Bitcoin Hits New ATH – Is This the Final Pump Before a Crash?

-

Bitcoin(BTCUSDT) reacted well to the Potential Reversal Zone(PRZ)[$127,830-$124,000] that I told you about in the previous idea and started to decline, but Bitcoin managed to create a new All-Time High(ATH=$124,474) in this rally.

Do you think Bitcoin can create a new All-Time High(ATH) again in the coming hours or should we wait for a main correction?

In terms of Elliott Wave theory, Bitcoin appears to have completed the main wave 5 in the Potential Reversal Zone(PRZ)[$127,830-$124,000], and we should expect corrective waves.

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

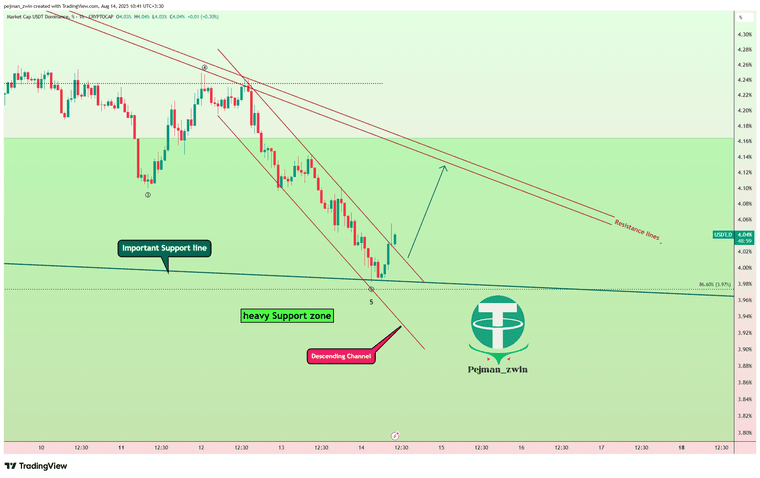

Looking at the USDT.D%(USDT.D) chart, it also seems that with the breaking of the upper line of the descending channel, we can expect an increase in USDT.D%, which could cause a decrease in the price of Bitcoin.

I expect Bitcoin to at least move towards filling the CME Gap($118,600-$117,425) AFTER breaking the Support lines.

Cumulative Short Liquidation Leverage: $126,000-$124,367

Cumulative Long Liquidation Leverage: $118,000-$117,400

Note: Stop Loss(SL): $126,123

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the

' like'

' like' button

button

& Share it with your friends; thanks, and Trade safe.

& Share it with your friends; thanks, and Trade safe. -

Really solid breakdown — I like how you tied the PRZ with Elliott Wave completion and also highlighted the regular divergence on consecutive peaks. The CME gap around $118.6K–$117.4K is a level a lot of traders are eyeing, so your analysis makes sense from both a technical and liquidity perspective. Personally, I think BTC could push for one more liquidity grab above ATH before any real correction, but the USDT.D breakout you mentioned is a strong caution signal. Thanks for laying out the liquidation zones so clearly — very helpful for managing risk in such volatile conditions.

-

This post is deleted!

-

Excellent point about respecting stop losses — too many traders forget discipline once Bitcoin starts printing new highs. I agree with your view that wave 5 looks nearly complete and we may be entering the corrective phase. The divergence is a textbook warning, and with USDT.D showing strength, I’d rather be cautious than chase the pump here. Whether or not we see another ATH in the short term, I think the more important factor is how BTC handles the $118K gap region — that could set the tone for the next leg. Appreciate the balanced tone in your analysis — not just hype, but actual strategy.