Sanctioned Exchange Garantex May Already Be Evading U.S. Actions, Says TRM Labs

-

August 14, 2025 — The U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned cryptocurrency exchange Garantex Europe for a second time on Thursday — alongside its successor Grinex — but blockchain intelligence firm TRM Labs warns the move may have little practical impact.

According to TRM Labs, exchanges like Garantex often have contingency plans in place months ahead of anticipated enforcement actions, enabling them to quickly shift clients, infrastructure, and funds to new platforms.

Sanctions History and Criminal Links

OFAC first sanctioned Garantex in 2022, identifying it as a major hub for ransomware laundering, darknet market transactions, and other illicit flows. The exchange reportedly processed billions in crypto transactions between 2019 and March 2025, including over $100 million in illicit trades before its first designation — and hundreds of millions more afterward.

Despite a joint U.S.-German-Finnish takedown in March 2025, TRM Labs says the operation did not halt Garantex’s activities. Instead, leadership appears to have immediately activated a pre-existing migration plan.

Grinex and Meer: Successors Lined Up Early

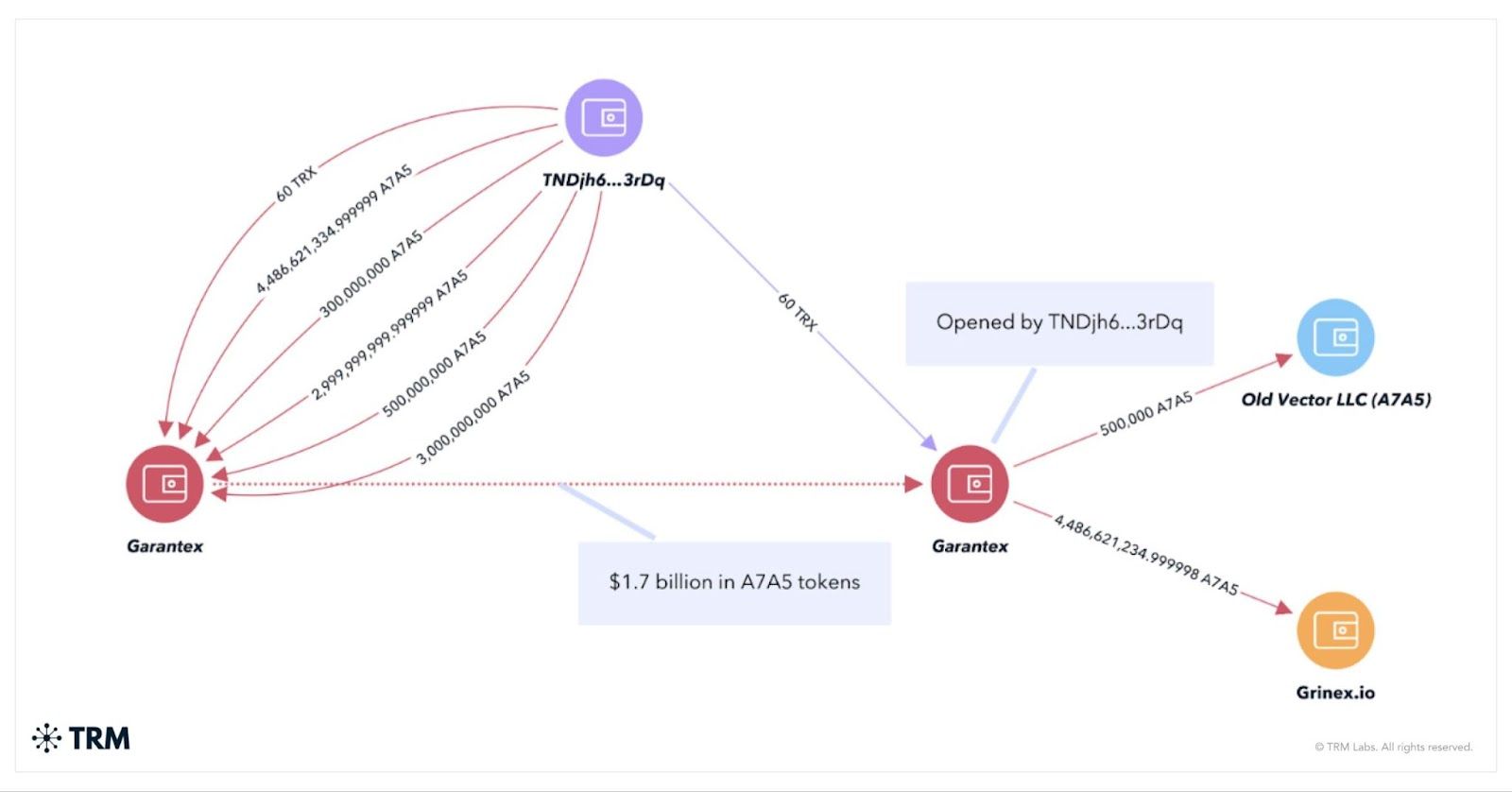

Kyrgyz records show Grinex was incorporated in December 2024, months before the takedown, positioning it to inherit Garantex’s operations. Around January 2025, Garantex-linked wallets began moving funds into A7A5, a Russian ruble–pegged stablecoin, suggesting foreknowledge of enforcement and the intent to create a sanctions-resistant transfer channel.

In the days after Garantex’s March disruption, Telegram channels linked to the exchange began promoting Grinex as a familiar alternative.

TRM Labs also flagged a third exchange, Meer, which:

Was registered in December 2024 — the same month as Grinex and A7A5

Shared similar trading interfaces and features with both

Was one of the first to list A7A5

Saw trading volumes spike immediately after Garantex’s takedown

The timing points to coordinated development, and TRM Labs suggests Meer may be another backup platform tied to the same operator network.

A7A5: The Stablecoin at the Center

A7A5 played a critical role in Garantex’s transition to Grinex, helping move and recover frozen customer funds. TRM Labs calls the Garantex–Grinex–A7A5 connection a “core case study” in illicit activity migration, showing how fiat-pegged stablecoins with opaque governance can be repurposed for sanctions evasion.

The firm warns that such tokens — often presented as ordinary settlement instruments — can become integral to illicit financial flows when linked to sanctioned financial institutions.

Key takeaway: The Garantex case highlights how sanctioned crypto operators are evolving, using pre-registered successor entities, alternative stablecoins, and layered infrastructure to sustain operations despite enforcement. TRM Labs says this underscores the need for enhanced due diligence on stablecoins and cross-border crypto networks.

-

The Garantex/Grinex/A7A5 triangle really shows how sanctions enforcement in crypto is becoming a cat-and-mouse game. Regulators may announce designations, but operators are often several steps ahead with successor entities and new rails ready to go. The pre-registration of Grinex and Meer in late 2024 looks less like coincidence and more like a deliberate continuity plan. What’s worrying is the role of A7A5 — fiat-pegged stablecoins without transparent governance can effectively act as shadow settlement layers for sanctioned actors. Unless policymakers figure out a way to scrutinize these tokens as aggressively as exchanges, we’ll likely keep seeing these “name-change and migrate” strategies work.

-

TRM Labs is spot on here — the impact of OFAC sanctions feels more symbolic than practical if successor entities like Grinex and Meer are already baked into the roadmap. This cycle is almost predictable: sanction > takedown attempt > migration > relaunch. What stands out is how integral Telegram and community channels are in steering users toward the “new” platforms immediately after disruption. It reinforces the point that enforcement can’t just be about blacklisting — regulators and compliance teams will need to track the wider ecosystem: affiliated wallets, stablecoin issuers, liquidity providers, and even off-chain comms networks. Otherwise, the sanctioned players just keep morphing.