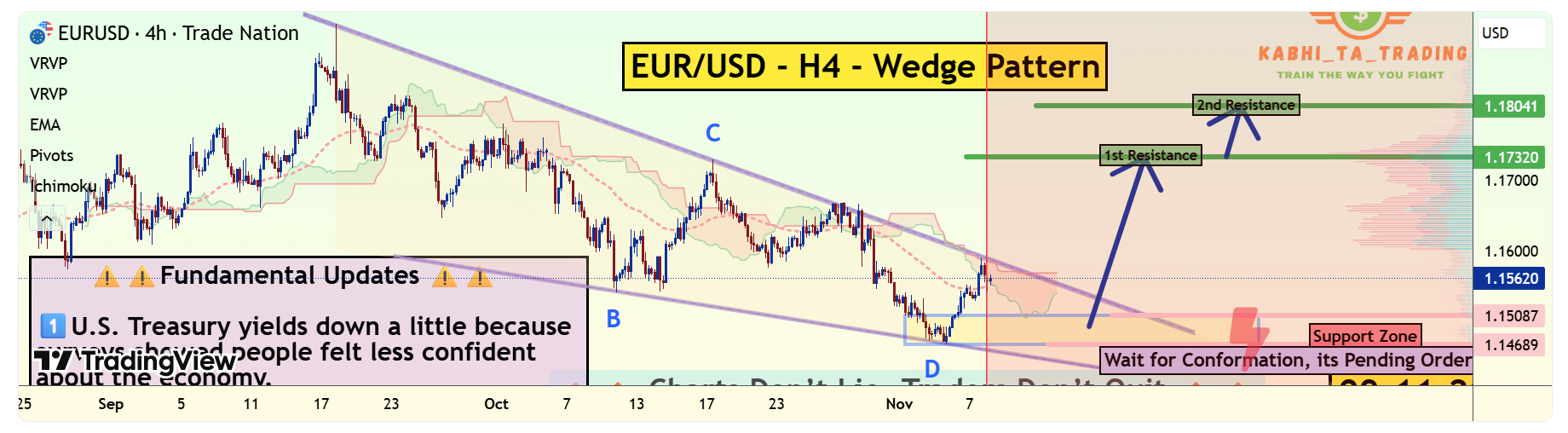

EUR/USD – H4 Wedge Pattern | Dollar Weakness & Fed Cut Bets

-

🧠 Setup Overview:

🧠 Setup Overview:

EUR/USD is forming a falling wedge pattern on the H4 chart — a potential bullish reversal structure after weeks of downside pressure. The pair is testing the upper wedge trendline, suggesting a possible breakout, but confirmation is still pending.EURUSD

Trading Plan:

Trading Plan:  Bullish Scenario:

Bullish Scenario:🟢Watch for a confirmed breakout above the wedge and cloud resistance zone.

🟢If confirmed, expect a move toward 1.1730 (1st Resistance) and 1.1800 (2nd Resistance). ️ Technical Levels:

️ Technical Levels:

🟢 1st Resistance: 1.1732

🟢 2nd Resistance: 1.1804

Support Zone: 1.1500 – 1.1470

Support Zone: 1.1500 – 1.1470🧩 Fundamental Updates (Today – 9 Nov 2025):

1️⃣ U.S. Treasury yields slipped slightly as surveys showed weaker consumer confidence, softening the dollar’s tone.2️⃣ Fed rate cut expectations increased — markets now price a 66% chance of a 25 bps cut in December, according to CME FedWatch.

3️⃣ Government funding worries: renewed concerns over a potential U.S. government shutdown weighed on sentiment and limited USD demand.

These factors combined create short-term bearish pressure on USD, which may fuel a EUR/USD rebound if momentum sustains above the wedge.

These factors combined create short-term bearish pressure on USD, which may fuel a EUR/USD rebound if momentum sustains above the wedge.

-

Market’s clearly pricing in a dovish Fed — euro could gain short-term momentum.

-

If the wedge breaks upside, 1.0950 looks like the next key target.