Why Crypto Is Taxable (And What You Need to Know)

-

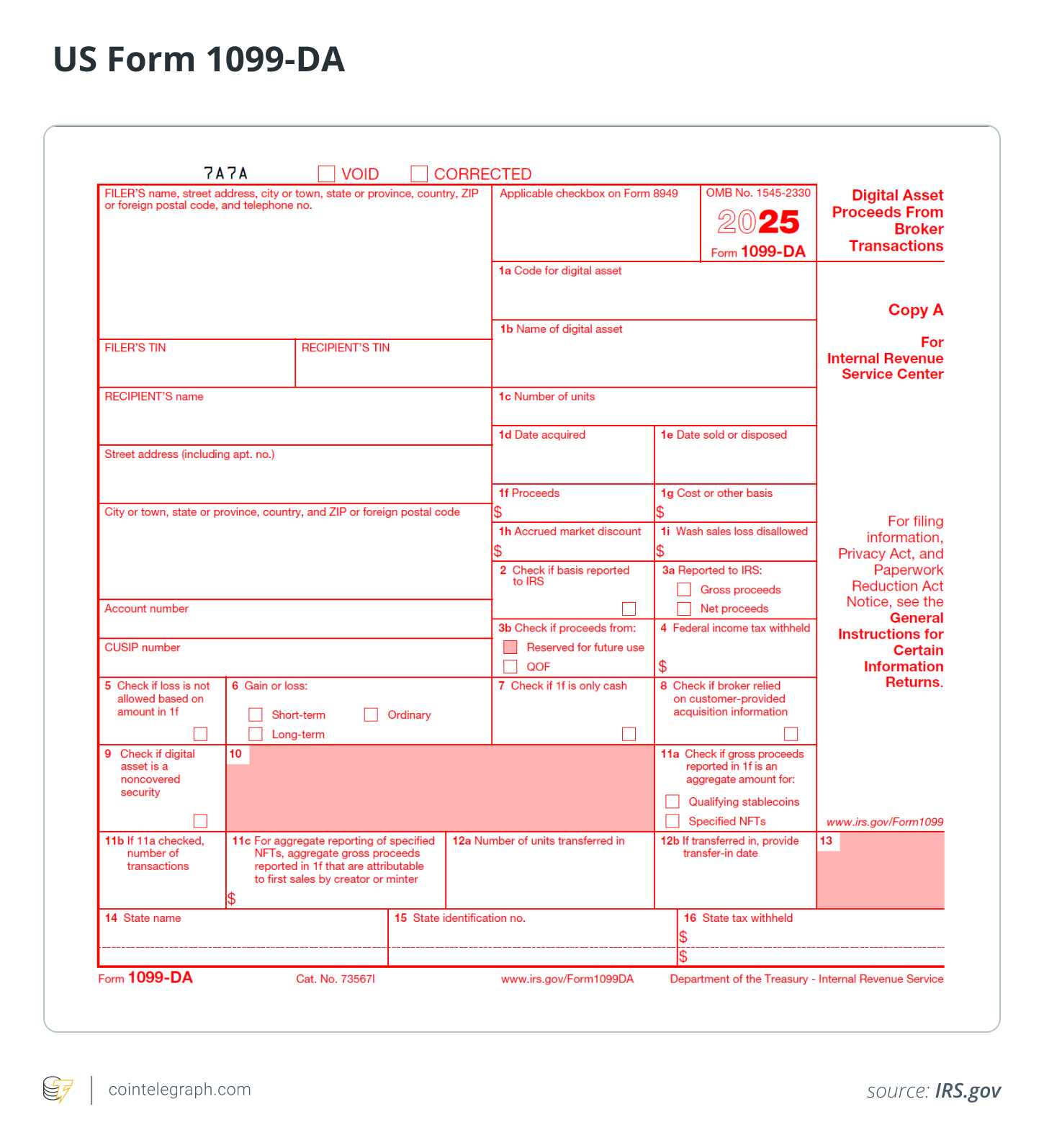

Tax agencies like the IRS, HMRC, and ATO treat cryptocurrency as property or a capital asset, not as currency.

That means selling, trading, or spending crypto triggers capital gains tax, and income from staking, mining, or airdrops must be reported at market value.

Even crypto-to-crypto swaps count as taxable events. Accurate records of every transaction are essential to avoid fines and audits. -

Crypto may feel decentralized, but profits still count as income — taxation bridges digital assets with real-world finance. 🧮

️

️ -

Understanding why crypto is taxable helps investors plan better and avoid future legal headaches. Knowledge saves money.

-

Crypto gains are great — until the taxman shows up. Staying compliant isn’t optional anymore, it’s part of the strategy. 🧾

-

Crypto profits are great just don’t forget the taxman.

🧾

🧾