New York Bill Proposes 0.2% Tax on Crypto Sales and Transfers

-

New York Assemblymember Phil Steck has introduced legislation that would impose a 0.2% excise tax on the sale and transfer of digital assets, including cryptocurrencies and non-fungible tokens (NFTs).

Assembly Bill 8966, submitted Wednesday, would amend state tax law to apply the levy to “digital currencies, digital coins, digital non-fungible tokens or other similar assets.” If passed, the tax would take effect immediately, with enforcement starting September 1.

Tax Revenue to Fund School Substance Abuse Programs

The bill specifies that revenue from the tax would be used to expand substance abuse prevention and intervention programs in upstate New York schools.

Steck’s proposal targets all sales and transactions involving digital assets — potentially generating substantial revenue given New York City’s position as a global finance and fintech hub.

Legislative Path Ahead

The bill faces several steps before becoming law:

Review and approval in committee

Vote in the full Assembly

Passage in the State Senate

Signature or veto by the governor

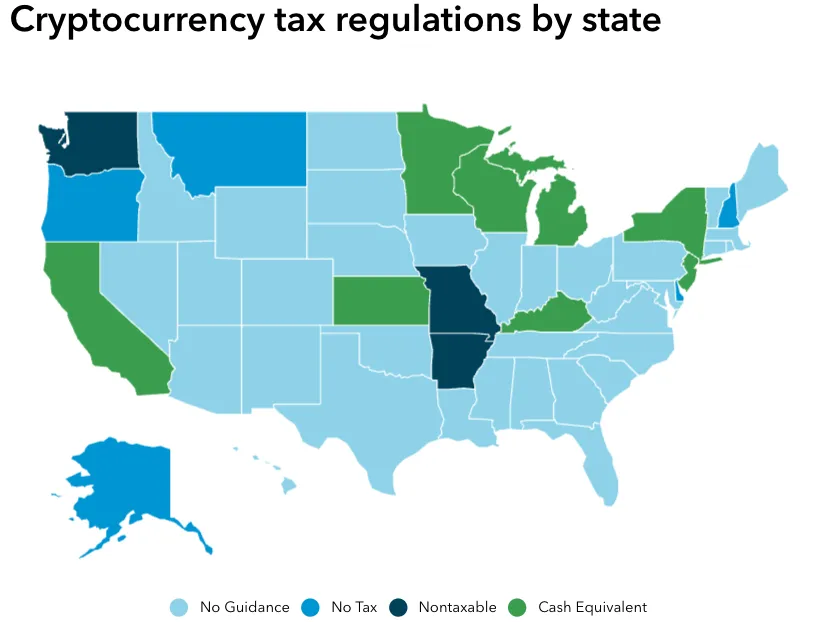

State-by-State Crypto Tax Landscape

Crypto tax policy in the U.S. varies widely:

Texas has eliminated certain corporate and income taxes to attract businesses.

California and New York classify crypto as cash for tax purposes.

Washington exempts crypto from taxes altogether.

According to Bloomberg Tax, many states have yet to issue clear guidance on digital asset taxation.

New York’s Crypto History

New York is home to major crypto players including:

Circle Internet Group (USDC stablecoin issuer)

Paxos (blockchain infrastructure and stablecoin issuer)

Gemini (crypto exchange)

Chainalysis (blockchain analytics firm)

The state pioneered formal crypto regulation with its BitLicense regime in 2015 — a framework that some firms left the state to avoid, while others embraced for its regulatory clarity.

Bottom line: If enacted, the 0.2% excise tax would add a new compliance layer for crypto users and businesses operating in New York, potentially impacting trading activity and transaction volumes in one of the world’s most important financial hubs.

-

A 0.2% tax may sound small, but it sets a dangerous precedent. New York already has one of the most restrictive environments for crypto (remember BitLicense?). Adding yet another friction point could push startups and trading volume out of the state — just when NY should be competing with Texas, Florida, and global hubs for blockchain talent. If lawmakers really want to fund schools, why not tax industries actually causing harm, instead of one that’s creating jobs and innovation?