215 but still bearish on deliveries/margins).

• Tape-check from Tesla: Q3-25 revenue $28.1B, non-GAAP EPS $0.50, record FCF, record deliveries & storage. (EPS miss vs some expectations; revenue beat.)

Headlines that moved the needle

Headlines that moved the needle

• NHTSA opens new FSD probe (scope ~2.9M vehicles).

• FSD v14 (Supervised) broad rollout; AI capacity to ~81k H100-eq; Bay Area robotaxi ride-hailing noted (Q3 deck).

• OBBB EV tax credits sunset 9/30/25; binding-contract/time-of-sale guidance enables limited post-deadline claims.

• Q3 print: record deliveries, record energy storage, record FCF; EPS light vs some models but narrative shifts to AI/energy.

🧭 Technicals: Levels & Structure (weekly focus)

Primary structure: since late-2022, TSLA’s traded inside a contracting wedge, with noteworthy compression into 2H-2025—typical of late-stage accumulation before a decisive break. Momentum divergences are improving on weekly frames even as price consolidates.

Key levels (spot-agnostic):

• Support: $360–$370 (prior breakdown area/weekly shelf); $330–$345 (multi-touch base/pivot); $310–$320 (cycle risk zone).

• Resistance: $405–$420 (range top & supply), $450–$475 (post-robotaxi pop zone / analyst PT cluster), $500 (psych), then $600–$650 (LT measured target band).

• Roadmap Expect one more downside probe into $310–$320 in Q1-2026 to complete the wedge, then trend break and resume bull leg toward $600/$650 over the subsequent cycle (≈ ~100% off the projected low).

• Risk markers: sustained weekly closes < $305 would postpone the “final low” timing and force a re-mark to the 200-week MA cluster; weekly closes > $475 accelerate the upside timing toward the $500/$600 handles.

Cases unchanged framework

• Bull: Robotaxi expands to more metros, regulators settle into a supervised-AV regime, energy/AI scale continues; market re-rates to $475–$600 (Benchmark/Wedbush anchors).

• Base: Solid execution across autos + energy, FCF stays healthy, autonomy rolls out cautiously under oversight; stock tracks Street $350–$400 band.

• Bear: Delivery softness post-credit-sunset, tougher pricing in China/EU, or adverse NHTSA actions; retest of $300–$330 zone before trend resolution.

What to watch next (60–90 days)

- NHTSA probe path and any software/recall remedies.

- Robotaxi geographic expansion cadence and any shift from safety-monitor to remote-assist ops.

- Energy bookings & Megapack 3/Megablock ramp against utility RFP calendars.

- Delivery run-rate post-credit sunset and mix of Standard trims.

-

600 target feels conservative if Q1 margins stay strong.

️

️