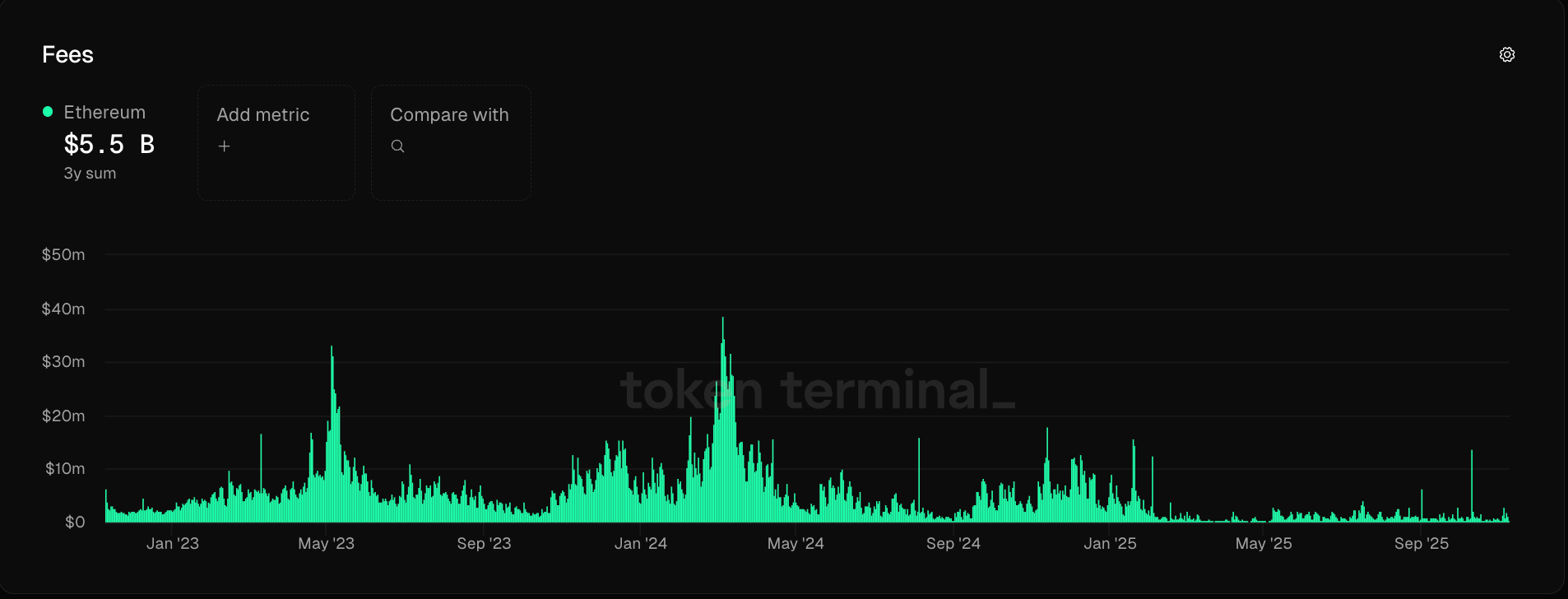

Ethereum Revenue Plunges 99% Since Dencun Upgrade

-

Ethereum’s base-layer revenue has plummeted 99% since 2024, largely due to the Dencun upgrade, which made layer-2 transactions cheaper.

During the 2021 bull run, Ethereum swaps could cost over $150. Now, most onchain actions cost under a dollar. While this benefits users, it’s created a revenue drought for validators, raising questions about how Ethereum will continue incentivizing network security.

Analysts suggest that Ethereum’s success in scaling via layer-2s may ironically be undermining its own fee economy.

-

Lower fees mean lower revenue — a classic trade-off for scalability.

-

Ethereum’s economy is shifting from fee-heavy to volume-driven — evolution in action.